A day in the life of Indian consumers after GST

The broad based tax structure under the much awaited Goods and Service Tax (GST) were decided by the GST Council to be 0%, 5%, 12%, 18% and 28% on Thursday.

While the 5% and 28% tax rate will be implemented for necessities and luxury commodities respectively; the 12% and 18% are standard rates which will levy tax on all other commodities.

The final inflationary or deflationary pressures on commodities will only be realised after the harmonisation with the respective tax rates and tax rates on individual products and services are decided. Even still, much speculation over impact of GST rates on inflation has been ruled out considering 50% of the items in the Consumer Price Index (CPI) will be kept out of the GST ambit (i.e. in the 0% tax slab).

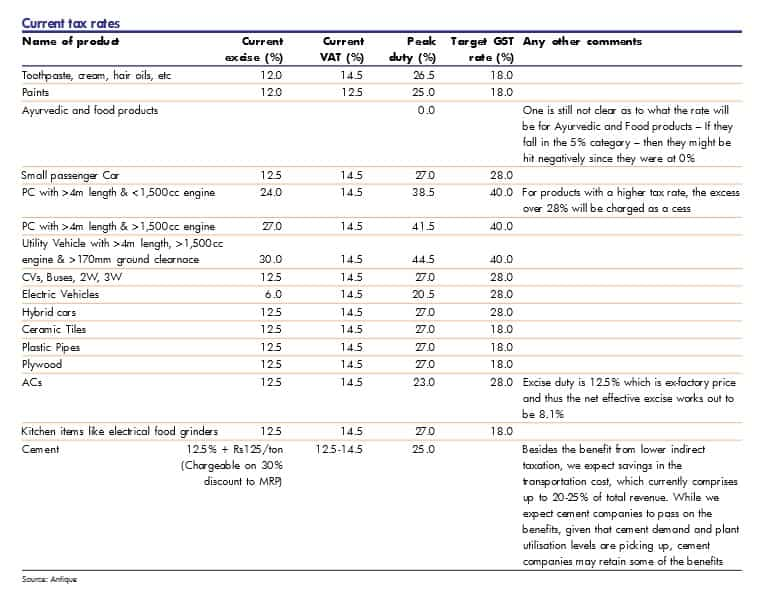

Starting with the quintessential toothpaste and bathing soap which is currently taxed by the state government at 12% along with Value Added Tax (VAT) at 14.5% bringing peak duty charge of 26.5% would become cheaper under the target GST rate of 18%, Antique Morning Presentation analysts said in a report dated November 4.

Consumer goods like - personal care products & consumer durables/electricals - are expected to become cheaper as tax imposed on these goods currently are 21-30% and will drop to 18%, Suhas Harinarayanan, Richard Liu, Vicky Punjabi and Chandra Gopal Choudhary, analysts from JM Financial said in a report dated November 4.

Tea and Jam which have current effective tax on MRP at 5.66% each would effectively be reduced by 0.9% after GST implementation of 4.76% tax, a report by Economic Times said.

Analysts said that agricultural products like cereals, fruits and vegetables will continue to be exempted form tax.

The ET report showed that bottled water’s tax could go up 3.5% as its current effective tax being 18.38% would go up to 21.88% with GST.

Oil and gas other than petro rated products which will be in the 0% tax slab that have a current tax rate of 21-31% would become comparatively cheaper under the 18% tax rate, analysts Manoj Bahety, Manoj Bahety, Ankit Dangayach and Prashant Bothra from Edelweiss said in a report dated Novemeber 3.

Demerit goods like cigarettes, aerated drinks, pan masala and high end SUVs which are going to be taxed at 28% with additional cess, will make the goods more expensive.

The GST Council said that the tax on cigarettes will be 65% which is higher than the current rate of around 45%.

Tax on kitchen items like electrical food grinder with a peak duty of 27% (Central excise =12.5% and VAT=14.5%) would be brought down to 18%, Antique report said.

Telecom services are likely to become more expensive as a potential 3 percentage point hike in service tax from current 15% level is foreseen by analysts form JM Financials.

Ayurvedic and food products, which are currently exempted from tax would be hit negatively if they fall in the 5% category, Antique analysts reported.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Largecap PSU Stock for 65% Gain in New Year: Anil Singhvi picks PSU bank for long term; know reasons and target prices

SBI Latest FD Rates: PSU bank pays these returns to senior citizens and other depositors on 1-year, 3-year and 5-year fixed deposits

Largecap Stocks To Buy: Analysts recommend buying Maruti Suzuki, 2 other stocks for 2 weeks; check targets

Power of Rs 15,000 SIP: How long it will take to achieve Rs 7 crore corpus? See calculations to know

Shark Tank India Season 4: Social Media influencer Gaurav Taneja shocks sharks with his earnings, earns Rs 1 crore in 1 hour!

SIP in Stocks For New Year 2025: Market guru Anil Singhvi recommends 1 largecap, 2 midcap scrips to buy in dips; note down targets

Top 7 Index Mutual Funds With Best SIP Returns in 10 Years: Rs 11,111 monthly SIP investment in No. 1 fund is now worth Rs 33,18,831; know how others have fared

04:48 PM IST

Maharashtra: High-Security Registration Plate price for vehicles varies from Rs 531 to Rs 879

Maharashtra: High-Security Registration Plate price for vehicles varies from Rs 531 to Rs 879 LIC gets GST demand notice of Rs 65 crore

LIC gets GST demand notice of Rs 65 crore GST on term life insurance premium, senior citizen's health coverage may be exempt

GST on term life insurance premium, senior citizen's health coverage may be exempt GST Council sets up GoM on compensation cess; panel to submit report by December 31

GST Council sets up GoM on compensation cess; panel to submit report by December 31 Zomato gets Rs 4.59 cr tax demand notices

Zomato gets Rs 4.59 cr tax demand notices