Anil Singhvi’s Strategy February 19: PSU stocks are Positive; Sell Auto stocks on a Rise

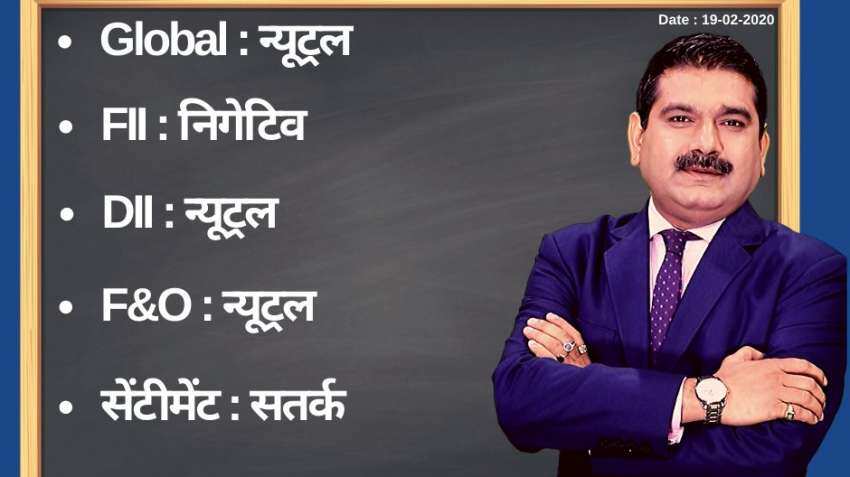

Anil Singhvi’s Strategy February 19: On account of neutral DIIs and F&o and negative FIIs, the short-term trend of the Indian stock markets will be positive on Wednesday.

Anil Singhvi’s Strategy February 19: Amid neutral global market, domestic institutional investors (DIIs) and futures & options (F&O) and negative foreign institutional investors (FIIs) cues, the short-term trend of the Indian stock markets will be positive on Wednesday, February 19, 2020, while sentiment is cautious.

The domestic stocks markets declined for the fourth straight session on Tuesday, February 18, 2020. it was dragged by banking stocks that have significant exposure to telecom sector debts. Weak global shares owing to the coronavirus outbreak also impacted trading sentiment. After a steep slide in the afternoon trade, the Nifty pared most of its losses and closed a tad below the 12,000-mark.

See Zee Business Live TV streaming below:

The Sensex at the Bombay Stock Exchange lost 161.32 points, or 0.39 per cent, to end at 40,894.38. The Nifty 50 at the National Stock exchange fell 53.30 points, or 0.44 per cent, to 11,992.50. Likewise, Bank Nifty lost 118.20 points or 0.39 per cent to settle at 30,562.50.

Zee Business's Managing Editor Anil Singhvi's Market Strategy for February 19:

12,000 and 30,500 are the deciding levels on Nifty and Bank Nifty respectively.

The small day range for trading on Nifty is 11,950-12,050, while medium and bigger ranges are 11,900-12,100 and 11,800-12,150 respectively.

The small day range for trading on Bank Nifty is 30,500-30,675, while medium and bigger ranges are 30,250-30,825 and 30,200-31,000 respectively.

For Existing Long Positions:

Nifty intraday and closing stop loss 11,900.

Bank Nifty intraday and closing stop loss 30,500.

For Existing Short Positions:

Nifty intraday and closing stop loss 12,125.

Bank Nifty intraday and closing stop loss 30,850.

For New Positions:

Buy Nifty with a stop loss 11,900 and target 12,050, 12,100, 12,125, 12,150.

Sell Nifty in 12,100-12,150 range with a stop loss 12,200 and target 12,050, 12,025, 12,000.

Buy Bank Nifty with a stop loss 30,500 and target 30,675, 30,775, 30,825, 31,000.

Sell Bank Nifty in 30,825-31,000 range with a stop loss 31,100 and target 30,750, 30,675, 30,575, 30,500.

Put-Call Ratio (PCR) is 1.11. The volatility index (VIX) is 14.51.

Enters F&O Ban again: Yes Bank

Already of Ban: NCC

Sectors:

Positive: PSU

Negative: Auto sell on rise

Stock of the Day:

Buy Shree Cement Futures: Stop loss 23,400 and target 24,500, 25,000, 27,000. Inclusion in Nifty from March 27, 2020.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Tata Motors, Muthoot Finance and 3 more: Axis Direct recommends buying these stocks for 2 weeks; check targets, stop losses

08:45 AM IST

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today  Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 12: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 12: Important levels to track in Nifty50, Nifty Bank today