Currency demonetisation: Housing prices may see correction, says Knight Frank

In a move to curb black money, Prime Minister Narendra Modi's on Tuesday said that Rs 500 and Rs 1000 currency notes will cease to be legal tender. India's real estate sector, the biggest generator of black money, is already feeling the pinch.

Shishir Baijal, Chairman & Managing Director, Knight Frank India said, "Prices coming down to more reasonable levels in the residential property market cannot be ruled out."

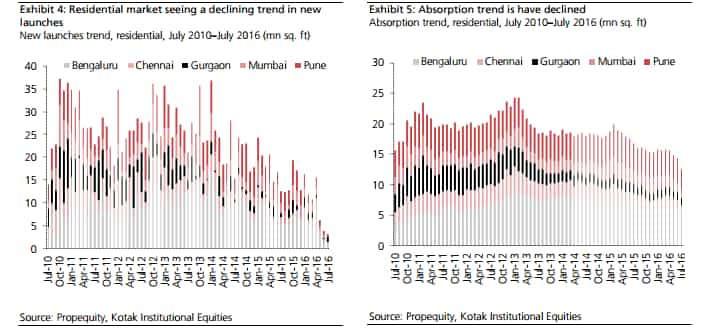

M B Mahesh, Nischint Chawathe and Abhijeet Sakhare, analysts at Kotak Institutional Equities said, “Correction in real-estate prices will lead to greater financial stress for developers accompanied by likely lower demand in the near-term, because investors have kept away on the back of high supply and steady demand which has show-cased in stagnant prices."

Shares of real estate companies on stock markets dipped between 10% to 20% on Wednesday.

Baijal said, "In the immediate future, the sector will be under serious pressure with volume, number of transactions and prices in residential and land markets seeing a substantial downward trend. The impact will be felt across the board with tier-II and tier-III markets taking a larger hit."

Another analyst Samar Sarda Kotak said," Cash-less economy may reduce primary residential sales as most unorganised players /secondary transactions still use cash. "

Kotak explained, "If prices in secondary markets are at high, discounts to primary markets in the near-term due to the inability to use cash, could lead to a correction in primary residential markets too where developers offering such units have stretched balance sheets. "

Kotak believes national capital region (NCR) and Mumbai Metropolitan Region may be affected more than Bangalore, Pune, Chennai and Hyderabad.

Also, transactions in tier-2 and small towns will be affected in the near-term the most, as we believe the ‘use of cash’ in transactions is higher in such markets, stated Kotak.

Given the uncertainties, Kotak said,"We expect the number of developers to reduce and market share of the top 10 /15 developers to increase going ahead. "

"However, RERA, GST, Benami Act and this recent move will prove to be a game changer for this sector and next year this time the real estate sector will be a totally different industry – a more evolved, transparent and a corporatized one!” Baijal said.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

04:37 PM IST

Rs 7,755 crore worth of withdrawn Rs 2,000 banknotes still in circulation

Rs 7,755 crore worth of withdrawn Rs 2,000 banknotes still in circulation Coronavirus on bank notes, mobile phones: Should you worry? What to do? TOP TIPS BY DOCTORS

Coronavirus on bank notes, mobile phones: Should you worry? What to do? TOP TIPS BY DOCTORS RBI to procure 50 note verifying machines

RBI to procure 50 note verifying machines Only 7% rise in transactions through cards post Demonetistion

Only 7% rise in transactions through cards post Demonetistion Rs 200 notes to be a reality soon; RBI places printing order

Rs 200 notes to be a reality soon; RBI places printing order