Budget 2019 expectations: Health insurers demand focus on out-of-pocket spending from Modi government

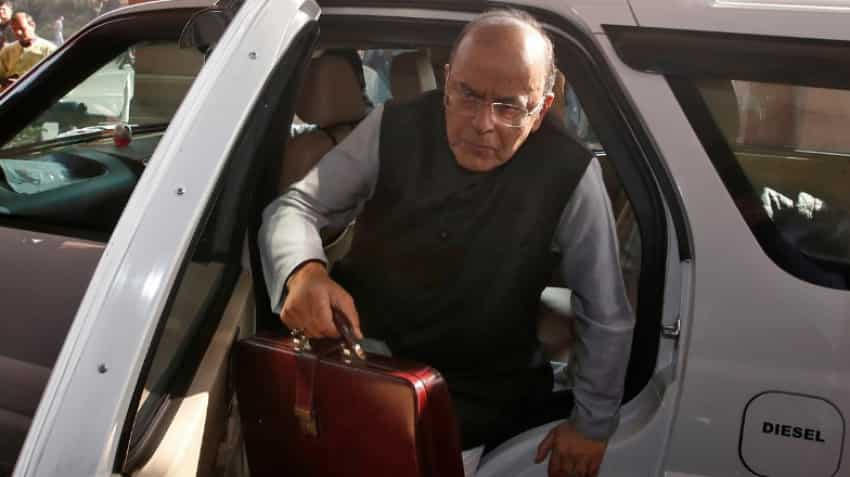

Health insurance companies operating in India have demanded from the Narendra Modi government to focus on this common public concern when the Indian finance minister rises in the parliament on February 1 to present the 2019 interim budget.

Budget 2019 demands: On account of healthcare spendings going out of pocket from the public in general aka aam aadmi, the health insurance companies operating in India have demanded from the Narendra Modi government to focus on this common public concern when the Indian finance minister rises in the parliament on February 1 to present the 2019 interim budget.

Speaking on the matter Varun Gera, Founder & CEO, HealthAssure, told Zee Business online, "Healthcare in India is perched for growth with the government rolling out the biggest publicly funded healthcare plan in the world, growing global investments into tertiary care and regulations imposed to cap prices of medical devices."

See Zee Business video below:

#ZBizExclusive | फ्यूचर में सिर्फ रहेंगे बड़े रियल एस्टेट डेवलपर्स, छोटे रियल एस्टेट डेवलपर्स का रास्ता होगा साफ: अजय पीरामल, चेयरमैन, पीरामल ग्रुप@anuragshah710 @PiramalGroup pic.twitter.com/xdPkAhDvmY

— Zee Business (@ZeeBusiness) January 29, 2019

Varun Gera of HealthAssure went on to add, "Alongside, it’s worth noting that India currently spends a little over 1 per cent of GDP on health. With a health-insurance penetration rate of only about 20 per cent, India has one of the world’s highest rates of out-of-pocket spending in healthcare."

Shreeraj Deshpande, Principal Officer at Future Generali India Insurance told, "Medical inflation is growing at 14-16 per cent every year and the healthcare expenses of the average household can easily exceed the capacity of their pocket. We expect the government to revise the 80 D limits for Health Insurance premiums under IT Act and further reduce the GST for health insurance premiums especially for retail policies."

Hailing the Ayushman Bharat Scheme of the Modi government Pankaj Verma, Head — SME lending at SBI General Insurance told, "Levying GST on the health insurance premium is something that the government should think waving-off in coming budget."

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Top 7 SBI Mutual Funds With Highest SIP Returns in 15 Years: No. 1 scheme has turned Rs 12,222 monthly SIP investment into Rs 1,54,31,754; know about others too

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

04:05 PM IST

Social Stock Exchange: What is it? Will it benefit social enterprises in India?

Social Stock Exchange: What is it? Will it benefit social enterprises in India? Housing for all by 2022: Outlook positive for affordable housing in the next 3 years

Housing for all by 2022: Outlook positive for affordable housing in the next 3 years Hit by massive trouble, NBFC sector gets a big boost; here is how

Hit by massive trouble, NBFC sector gets a big boost; here is how Investment tips: These 10 stocks can help your wealth grow in July 2019

Investment tips: These 10 stocks can help your wealth grow in July 2019  Sensex crash! Rs 5.61 lakh crore of investor wealth wiped out in 2 days - 8 reasons why

Sensex crash! Rs 5.61 lakh crore of investor wealth wiped out in 2 days - 8 reasons why