Budget 2019: Fiscal deficit to play spoilsport, what will be Arun Jaitley's next step?

Well, looks like, the Union Budget 2019 will not be much different this time as many are expecting the Finance Ministry to once again raise the target for this indicator.

The next big thing and the most awaited day for India in 2019 now is the Union Budget 2019, which will take place on February 01, 2019. Every eye will be watching Finance Minister Arun Jaitley on the day for the announcements, and big reforms, if any, that he may make. Expectations in India are definitely high! Needless to say, the upcoming budget is very crucial for PM Narendra Modi led NDA government. Why? It may impact the upcoming general elections that will be held between April to May 2019. Apart from the more popular ones, among many announcements, one of the most awaited would be a new target set by the Centre for fiscal deficit, which currently is out of control and has given some sleepless nights to authorities concerned - fiscal deficit has overshot budget estimates on multiple occasions.

Well, looks like, the Union Budget 2019 will not be much different this time as many are expecting the Finance Ministry to once again raise the target for this indicator.

A fiscal deficit reveals the financial situation of a country and key difference between revenue and expenditures. Simply, put a deficit occurs when government’s total expenditure exceeds the total receipts excluding borrowings made in that fiscal.

Significantly, there are many occasions when a government increases its expenditure, one such is to stimulate economic growth. Notably, a ticking economy is one of the most important indicators for what may happen during general elections.

Coming back to India, the country’s financial situation is in trouble as the fiscal deficit has already surpassed the government’s budgeted estimates.

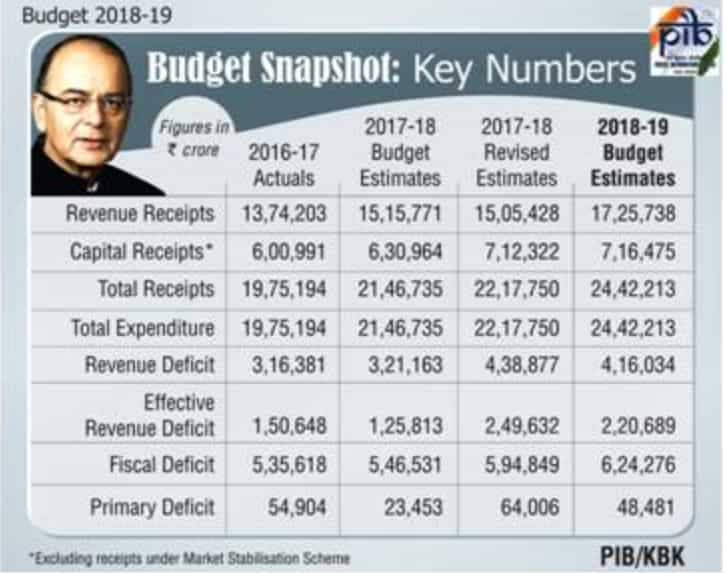

Data is given till November 2018, where fiscal deficit stood at Rs 7.17 lakh crore overshooting budget estimate of over Rs 6.24 lakh crore by a whopping 115%.

In JM Financial’s view, weakness persisted in Centre’s receipts (3% YoY vs. 5% last year) owing to i) stagnancy in indirect taxes (0.1% YoY), ii) lack of progress in the pace of direct tax collections (47.1% of BE vs. 47.5% last year), and iii) poor realisation of non-debt capital receipts (mainly divestment).

On the expenditure front, JM Financials highlights that, spending cuts in Nov '18 resulted in the FYTD19 i) decline of revenue expenditure realisation below the 13-year average of 68%, and ii) reduction in capex growth to merely 4% YoY vs. 29% YoY last year (post contraction for three consecutive months), although as % of BE, capex realisation remains one of the best in the past 13 years (64% of BE).

