Anil Singhvi’s Strategy January 23: Market Trend is Neutral; Banking Sector is Negative, Sell them on Rise

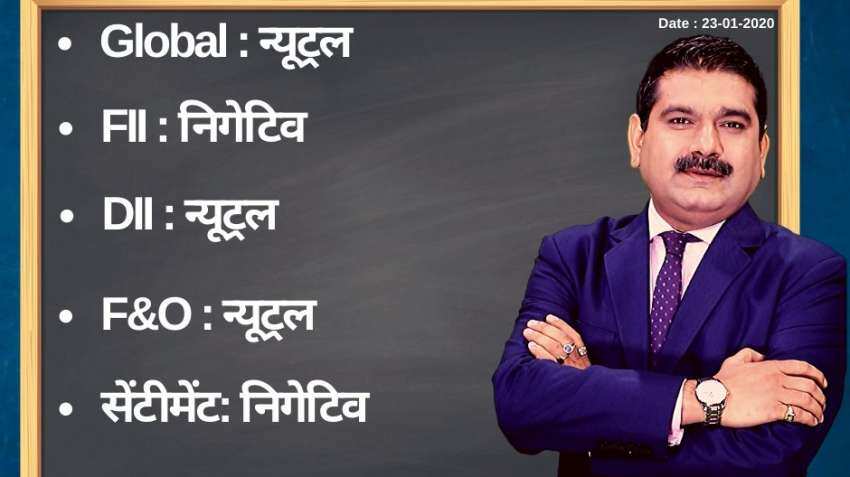

On account of neutral DIIs, F&O and negative FIIS, the short-term trend of the Indian stock markets will be neutral, says Zee Business Managing Editor Anil Singhvi.

Amid neutral global markets, domestic institutional investors (DIIs), futures & options (F&O) and negative foreign institutional investors (FIIs) and Sentiment cues, the short-term trend of the Indian stock markets will be neutral on Wednesday, January 22, 2020.

Key domestic benchmarks on Wednesday, January 22, 2020, declined for the third straight session. Large-caps witnessed selling pressure due to concerns over stretched valuations. At the stock market, the Sensex at the Bombay Stock Exchange dropped 208.43 points, or 0.50 per cent, to end at 41,115.38. The Nifty 50 at the National Stock exchange - which fell for the fourth day in a row - slipped 62.95 points, or 0.52 per cent, to 12,106.90. Bank Nifty lost 246.10 points, or 0.80 per cent, to settle at 30,701.45.

See Zee Business Live TV streaming below:

Zee Business's Managing Editor Anil Singhvi's Market Strategy for January 23:

Put-Call Ratio (PCR) is 1.00, alert at lower levels, the volatility index (VIX) up 3% to 16.36.

Volatility to increase on expiry day

Follow sell on rise strategy or Contra trade near the range

Next important support zone on Nifty is 12,000-12,025 and Bank Nifty is 30,200-30,300.

The small day range for trading on Nifty is 12,075-12,150, while medium and bigger trading ranges are 12,050-12,200 and 12,000-12,225 respectively.

The small day range for trading on Bank Nifty is 30,600-30,850, while medium and bigger trading ranges are 30,500-30,950 and 30,250-31,100 respectively.

Fresh Buying and big short-covering ONLY IF sustains above 12,225 and 31,150 level

For Existing Long Positions:

Nifty intraday and closing stop loss 12,075.

Bank Nifty intraday and closing stop loss 30,600.

For Existing Short Positions:

Nifty intraday and closing stop loss 12,230.

Bank Nifty intraday and closing stop loss 31,000.

For New Positions:

Buy Nifty in 12,000-12,025 range with a stop loss of 11,950 and target 12,075, 12,100, 12,150.

Sell Nifty in 12,160-12,200 range with a stop loss of 12,250 and target 12,110, 12,090.

Sell Bank Nifty in 30,950-31,100 range with a stop loss of 31,200 and target 30,850, 30,700, 30,600.

Buy Bank Nifty near 30,500, for aggressive traders with strict stop loss 30,450 and target 30,600, 30,700, 30,850.

Still in F&O Ban: Yes Bank

Sectors:

Negative: Banks sell on rise

Result Review:

L&T Futures:

Negative: Weak operational results.

Positive: Valuations reasonable.

Support range 1265-1280, higher range 1325-1340.

RBL Futures:

Negative: Asset quality weak but as expected.

Positive: Better Operational performance.

Support range 318-320, higher range 360-365.

Stock of the Day:

Sell Axis Futures: Stop loss 720 and target 690, 685, 670. Weak asset quality, Fresh slippages at Rs6150 Crore. Brokerages EPS cut from 7-23% range.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

SBI 5-Year FD vs MIS: Which can offer higher returns on a Rs 2,00,000 investment over 5 years? See calculations

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

08:53 AM IST

Final Trade: Sensex ends 423 pts lower, Nifty settles at 23,350; as Adani, PSU Bank stocks tank

Final Trade: Sensex ends 423 pts lower, Nifty settles at 23,350; as Adani, PSU Bank stocks tank Sensex, Nifty slip 1% each; Adani Energy Solutions hits 52-week low

Sensex, Nifty slip 1% each; Adani Energy Solutions hits 52-week low FIRST TRADE: Indices open mixed, Sensex up 26 points, Nifty down at 23,344

FIRST TRADE: Indices open mixed, Sensex up 26 points, Nifty down at 23,344 GIFT Nifty down 75 points, Asian indices trade lower; Markets signal a negative start

GIFT Nifty down 75 points, Asian indices trade lower; Markets signal a negative start Nifty50 below 200-DMA, Bank Nifty breaches key 50,000 level: What next?

Nifty50 below 200-DMA, Bank Nifty breaches key 50,000 level: What next?