Anil Singhvi’s Strategy June 5: Metal Sector is Positive & Real Estate is Negative; Sell DLF Futures with Stop Loss 160

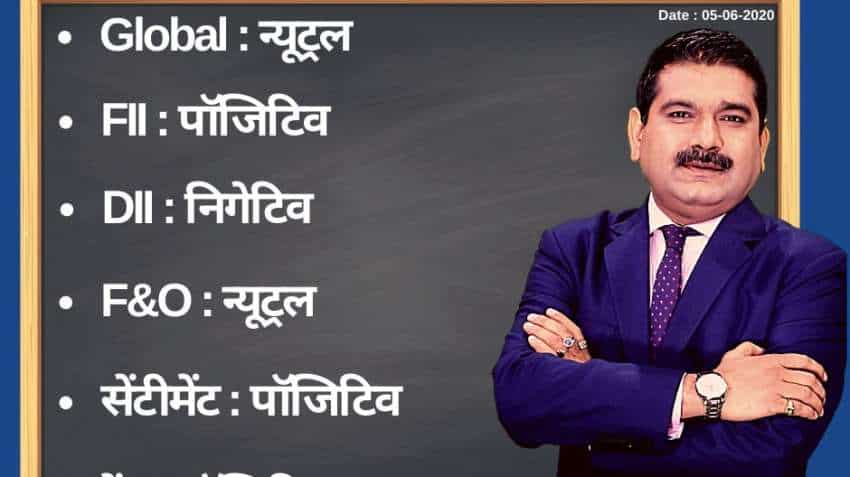

Anil Singhvi’s Strategy June 5: Amid neutral global market, F&O, positive FIIs and negative DIIs, the short-term trend of the Indian stock markets will be positive today.

Anil Singhvi’s Strategy June 5: Amid neutral global market, futures & options (F&O), positive foreign institutional investors (FIIs), sentiment and negative domestic institutional investors (DIIs) cues, the short-term trend of the Indian stock markets will be positive on Friday, June 5, 2020.

Snapping winning rally of six sessions, domestic equity benchmarks on Thursday, June 4, 2020, fell marginally amid mixed global cues. Selling in banks stocks put pressure on bourses. Banks corrected after the Supreme Court (SC) raised concerns over levying of interests on loans during the six-month moratorium period. Trading was volatile due to expiry of weekly index options. The Sensex at Bombay Stock Exchange declined 129 points, or 0.38 per cent, to close at 33,981. Similarly, Nifty at National Stock Exchange slipped 32 points, or 0.32 per cent, up at 10,029. Bank Nifty fell 550 points, or 2.63 per cent, to 20,390.

See Zee Business Live TV streaming below:

Zee Business’s Managing Editor Anil Singhvi’s Market Strategy for June 5:

Day Support Zone on Nifty is 9,825-9,950 and the Higher Range is 10,125-10,175.

Day Support Zone on Bank Nifty is 19,650-19,850 and the Higher Range is 20,800-20,950.

The small day range for trading on Nifty is 10,000-10,060, while the medium and bigger ranges are 9,950-10,125 and 9,825-10,175.

The small day range for trading on Bank Nifty is 20150-20525, while the medium and bigger ranges are 19,950-20,625 and 19,850-20,850 respectively.

Put-Call Ratio (PCR) is 1.53 and India Volatility Index (VIX) down 1% at 29.69.

For Existing Long Positions:

Nifty intraday and closing stop loss are 9,925.

Bank Nifty intraday and closing stop loss are 20,200.

For Existing Short Positions:

Nifty intraday and closing stop loss are 10,200.

Bank Nifty intraday and closing stop loss are 20,550.

For New Positions:

Buy Nifty in 9,925-10,000 range with a stop loss of 9,825 and target 10,050, 10,125, 10,175.

Sell Nifty in 10,125-10,175 range with a stop loss of 10,200 and target 10,075, 10,025, 10,000.

Buy Bank Nifty in 19,850-19,950 range with a stop loss of 19,600 and target 20,100, 20,225, 20,350, 20,500.

Sell Bank Nifty in 20,800-20,950 range with a stop loss of 21,150 and target 20,650, 20,550, 20,400, 20,300.

Sector Analysis:

Positive: Metals

Negative: Real Estate

No Stock in F&O Ban

Stock of the Day

Sell DLF Futures: Stop loss 160 and target 147, 142. Results are operationally very weak.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

08:59 AM IST

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today  Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 12: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 12: Important levels to track in Nifty50, Nifty Bank today