7th Pay Commission: Here's how you can calculate your revised salary

The government announced 23.55% overall hike in salaries, allowances and pension.

The Government of India on Tuesday published 7th Pay Commission notification. The central government employees will now get the revised salary from August 1.

Ministry of Finance had cleared 7th Pay Commission recommendations for its 47 lakh central government employees and 52 lakh pensioners last month. The basic salary of an employee was increased from Rs 7000 to Rs 18000 per month.

The government announced 23.55% overall hike in salaries, allowances and pension involving an additional burden of Rs 1.02 lakh crore or nearly 0.7% of the gross domestic product (GDP).

Under the notification, the minimum pay in government will be with effect from January 1.

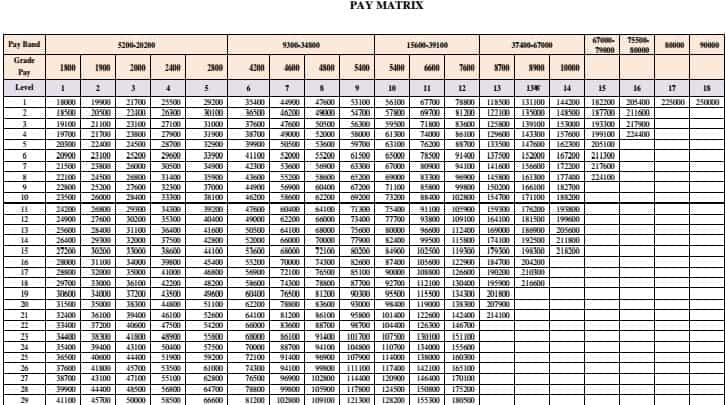

The pay in the applicable Level in the Pay Matrix will be the pay obtained by multiplying the existing basic pay by a factor of 2.57, the notification said.

Here's how you can calculate the revised salary:

For example:

Existing Pay Band: PB-1

Existing Grade Pay : 2400

Existing Pay in Pay Band: 10160

Existing Basic Pay : 12560 (10160+2400)

Pay after multiplication by a fitment factor of 2.57 : 12560 x 2.57 = 32279.20 (rounded off to 32279)

Which is Level 4. Therefore, Revised Pay in Pay Matrix (either equal to or next higher to 32279 in Level 4) : 32300.

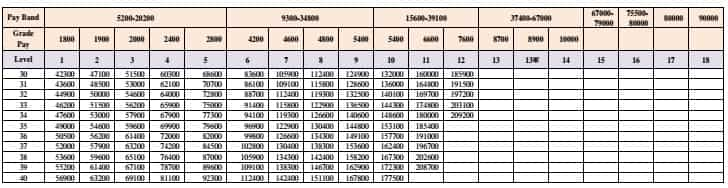

Similarly, suppose, if an employee is entitled to Dearness Allowance and Non-Practicing Allowance (NPA) the pay in the revised pay structure will be fixed in the following manner:

Existing Pay Band : PB-3

Existing Grade Pay : 5400

Existing pay in Pay Band : 15600

Existing Basic Pay : 21000

25% NPA on Basic Pay : 5250

DA on NPA@ 125% : 6563

Pay after multiplication by a fitment factor of 2.57:

21000 x 2.57 = 53970

DA on NPA : 6563 (125% of 5250)

Sum of 53970+6563 = 60533

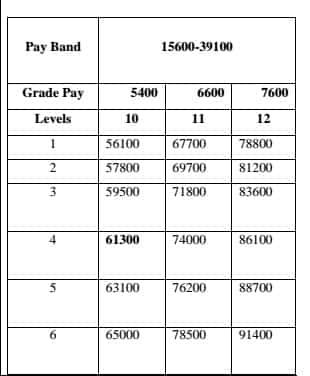

Level corresponding to Grade Pay 5400 (PB-3): Level 10

Revised Pay in Pay Matrix (either equal to or next higher to 60540 in Level 10) : 61300

Pre-revised Non-Practicing Allowance : 5250

Revised Pay + pre-revised Allowance : 66550

The recommendations on Allowances (except Dearness Allowance) will be referred to a Committee comprising Finance Secretary and Secretary (Expenditure) as Chairman and Secretaries of Home Affairs, Defence, Health and Family Welfare, Personnel and Training, Posts and Chairman, Railway Board as Members. The Committee will submit its report within a period of four months.

"Till a final decision on Allowances is taken based on the recommendations of this Committee, all allowances will continue to be paid at existing rates in existing pay structure, as if the pay had not been revised with effect from 1st day of January, 2016", the notification said.

Lastly, under the notification, the recommendations of the Commission relating to interest bearing advances as well as interest-free advances have been accepted with the exception that interest-free advances for Medical Treatment, Travelling Allowance for family of deceased, Travelling Allowance on tour or transfer and Leave Travel Concession shall be retained.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

02:11 PM IST

Govt notifies 7th Pay Commission; employees to get revised pay from August

Govt notifies 7th Pay Commission; employees to get revised pay from August 7th Pay Commission: Govt to set up high-level committee to look into employees' demands

7th Pay Commission: Govt to set up high-level committee to look into employees' demands  7th Pay Commission may not help developers sell homes this time

7th Pay Commission may not help developers sell homes this time Casting ‘inflation’ doubts over 7th Pay Commission salary hikes is wrong

Casting ‘inflation’ doubts over 7th Pay Commission salary hikes is wrong Can 7th Pay Commission salary hike meaningfully boost Indian economy?

Can 7th Pay Commission salary hike meaningfully boost Indian economy?