Anil Singhvi’s Strategy January 16: PSU, Gas Companies & Aviation sector are Positive; Buy Indigo Futures with Stop Loss 1450

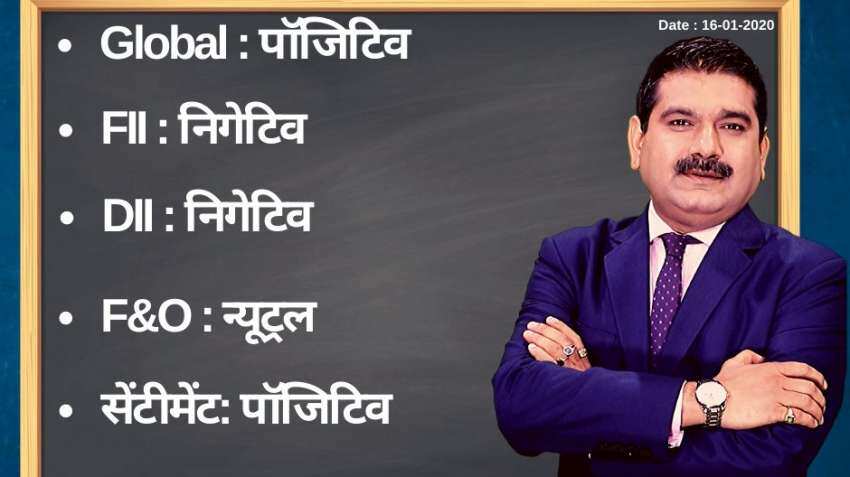

On account of positive global sentiments, neutral G&O, negative DIIs and FIIs, the short-term trend of the Indian stock markets will remain positive, says Zee Business Managing Editor Anil Singhvi.

Amid positive global markets and sentiment, neutral futures & options (F&O), negative foreign institutional investors (FIIs) and domestic institutional investors (DIIs) cues, the short-term trend of the Indian stock markets will remain positive on Thursday, January 16, 2020.

Market benchmarks, Sensex and Nifty, on Wednesday, January 15, 2020, ended marginally lower amid weak Asian cues that triggered profit selling in the domestic market. The key indices lost around 0.2 per cent. The Sensex fell 79.90 points, or 0.19%, to close at 41,872.73. Likewise, the broader Nifty slipped 19 points, or 0.15%, to settle at 12,343.30 and Bank Nifty lost 246.75 points, or 0.77%, to settle at 31,824.90.

See Zee Business Live TV streaming below:

Zee Business's Managing Editor Anil Singhvi's Market Strategy for January 16:

Day support zone on Nifty is 12,250-12,300 and Bank Nifty is 31,650-31,700.

Higher zone on Nifty is 12,375-12,400 and Bank Nifty is 32,075-32,200.

The small day range for trading on Nifty is 12,300-12,375, while the medium and bigger ranges are 12,275-12,400 and 12,250-12,450 respectively.

The small day range for trading on Bank Nifty is 31,700-32,00, while the medium and bigger ranges are 31,650-32,075 and 31,500-32,200 respectively.

For Existing Long Positions:

Nifty intraday and closing stop loss 12,250.

Bank Nifty intraday and closing stop loss 31,650.

For Existing Short Positions:

Nifty intraday and closing stop loss 12,400.

Bank Nifty intraday and closing stop loss 32,200.

For New Positions:

Buy Nifty in 12,275-12,300 range with a stop loss of 12,250 and target 12,325, 12,350, 12,375.

Sell Nifty in 12,375-12,400 range with a stop loss of 12,450 and target 12,350, 12,325, 12,300.

Buy Bank Nifty in 31,650-31,700 range with a stop loss of 31,600 and target 31,800, 31,900, 32,000, 32,075.

Sell Bank Nifty in 32,075-32,200 range with stop loss of 32,250 and target 32,000, 31,900, 31,800, 31,700.

Put-Call Ratio (PCR) is 1.57. The volatility index (VIX) is 14.12.

Enters F&O Ban: Yes Bank

Sectors:

Positive: PSU, Gas companies, Aviation

Stock of the Day:

Buy Indigo Futures: Stop loss 1450 and target 1500, 1550, 1600. Qatar Airways is interested in picking up the stake.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

09:35 AM IST

Midday Market Report: Sensex, Nifty hold gains; HDFC AMC, Shoppers Stop surge

Midday Market Report: Sensex, Nifty hold gains; HDFC AMC, Shoppers Stop surge GIFT Nifty futures up 40 points; markets likely to open higher on positive global cues

GIFT Nifty futures up 40 points; markets likely to open higher on positive global cues Final Trade: Sensex gains 170 points, Nifty ends at 23,176; HDFC AMC Q3 PAT soars 31%

Final Trade: Sensex gains 170 points, Nifty ends at 23,176; HDFC AMC Q3 PAT soars 31% Midday Market Report: Sensex climbs 250 points, Nifty near 23,200; HCL Tech tumbles 8%

Midday Market Report: Sensex climbs 250 points, Nifty near 23,200; HCL Tech tumbles 8% GIFT Nifty futures up 150 points; markets likely to open higher

GIFT Nifty futures up 150 points; markets likely to open higher