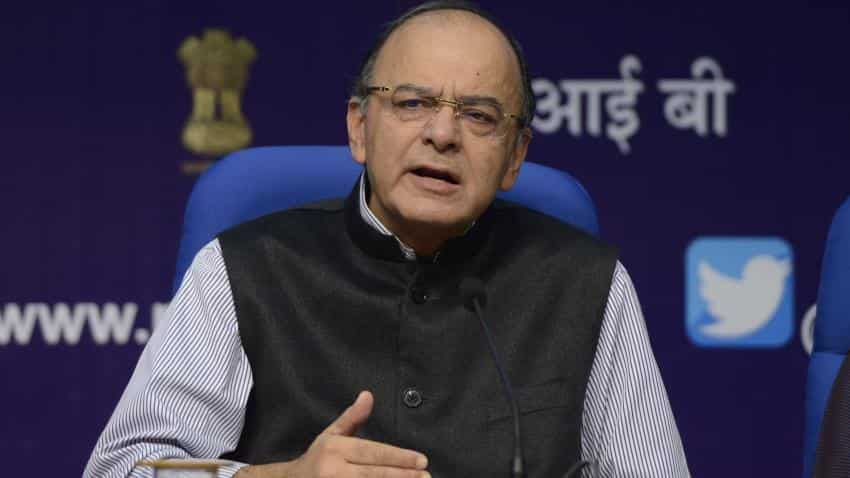

Budget 2017: Can Centre deliver on its disinvestment promise?

Sanjeev Prasad, Suvodeep Rakshit , Sunita Baldawa and Anindya Bhowmik of Kotak Institutional Equities wrote, “We expect the government to continue to focus on divestment of its stakes in various companies to bolster its overall revenues. The divestment figure will be crucial as tax revenues may not be entirely supportive of likely higher capital expenditure as well as revenue expenditure.”

Amongst other things, Government is likely to focus on disinvestment, or selling stakes in its companies, to raise money.

Sanjeev Prasad, Suvodeep Rakshit , Sunita Baldawa and Anindya Bhowmik of Kotak Institutional Equities wrote, “We expect the government to continue to focus on divestment of its stakes in various companies to bolster its overall revenues. The divestment figure will be crucial as tax revenues may not be entirely supportive of likely higher capital expenditure as well as revenue expenditure.”

“Government had many options to raise larger amount from divestment of its stakes in state-owned companies, but has consistently fallen on meeting divestment targets given limited appetite among investors and low clarity on the divestment schedule,”they said.

However, since last six years, Centre has failed to achieve its divestment targets.

During the last Union Budget, finance ministry had set a divestment target of Rs 56,500 crore. Rs 36,000 crore was expected from minority stake sales and remaining Rs 20,500 crore from strategic stake sales.

Data published by Finance Ministry show that till November 2016, it managed to raise up to Rs 23,432.38 crore via divestment in PSUs, which would be only 38% of the set target.

Some of the key divestments in FY17 are - NHPC: Rs 2,716 crore, and MOIL: Rs 793 crore.

During 2015-16, Centre raised Rs 25,312 crore from the set target of Rs 69,500 crore - out of which Rs 41,000 crore was via minority stake sale and an additional Rs 28,500 crore from strategic sale.

Kotak said, "The divestment shortfall has put pressure on other revenue sources to finance expenditure."

Kotak said, "Government can raise around Rs 12 lakh crore if it sells entire holding in its PSUs."

Recently, the government decided to list five general insurance companies by divesting 25% stake in them. These companies are New India Assurance, Oriental Insurance, National Insurance, United India Insurance and national Reinsurer General Insurance Company.

Kotak expects a divestment target of Rs 60,000 crore out of which Rs 15,000 would likely be through stake sale in non-government companies.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

01:58 PM IST

100% penalty if Rs 2 lakh or more transacted in cash, warns IT Department

100% penalty if Rs 2 lakh or more transacted in cash, warns IT Department ArthVeda Fund Management raises $250 million from Qatar Holding to invest in Affordable Housing

ArthVeda Fund Management raises $250 million from Qatar Holding to invest in Affordable Housing  Steel Ministry to continue with import duty reduction demand

Steel Ministry to continue with import duty reduction demand Budget 2017: Meeting disinvestment target is key to achieving fiscal deficit goal

Budget 2017: Meeting disinvestment target is key to achieving fiscal deficit goal From no service charge on tickets to passenger safety: Key highlights of Railway Budget 2017-18

From no service charge on tickets to passenger safety: Key highlights of Railway Budget 2017-18