100% penalty if Rs 2 lakh or more transacted in cash, warns IT Department

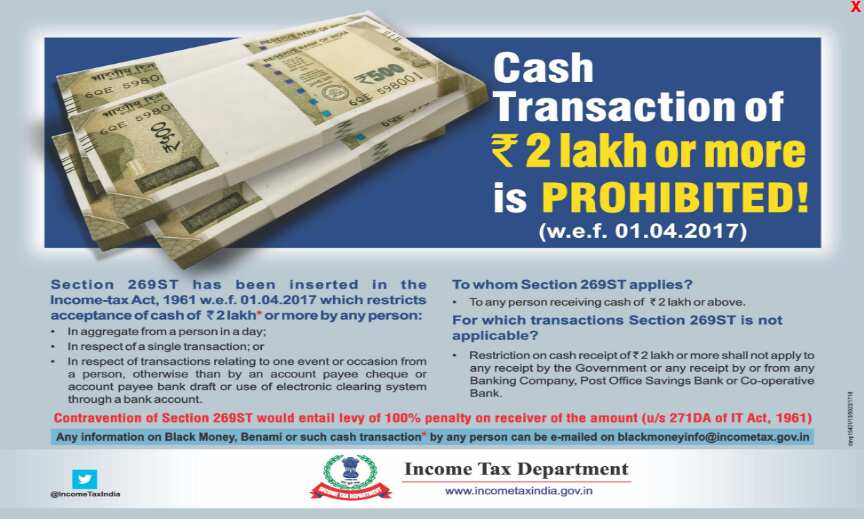

Income Tax Department, in an advertisement, has warned people for not transacting in cash for Rs 2 lakh or more.

The Income Tax Department on Friday sent out a warning note on its website for people carrying out cash transactions of Rs 2 lakh or more.

It said that Section 269ST has been inserted in the Income Tax Act, 1961 with effect from April 01, 2017 - which restricts acceptance of cash of Rs 2 lakh or more by any person.

"Contravention of Section 269ST would entail levy of 100 per cent penalty on receiver of the amount," the Income Tax Department said.

Restriction on cash receipt of Rs 2 lakh or more is not applicable to any receipt by the Government, Banking company, Post Office Savings Bank or Co-operative Bank.

Finance Minister Arun Jaitley, while presenting the Union Budget 2017-18, proposed a ban on cash transaction of over Rs 3 lakh with effect from April 01.

This limit was later reduced to Rs 2 lakh in the month of March 2017 as an amendment to the Finance Bill, which was passed by the Lok Sabha in the same month.

Jaitley in an IANS report said, "Following the government`s demonetisation drive to curb corruption, various income tax incentives had been introduced, including electoral bonds, to deal with black money in political life. This had necessitated amendments to various Acts."

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

18x15x12 SIP Formula: In how many years, Rs 15,000 monthly investment can grow to Rs 1,14,00,000 corpus; know calculations

Hybrid Mutual Funds: Rs 50,000 one-time investment in 3 schemes has grown to at least Rs 1.54 lakh in 5 years; see list

Rs 5,000 SIP for 40 years vs Rs 50,000 SIP for 20 years: Which can create higher corpus? See calculations to know it

05:23 PM IST

Centre okays PAN 2.0 project worth Rs 1,435 crore to transform taxpayer registration

Centre okays PAN 2.0 project worth Rs 1,435 crore to transform taxpayer registration Income tax return filer base up 2.2 times in 10 years, 5 times growth in Rs 50 lakh-plus income category: Sources

Income tax return filer base up 2.2 times in 10 years, 5 times growth in Rs 50 lakh-plus income category: Sources  I-T department notifies tolerance range for AY25 for transfer pricing cases

I-T department notifies tolerance range for AY25 for transfer pricing cases IT department issues guidance note on Vivad Se Vishwas dispute resolution scheme

IT department issues guidance note on Vivad Se Vishwas dispute resolution scheme Nirmala Sitharaman advises I-T Department to avoid 'unnecessary harassment' of individual as well as corporate taxpayers

Nirmala Sitharaman advises I-T Department to avoid 'unnecessary harassment' of individual as well as corporate taxpayers