Anil Singhvi’s Strategy March 12: Auto, Metals, NBFC & IT sectors are Negative

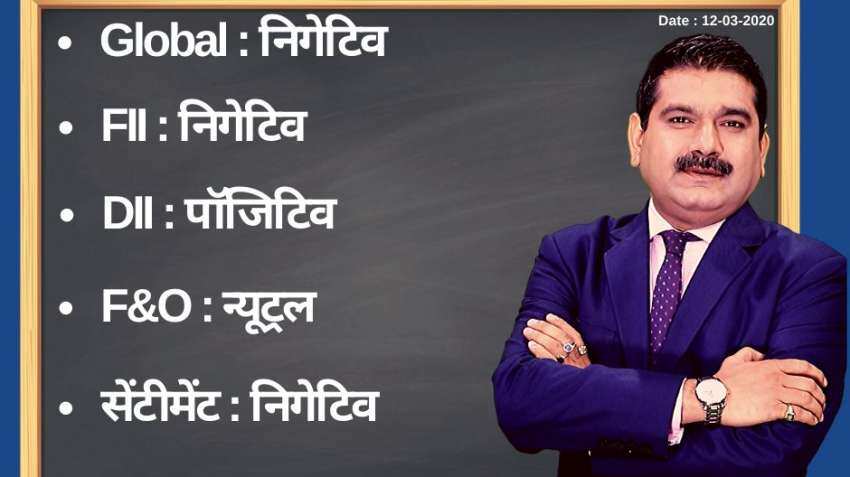

Anil Singhvi’s Strategy March 12: On account of positive DIIs, neutral F&O and negative FIIs, the short-term trend of the Indian stock markets will be negative.

Anil Singhvi’s Strategy March 12: Amid positive domestic institutional investors (DIIs), neutral futures & options (F&O), negative global markets, foreign institutional investors (FIIs) and sentiment cues, the short-term trend of the Indian stock markets will be negative on Thursday, March 12, 2020.

The domestic stock markets ended almost flat after a volatile trading session on Wednesday, March 11, 2020. Gains were capped as investors continued to worry about the unabating spread of the coronavirus. The barometer index, the S&P BSE Sensex, rose 62.45 points or 0.18% at 35,697.40. The index rose 386.56 points, or 1.08% to hit the day's high of 36,021.51 in afternoon trade. The Nifty 50 index gained 6.95 points, or 0.02%, to close at 26,487.80.

See Zee Business Live TV streaming below:

Zee Business's Managing Editor Anil Singhvi's Market Strategy for March 12:

Next Support zone on Nifty is 9,950-10,000 and Bank Nifty is 25,500.

If sustain below that, then bigger risk opens till 9,600 and 24,250 levels.

The small day range for trading on Nifty is 10,000-10,300, while the medium and bigger ranges are 9,950-10,350 and 9,800-10,450 respectively.

The small day range for trading on Bank Nifty is 25,500-26,000, while the medium and bigger ranges are 25,000-26,250 and 25,000-26,500 respectively.

Put-Call Ratio (PCR) High 1.07, Volatility Index (VIX) up by 2% 31.56.

For Existing Long Positions:

Nifty intraday and closing stop loss 10,300.

Bank Nifty intraday and closing stop loss 25,900.

For Existing Short Positions:

Nifty intraday and closing stop loss 10,550.

Bank Nifty intraday and closing stop loss 26,500.

For New Positions:

Sell Nifty with a stop loss of 10,300 and target 10,000, 9,950, 9,800.

Sell Bank Nifty with a stop loss of 26,500 and target 25,500, 25,000, 24,500, 24,250.

Can Consider cutting shorts near Nifty 9,950 and Bank Nifty 25,500 or hold them with trailing Stop Loss of 10,300 and 26,100.

I will give Nifty and Bank Nifty buy call during live markets if at all any signal comes.

Sectors:

Negative: Auto, Metals, NBFC, IT

No stock in F&O Ban

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Tata Motors, Muthoot Finance and 3 more: Axis Direct recommends buying these stocks for 2 weeks; check targets, stop losses

08:44 AM IST

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today  Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 12: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 12: Important levels to track in Nifty50, Nifty Bank today