Year-Ender 2022: RBI's repo rate hike impact on your money, banks, economy

RBI Repo Rate Hike: RBI hiked the repo rate in 2022 for the fifth time which impacted loan borrwers, economy and even GDP

RBI Repo Rate Hike: The Reserve Bank of India (RBI) recently hiked the repo rate by 35 bps, the fifth such increase in 2022. The repo rate currently stands at 6.25 per cent. The first time RBI hiked the repo rate was in May when the central bank's rate setting panel unanimously hiked the benchmark lending rate by 40 bps. This was followed by an increase of 50 bps each in June, August and September. In total, the RBI has hiked the rate by 190 bps.

Prior to May 2022, RBI had cut the rate by 40 bps in May 2020 when the repo rate was at 4 per cent.

Click here to get more updates on Stock Market I Zee Business Live

Why did RBI increase the repo rate?

According to experts, the rate hike was done to tackle record high inflationary numbers.

“This aggressive rate hike stance was done in order to tackle record high inflationary numbers. The inflationary pressure, global geopolitical uncertainties, covid restrictions, heightened volatility levels,” said Tanvi Kanchan, Head of Corporate Strategy, Anand Rathi Shares and Stock Brokers.

Repo rate hike impact so far

Economic growth

Tanvi said that the successive rate hike can have an unplanned negative effect on economic growth, even though these measures are essential to tackle inflation numbers.

Impact on GDP

Ashish Jain, CFO, LoanTap, said that with an increase in repo rate to a total of 6.25 per cent, goods and services look costlier and are expected to have a negative impact on the GDP.

Corporate borrowing

Tanvi explained that rate hike also impacts the corporate borrowing as it makes the cost of borrowings higher. "This can have a direct impact on the earnings potential,” Tanvi said.

Click here to get more updates on Stock Market I Zee Business Live

Effect on borrowers

Vinit Bolinjkar, Head of Research, Ventura Securities, said that the rates are not as alarming to cause economic contraction and with growth opportunities abounding in the country, borrowers are not averse to raising loans if the revenue growth and profitability are not too much compromised.

Ashish Jain of Loantap said that the hike in repo rate is increasing the cost of borrowing. “The increase in repo rate directly increases the cost of borrowing, thereby making borrowing more expensive for all types of loans,” he said.

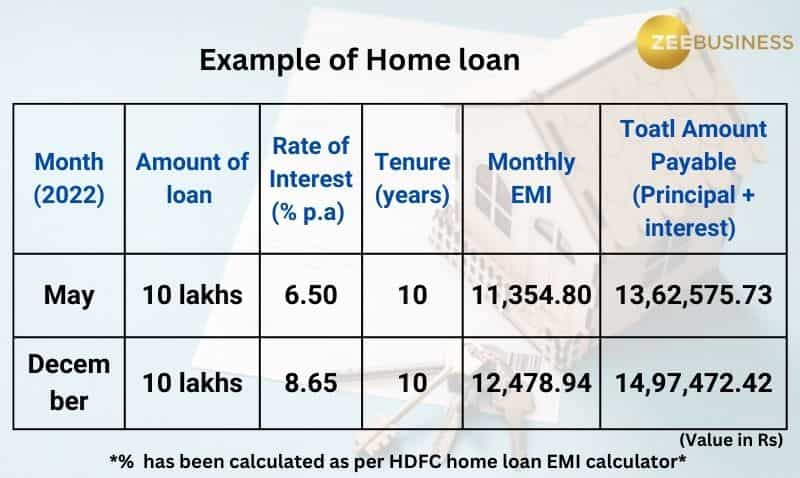

Impact on housing sector

Tanvi said that hike in repo rate has made buying a house expensive. Higher central bank interest rates affect the cost of borrowing for banks. Banks then pass those costs onto businesses, consumers and even governments.

Banking growth

Vinit Bolinjkar said that banks play an important role in the growth of an economy. He said that the Net Interest Margins (NIM) continue to remain resilient and "we believe that the India growth story is expected to continue at the existing pace if not accelerate further".

"India being an underbanked and rapidly developing country, the outlook for banks will continue to remain strong,” he said.

He said that India has emerged far stronger from the pandemic than any of the other countries and hence the springboard for high growth is well in place.

Explaining the importance of banking in an economy Ashish Jain said, “Banks and financial institutions always have a positive impact on the growth of an economy. Currently, even though the cost of borrowings has increased, the facilitation of credit and liquidity in the market is provided only by banks.”

Click here to get more updates on Stock Market I Zee Business Live

Impact on Stock Market

Ashish Jain said that the Nifty Bank's bull run is an exception and it shows investors’ confidence. “Usually, a repo rate hike has the opposite effect on the stock market. This shows investors' confidence in the RBI policies."

“During the initial phases of the upward rate revisions, credit rates were repriced faster than the deposit rates, which fueled the initial part of the rally in Bank Nifty. In the latter part of the upward rally, it is the Public Sector Undertaking (PSU) banks which were undervalued and are now rerating. It may optically appear that there is a correlation between the increase in rates and the performance of Bank Nifty, but it is a coincidence.”

Outlook

Experts have predicted that RBI will hike the rates to balance issues of liquidity, capital and inflation.

“With recession trends looming in developed economies, RBI might provide a stop to interest hike to provide for economic growth. However, with this threat, the increased threat of inflation persists. We might see another increase in repo rate to balance out the issues of liquidity, capital and inflation,” said Ashish Jain.

Comparing India’s situation with foreign countries Vinit Bolinjkar said that India’s inflation is well managed and the need for rate hikes will be taken into consideration with how the supply side inflation plays out.

He further said that the cheap money which was available for the last couple of years is virtually over now. Since the decoupling of USD with petrol (petro-dollar), inflation was high and the interest rate had to go up. A similar inflationary trend is going on now because energy costs globally have catapulted.

"With cheap energy not available, the cost of everything is up and it is here to stay. So, with cheap money no longer available, we expect interest rates to remain firm and there is a possibility that the interest rates may rise one-sided," he said.

Bolinjkar added global growth rate and inflation will be the deciding factor on the basis of which RBI would decide when it would stop increasing rates.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Highest FD Rates: This is what banks like SBI, BoB, PNB, Canara Bank, ICICI Bank and HDFC Bank are providing on Rs 2 lakh investment

Senior Citizen Guaranteed Return Schemes: Know what banks like SBI, BoB, Canara Bank, ICICI Bank, HDFC Bank are providing on 1-year, 3-year, and 5-year FDs

Power of Compounding: In how many years can Rs 1.5 lakh mutual fund lump sum investment generate Rs 1,00,00,000 corpus?

09:00 AM IST

No interest rate cut in RBI's February policy review, or anytime in FY26: Axis Bank chief economist Neelkanth Mishra

No interest rate cut in RBI's February policy review, or anytime in FY26: Axis Bank chief economist Neelkanth Mishra RBI to keep repo rate unchanged at meeting next week, chances of rate cut in February increased: Report

RBI to keep repo rate unchanged at meeting next week, chances of rate cut in February increased: Report Dalal Street Week Ahead: Earnings, macro data, FII trends, global cues set to dictate market trend

Dalal Street Week Ahead: Earnings, macro data, FII trends, global cues set to dictate market trend RBI October MPC Review: No change in repo rate, stance revised to 'neutral', announces Shaktikanta Das

RBI October MPC Review: No change in repo rate, stance revised to 'neutral', announces Shaktikanta Das Dalal Street Week Ahead: RBI rate decision, TCS results, FII activity, global cues set to dictate market trend

Dalal Street Week Ahead: RBI rate decision, TCS results, FII activity, global cues set to dictate market trend