Big Bull Rakesh Jhunjhunwala’s net worth rises by whopping 21% in Q3FY19 - These stocks proved money magnet

Jhunjhunwala has finally posted a 21% rise in his networth during October - December 2018 quarter.

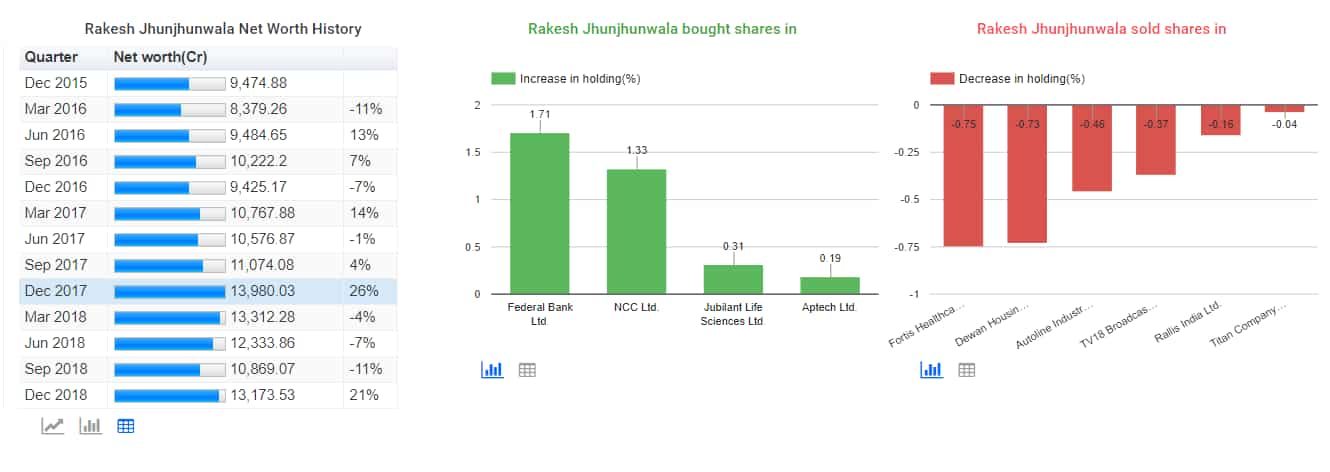

Looks like bad days are over for big bull Rakesh Jhunjhunwala, as his favourite stocks have reversed the negative trend and are in fact among major money magnets. Jhunjhunwala who is known as also golden midas in stock market, has definitely shown how one must trade as his portfolios, since he started his trading career has not failed to disappoint him. But sadly, this was not the case for Jhunjhunwala last year, as a TrendLyne.com data reveals that, the ace investor has not recorded any profit since March 2018. However, as Jhunjhunwala says, “Respect the market. Have an open mind. Know what to stake. Know when to take a loss. Be responsible.” This is definitely quite true, because the year end 2018, did not go in waste as Jhunjhunwala has finally posted a 21% rise in his networth during October - December 2018 quarter.

According to the data, Jhunjhunwala whose net worth rose by 26% to Rs 13,980.03 crore in December 2017 from Rs 11,074.08 crore in September 2017, has been witnessing drop in his wealth since then.

In March 2018, Jhunjhunwala’s wealth plunged by 4% to Rs 13,312.28 crore, and further by 7% in June 2018 quarter to Rs 12,333.86 crore. But it was September 2018 quarter, which played the most spoilsport for Jhunjhunwala. In mid-September 2018, the Dalal Street witnessed a great bearish sentiment, taking down many large caps, small caps and midcaps. Hence, Jhunjhunwala’s portfolio also felt the heat, because in Q2FY19, his wealth tumbled massively by 11% to Rs 10,869.07 crore - which would be over Rs 3,110 crore loss in nine months time. Not only this, the data also reveals that, 2018 was the worst year for Jhunjhunwala, as he faced most losses in last 3 years.

Coming back to Q3FY19, although it is still not near December 2017 level, but an improvement has been witnessed. From Q2FY19, Jhunjhunwala’s wealth bounced back to Rs 13,173.53 crore in Q3FY19.

In latest quarter, Jhunjhunwala has also done many interesting buyings and selling.

Under buying list, the ace investor increased his holding by 1.71% in Federal Bank, followed by 1.33% in NCC, 0.31% in Jubilant Life Science and 0.19% in Aptech stocks.

(Image source: TrendLyne.com)

However, the Dalal Street king made quite an interesting selling in Q3FY19. He reduced his holding massively by 0.75% in Fortis Healthcare which was his most recent buying in Q2FY19. Apart from Fortis, Jhunjhunwala also sold some portion of his holding in Dewan Housing Finance Corp (DHFL) by 0.73%, Autoline Industries by 0.46%, TV18 Broadcast by 0.37%, Rallis India by 0.16% and surprisingly in his most favorite stock Titan as well by 0.04%.

Among the stocks which made the Warren Buffett of India rich were - Titan Company which rose by nearly 37% in last six months time, followed by NCC by 30%, Federal Bank by 22%, SpiceJet by 22%, Escorts by 16%, MCX by over 5% and Delta Corp above 4%.

Notably, Jhunjhunwala needed only the stock to rise and that was none other than jewelry maker Titan. His holding which was valued below Rs 6,000 crore by end of December 2018, has risen to Rs 6,937.4 crore. Hence, massive gains came in from this stock. He holds 7.08% in Titan with 62,901,220 equity shares.

Meanwhile, in NCC the ace investor’s holding stands at 10.78% with 64,708,266 equity shares worth Rs 713 crore, followed by Federal Bank where he has 3.45% stake with 67,471,060 shares worth Rs 611 crore.

Additionally, he has 1.25% stake in SpiceJet with 7,500,000 equity shares worth Rs 73.6 crore, in Escorts the holding is 8.16% with 10,000,000 equity shares valued at Rs 804.3 crore. Lastly he holds 3.92% and 7.38% in MCX and Delta with 2,000,000 and 20,000,000 equity shares which are aggregating up to Rs 158.6 crore and Rs 482.3 crore respectively..

Thereby, just like Jhunjhunwala if you have invested in the above mentioned stocks, then you have become rich as well.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

03:13 PM IST

Padma Awards: Industrialist Kumar Mangalam Birla, late stock market investor Rakesh Jhunjhunwala awarded

Padma Awards: Industrialist Kumar Mangalam Birla, late stock market investor Rakesh Jhunjhunwala awarded Hurun Rich List 2023: Rekha Rakesh Jhunjhunwala tops the list of 16 new Indian billionaires

Hurun Rich List 2023: Rekha Rakesh Jhunjhunwala tops the list of 16 new Indian billionaires Rekha Jhunjhunwala picks additional stakes in this PSU bank and stock broking company – Check details

Rekha Jhunjhunwala picks additional stakes in this PSU bank and stock broking company – Check details This Rekha Jhunjhunwala-owned mutlibagger stock hits new 52-week high on securing Rs 260 cr order – Brokerage recommends this

This Rekha Jhunjhunwala-owned mutlibagger stock hits new 52-week high on securing Rs 260 cr order – Brokerage recommends this Rekha Jhunjhunwala Portfolio: Ace investor takes fresh position in this multibagger stock – scrip up 150% in 2 years

Rekha Jhunjhunwala Portfolio: Ace investor takes fresh position in this multibagger stock – scrip up 150% in 2 years