Anil Singhvi’s Strategy November 4: Day support range on Nifty is 11,650-11,725 & Bank Nifty is 25,100-25,250

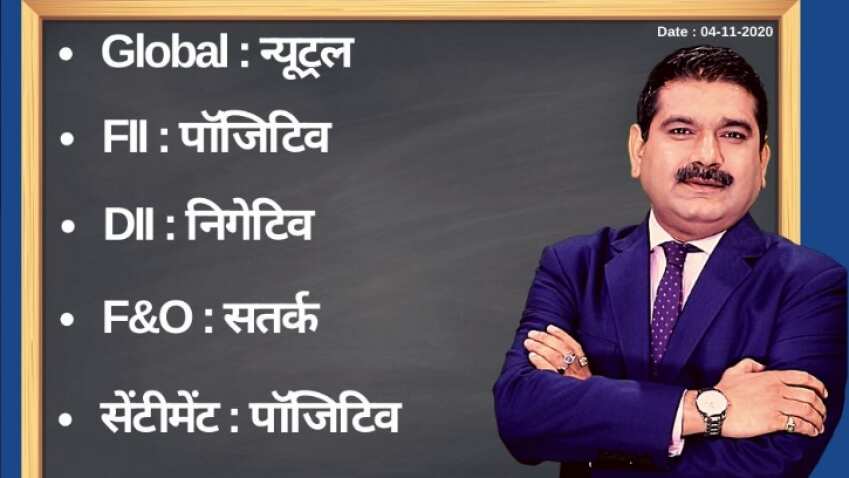

Amid neutral global markets, positive foreign institutional investors (FIIs), sentiment, negative domestic institutional investors (DIIs) and cautious futures & options (F&O) & and cues, the short-term trend of the Indian stock markets will be positive on Wednesday, November 4, 2020

Amid neutral global markets, positive foreign institutional investors (FIIs), sentiment, negative domestic institutional investors (DIIs) and cautious futures & options (F&O) & and cues, the short-term trend of the Indian stock markets will be positive on Wednesday, November 4, 2020.

Equity benchmarks on Tuesday, November 3, 2020, logged gains of around 1.25 per cent amid a jump in global stocks. The BSE 30-share index, Sensex, regained 40,000-mark, while the NSE Nifty-50 index reclaimed 11,800 level.

The Sensex climbed 504 points or 1.27 per cent to settle at 40,261. The Nifty also rose 144 points or 1.24 per cent to settle at 11,814. Nifty Bank added 790.30 points, or 3.17 per cent, to end at 25,682.80.

The broader market at BSE also climbed but underperforming the Sensex. The BSE Mid-Cap index rose 0.42 per cent and the BSE Small-Cap index appreciated 0.35 per cent.

Zee Business’s Managing Editor Anil Singhvi’s Market Strategy for November 4:

Day support range on Nifty is 11,650-11,725, below that 11,550-11,600 is the strong buy zone.

Day higher range on Nifty is 11,875-11,925, above that 11,975-12,025 is strong sell zone.

Day support range on Bank Nifty is 25,100-25,250, below that 24,750-24,900 is strong buy zone.

Day higher range on Bank Nifty is 25,950-26,250, above that 26,450-26,750 is strong Sell zone.

The small day range for trading on Nifty is 11,725-11,925, while the medium and bigger day range are 11,650-11,975 and 11,550-12,025, respectively.

The small day range for trading on Bank Nifty is 25,450-25,950, while the medium and bigger day range are 25,150-26,250 and 24,800-26,450, respectively.

FIIs Net Index long increased to 50% Vs 47%.

Put-Call Ratio (PCR) at 1.59 Vs 1.48, Alert at higher levels.

India VIX 4% down at 24.24.

For Existing Long Positions:

Nifty Intraday stop loss is 11,725 and closing stop loss is 11,640.

Bank Nifty Intraday stop loss is 25,450 and closing stop loss is 24,900.

For Existing Short Positions:

Nifty Intraday and closing stop loss are 11,850.

Bank Nifty Intraday and closing stop loss are 25,800.

For New Positions:

Buy Nifty in 11,650-11,750 range with a stop loss of 11,550 and target 11,825, 11,875, 11,925, 11,975.

Sell Nifty in 11,925-11,975 range with a stop loss of 12,050 and target 11,875, 11,825, 11,750, 11,725.

For New Position

Buy Bank Nifty in 25,100-25,250 range with a stop loss of 24,900 and target 25,350, 25,500, 25,650, 25,750.

Sell Bank Nifty in 26,225-26,450 range with a stop loss of 26,800 and target 26,000, 25,800, 25,700, 25,550.

See Zee Business Live TV Streaming Below:

No Stocks in F&O Ban

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

08:33 AM IST

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today  Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 12: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 12: Important levels to track in Nifty50, Nifty Bank today