Anil Singhvi’s Strategy May 22: 9,000 is deciding level on Nifty; Buy RIL Futures with Stop Loss 1,435

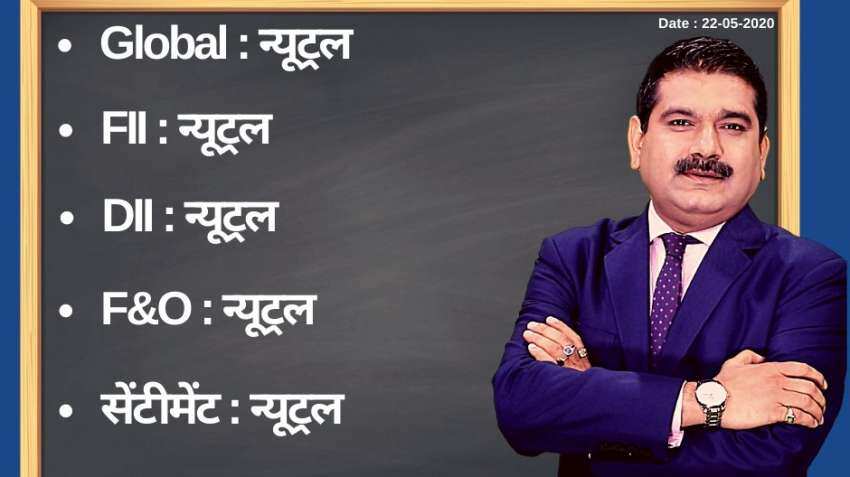

Anil Singhvi’s Strategy May 22: Amid neutral global markets, FIIs, DIIs, F&O and sentiment cues, the short-term trend of the Indian stock markets will be neutral today.

Anil Singhvi’s Strategy May 22: Amid neutral global markets, foreign institutional investors (FIIs), domestic institutional investors (DIIs), futures & options (F&O) and sentiment cues, the short-term trend of the Indian stock markets will be neutral on Friday, May 22, 2020.

Amid some volatility, the Indian markets managed to end in the green Thursday, May 21, 2020. The benchmark index at the Bombay Stock Exchange climbed 114 points or 0.37 per cent to end at 30,933. While the Sensex had touched an intra-day high of 31,189; heavy profit-booking, negative global cues, concerns over the long-term impact of COVID-19 and worsening China-US relations kept investors on the edge. An appreciation in the rupee, however, did support the markets.

See Zee Business Live TV streaming below:

While shares of auto, metal, IT, technology and FMCG sectors recorded huge gains today, shares of capital goods, power, finance, banking and utility sectors witnessed selling

The National Stock Exchange too ended on the higher side. The Nifty gained 40 points or 0.44 per cent to end at 9,106. However, Nifty Bank declined 105 points, or 0.59 per cent, to 17,735.

Zee Business's Managing Editor Anil Singhvi's Market Strategy for May 22:

9,000 is the deciding level on Nifty.

Day Support Zone on Nifty is 8825-8875 and the Higher Range is 9,175-9,250.

17,400-17,600 and 16,800-17,100 are the Day Support Range on Bank Nifty and the Higher Range is 18,000-18,300.

Small Day Range for trading on Nifty is 9,050-9,150, while the medium and bigger ranges are 9,000-9,200 and 8,875-9,250 respectively.

Small Day Range for trading on Bank Nifty is 17,500-18,000, while the medium and bigger ranges are 17,400-18,150 and 17,100-18,300 respectively.

Market bullish if Nifty and Bank Nifty closes above 9,200 and 19,000.

Market negative again if Nifty and Bank Nifty closes below 8,900 & 17,500.

Put-Call Ratio (PCR) 1.29 and India Volatility Index (VIX) down 8% at 32.99.

For Existing Long Positions:

Nifty intraday and closing stop loss 9,000.

Bank Nifty intraday and closing stop loss 17,400.

For Existing Short Positions:

Nifty intraday and closing stop loss 9,200.

Bank Nifty intraday and closing stop loss 18,000.

For New Positions:

Buy Nifty in 8,925-9,000 range with a stop loss of 8,800 and target 9,050, 9,100, 9,150, 9,175.

Sell Nifty in 9,150-9,250 range with a stop loss of 9,325 and target 9,100, 9,050, 9,000.

Buy Bank Nifty in 17,400-17,500 range with a stop loss of 17,350 and target 17,650, 17,750, 17,850, 18,000.

Sell Bank Nifty in 18,000-18,300 range with a stop loss of 18,500 and target 17,850, 17,750, 17,600, 17,500.

Out of F&O Ban: Vodafone Idea

Stock of the Day:

Buy RIL Futures: Stop loss 1,435 and target 1,465, 1,480, 1,500. KKR to invest Rs 11,367 Crore in Jio Platforms.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

SBI 5-Year FD vs MIS: Which can offer higher returns on a Rs 2,00,000 investment over 5 years? See calculations

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

09:41 AM IST

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today  Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 12: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 12: Important levels to track in Nifty50, Nifty Bank today