Anil Singhvi’s Strategy May 26: Midcap Cement Companies are Positive; Nifty bullish if closes above 9,200

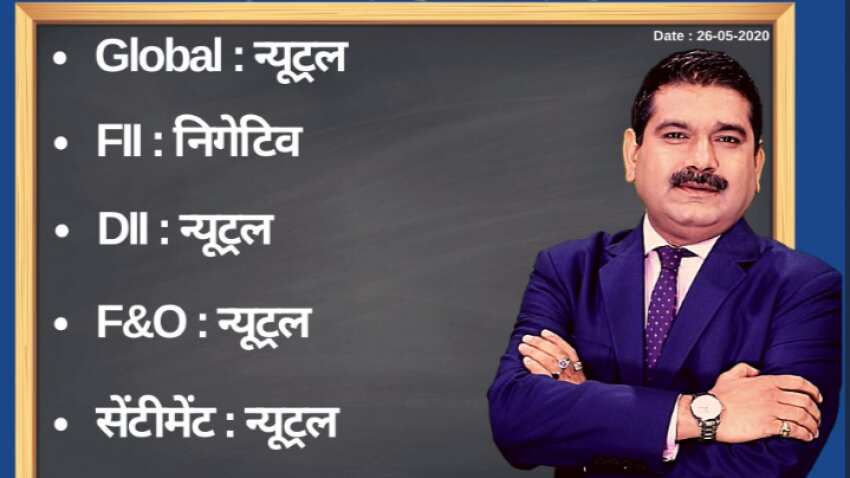

Amid neutral global markets, domestic institutional investors (DIIs), futures & options (F&O), sentiment and negative foreign institutional investors (FIIs) cues, the short-term trend of the Indian stock markets will be neutral on Tuesday, May 26, 2020.

Domestic equity benchmarks on Friday, May 22, 2020, snapped winning streak of three sessions amid negative global cues. Global stocks plunged as rising tensions between Washington and Beijing, the gloomy outlook for China’s economy and the increasing number of Coronavirus cases worldwide weighed on investors’ sentiment. Shares of banks and financial firms tumbled after the Reserve Bank of India extended loan moratorium by three more months. RBI Governor's projection of likely negative GDP growth in FY21 further impacted sentiment.

Sensex and Nifty, both, lost around 0.8 per cent. Sensex at Bombay Stock Exchange declined 260.31 points, or 0.84 per cent, to end at 30,672.59. Similarly, the Nifty at National Stock Exchange settled 67 points, or 0.74 per cent, down at 9039.25, while Bank Nifty lost 456.20 points, or 2.57 per cent, and closed at 17,278.90.

Zee Business's Managing Editor Anil Singhvi's Market Strategy for May 26:

Day Support Zone on Nifty is 8,875-8,975 and the Higher Range is 9,150-9,200.

Day Support Zone on Bank Nifty is 16,800-17,100 and the Higher Range is 17,650-17,850.

Small day range for trading on Nifty is 9,000-9,100, while the medium and bigger day ranges are 8,975-9,150 and 8,875-9,200 respectively.

Small day range for trading on Bank Nifty is 17,100-17,500, while the medium and bigger day ranges are 17,000-17,650 and 16,800-17,850 respectively.

Nifty bullish if closes above 9,200

Bank Nifty neutral if closes above 18,000

Market negative again if Nifty and Bank Nifty closes below 8,900 and 17,500.

Put-Call Ratio (PCR) 1.28 and India Volatility Index (VIX) down 2% at 32.38.

For Existing Long Positions:

Nifty intraday and closing stop loss 9,000.

Bank Nifty intraday and closing stop loss 17,100.

For Existing Short Positions:

Nifty intraday and closing stop loss 9,200.

Bank Nifty intraday and closing stop loss 17,600.

For New Positions:

Buy Nifty with a stop loss of 8,950 and target 9,150, 9,175, 9,200.

Sell Nifty in 9,175-9,250 range with a stop loss of 9,325 and target 9,125, 9,100, 9,050.

Buy Bank Nifty with a stop loss of 16,800 and target 17,500, 17,650, 17,750, 17,850.

Sell Bank Nifty in 17,750-17,950 range with a stop loss of 18,000 and target 17,650, 17,575, 17,500, 17,400.

No Stock in F&O Ban

Sector

Positive: Midcap Cement Companies.

Results Analysis

Bata Futures: Support Range 1210-1240, Higher Zone 1325-1340. Mix results.

See Zee Business Live TV Streaming Below:

HDFC Ltd. Futures: Support Range 1465-1485, Higher Level 1600. Weak results but short covering expected from lower levels.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

SBI 5-Year FD vs MIS: Which can offer higher returns on a Rs 2,00,000 investment over 5 years? See calculations

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

09:00 AM IST

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today  Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 12: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 12: Important levels to track in Nifty50, Nifty Bank today