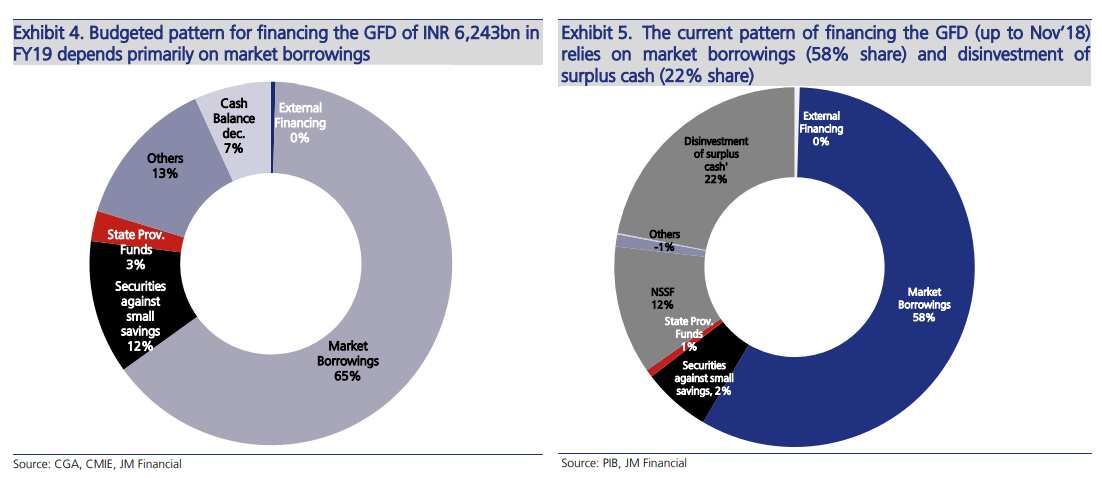

Overall, the fiscal deficit was financed primarily by market borrowing (58% share).

Following which, analysts at JM Financial continue to expect a 20bps fiscal slippage for the Centre on account of a) unaccounted expenditure (MSP hikes, underprovided fuel subsidy, net supplementary grant), and b) revenue shortfall (GST, telecom, OMC dividend, excise duty cuts), even after accounting for a) additional receipts through-residual services tax collections, import duty hikes, higher-than-budgeted income tax, and b) some expenditure cuts.

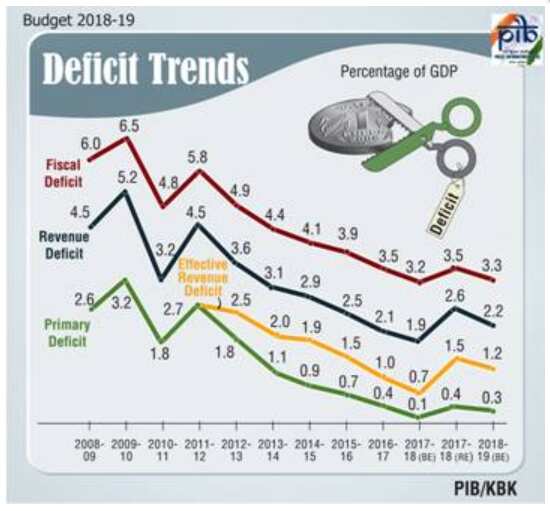

Similarly, for Union Budget 2019-20, Teresa John, Research Analysts at Nirmal Bang said, “we expect the fiscal deficit to breach the budgeted target of 3.3% of GDP and come in at 3.5% in FY19, and also in FY20.”

What is noteworthy is that, Jaitley during Budget 2018 speech had already increased India's fiscal deficit target by 30 basis points to 3.5% for entire FY18.

Jaitley has estimated fiscal deficit target at 3.5% of GDP by end of current fiscal, while the government expects to bring down this target to 3.3% in next fiscal (FY19).

However, looks like Jaitley’s FY19 fiscal deficit target is a lost cause. It would be interesting, to watch if the Centre hikes the target for this indicator in FY19 and FY20.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Tata Motors, Muthoot Finance and 3 more: Axis Direct recommends buying these stocks for 2 weeks; check targets, stop losses

12:19 PM IST

No change in dividend distribution tax, but grandfathering tax can be discussed: Govt

No change in dividend distribution tax, but grandfathering tax can be discussed: Govt Your money: Investors alert! CPSE ETFs as ELSS coming soon; get tax breaks and more

Your money: Investors alert! CPSE ETFs as ELSS coming soon; get tax breaks and more This is how Modi government's infra push can help travel and tourism industry

This is how Modi government's infra push can help travel and tourism industry No PAN mandatory for deposit or cash transactions above Rs 50,000, you can use Aadhaar

No PAN mandatory for deposit or cash transactions above Rs 50,000, you can use Aadhaar Budget 2019: Four proposals made by government to boost Digital India

Budget 2019: Four proposals made by government to boost Digital India