Anil Singhvi’s Strategy August 11: Day support zone on Nifty is 11,150-11,225 & Bank Nifty is 21,650-21,800; Sell Titan Futures with Stop Loss 1115

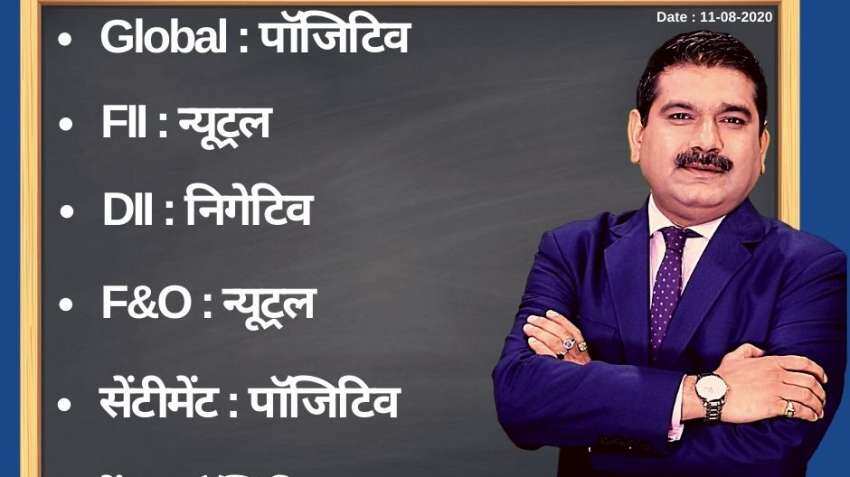

Anil Singhvi’s Strategy August 11: Amid positive global markets, neutral FIIs, F&O and negative DIIs, the short-term trend of the Indian stock markets will be positive on Tuesday.

Anil Singhvi’s Strategy August 11: Amid positive global markets, sentiment, neutral foreign institutional investors (FIIs), futures & options (F&O) and negative domestic institutional investors (DIIs) cues, the short-term trend of the Indian stock markets will be positive on Tuesday, August 11, 2020.

The domestic stocks markets closed with decent gains on Monday, August 10, 2020. The Sensex and the Nifty sharply came off the day's high as profit booking emerged at higher levels. Global stock markets were upbeat as an improvement in Chinese factory data calmed nerves.

After rallying 390 points during the day, the 30-share BSE benchmark pared some gains to end 142 points or 0.37 per cent higher at 38,182. The NSE Nifty climbed 56 points or 0.54 per cent to close at 11,270. Similarly, Bank Nifty gained 173 points or 0.79 per cent and closed at 21,927.

See Zee Business Live Streaming below:

In the broader market at BSE, the Mid-cap closed 1.42 per cent up and Small-cap gained 1.47 per cent.

Zee Business’s Managing Editor Anil Singhvi’s Market Strategy for August 11:

Day support zone on Nifty is 11,150-11,225 and the day higher range is 11,400-11,450.

Day support zone on Bank Nifty is 21,650-21,800 and the day higher range is 22,075-22,250, above that 22,350-22,500 is profit booking zone.

The small day range on Nifty is 11,235-11,335, while the medium and bigger ranges are 11,200-11,400 and 11,150-11,450, respectively.

The small day range on Bank Nifty is 21,800-22,250, while the medium and bigger ranges are 21,750-22,350 and 21,650-22,425, respectively.

Put-Call Ratio (PCR) is 1.59, India Volatility Index (VIX) at 22.51.

For Existing Long Positions:

Nifty intraday and closing stop loss are 11,200.

BankNifty intraday and closing stop loss are 21,650

For Existing Short Positions:

Nifty intraday and closing stop loss are 11,350.

BankNifty intraday and closing stop loss are 22,100.

For New Positions:

Buy Nifty with a stop loss of 11,200 and target 11,335, 11,400, 11,450.

Sell Nifty in 11,400-11,450 range with a stop loss of 11,500 and target 11,350, 11,300, 11,275.

Buy Bank Nifty with a stop loss of 21,750 and target 22,075, 22,250, 22,350, 22,400, 22,450.

Sell Bank Nifty in 22,350-22,450 range with a stop loss of 22,550 and target 22,250, 22,100, 22,000, 21,900.

Sectors in Focus:

Positive: Banks, NBFC

5 Stocks In F&O Ban:

New in Ban: Muthoot Finance

Already In Ban: Canara Bank, Century Textile, Vodafone Idea, Vedanta

Result Analysis:

Sell Titan Futures: Stop loss 1115 and target 1050, 1030, 1010. Very poor results, weak guidance.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Tata Motors, Muthoot Finance and 3 more: Axis Direct recommends buying these stocks for 2 weeks; check targets, stop losses

08:42 AM IST

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today  Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 12: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 12: Important levels to track in Nifty50, Nifty Bank today