Anil Singhvi’s Strategy June 1: Banks, Metals & Fertilizers are Positive; Buy RCF with Stop Loss of 39.50

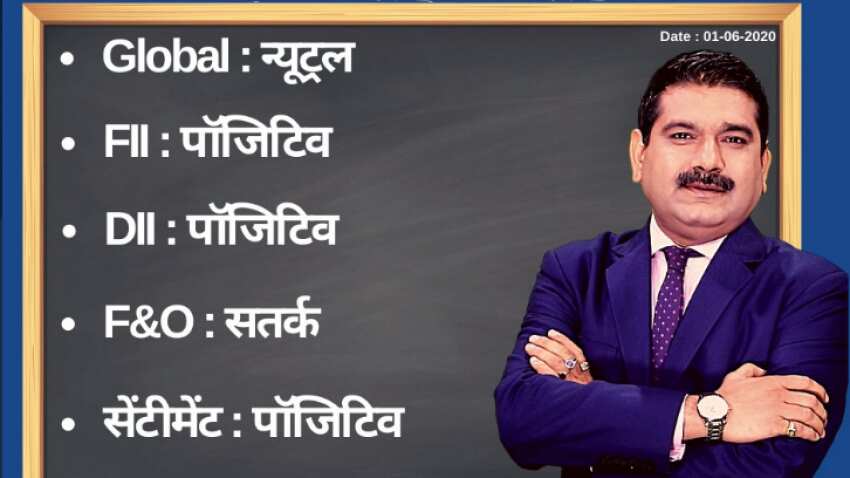

Amid neutral global markets, positive foreign institutional investors (FIIs), domestic institutional investors (DIIs), sentiment and cautious futures & options (F&O) cues, the short-term trend of the Indian stock markets will be positive on Monday, June 1, 2020

Amid neutral global markets, positive foreign institutional investors (FIIs), domestic institutional investors (DIIs), sentiment and cautious futures & options (F&O) cues, the short-term trend of the Indian stock markets will be positive on Monday, June 1, 2020.

Domestic equity benchmarks Friday, May 29, 2020, gained for the third day in a row even as the global cues were negative. Sensex at Bombay Stock Exchange climbed 224 points, or 0.69 per cent, to close at 32,424. Similarly, the Nifty at National Stock Exchange settled 90 points, or 0.95 per cent, up at 9,580. In the previous two sessions, both indices rose more than five per cent. Similarly, Bank Nifty gained 127 points, or 0.66 per cent, to settle at 19,298.

Zee Business’s Managing Editor Anil Singhvi’s Market Strategy for June 1:

Day Support Zone on Nifty is 9,375-9,500 and the Higher Range is 9,725-9,850.

Day Support Zone on Bank Nifty is 18,725-18,825 and the Higher Range is 19,900-20,100.

The small Day Range for trading on Nifty is 9,575-9,725, while the medium and bigger ranges are 9,500-9,800 and 9,475-9,850 respectively.

The small Day Range for trading on Bank Nifty is 19,300-19,700, while the medium and bigger ranges are 19,150-19,900 and 18,800-20,100 respectively.

Put-Call Ratio (PCR) is 1.61, alert at higher levels and Volatility Index (VIX) up 1% at 30.22.

For Existing Long Positions:

Nifty intraday and closing stop loss 9,475.

Bank Nifty intraday and closing stop loss 19,150.

For Existing Short Positions:

Nifty intraday and closing stop loss 9,600.

Bank Nifty intraday and closing stop loss 19,500.

For New Positions:

Buy Nifty with a stop loss of 9,575 and target 9,650, 9,725, 9,800, 9,850.

Sell Nifty in 9,725-9,850 range with a stop loss of 9,900 and target 9,700, 9,650.

Buy Bank Nifty with a stop loss of 19,150 and target 19,650, 19,750, 19,900, 20,100.

Sell Bank Nifty in 19,900-20,000 with a stop loss of 20,150 and target 19,750, 19,650.

Sectors:

Positive: Banks, Metals and Fertilizers.

No Stock in F&O Ban

Result Analysis:

Amara Raja Futures: Support Zone 590-600; Higher Range 650-655. Exit from the short position above 625.

Stock of the Day:

Buy RCF: Stop loss 39.50 and target 44, 47. Extraordinary results, Deep value stock.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

09:03 AM IST

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today  Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 12: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 12: Important levels to track in Nifty50, Nifty Bank today