India to become 3rd largest economy by 2027; m-cap to touch $10 trillion by 2030: Jefferies

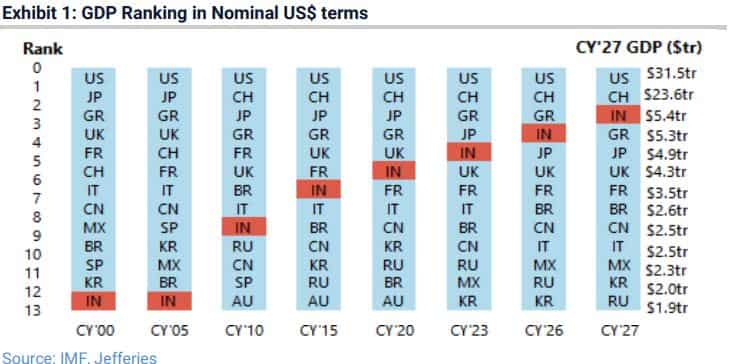

The brokerage said that over the next four years, India's gross domestic product (GDP), the standard measure of the value added created through the production of goods and services, is likely to overtake that of Japan and Germany and touch US$5 trillion.

)

Jefferies, the global investment banking and capital markets firm, is bullish on the Indian economy and expects it to become the third-largest economy in the world by 2027 amid a series of tailwinds such as demographics (consistent labour supply), a strong institutional framework of regulators, and an improvement in governance.

The brokerage said that over the next four years, India's gross domestic product (GDP), the standard measure of the value addition created through the production of goods and services, is likely to overtake that of Japan and Germany and touch US$5 trillion. Currently, India is the fifth-largest economy in the world.

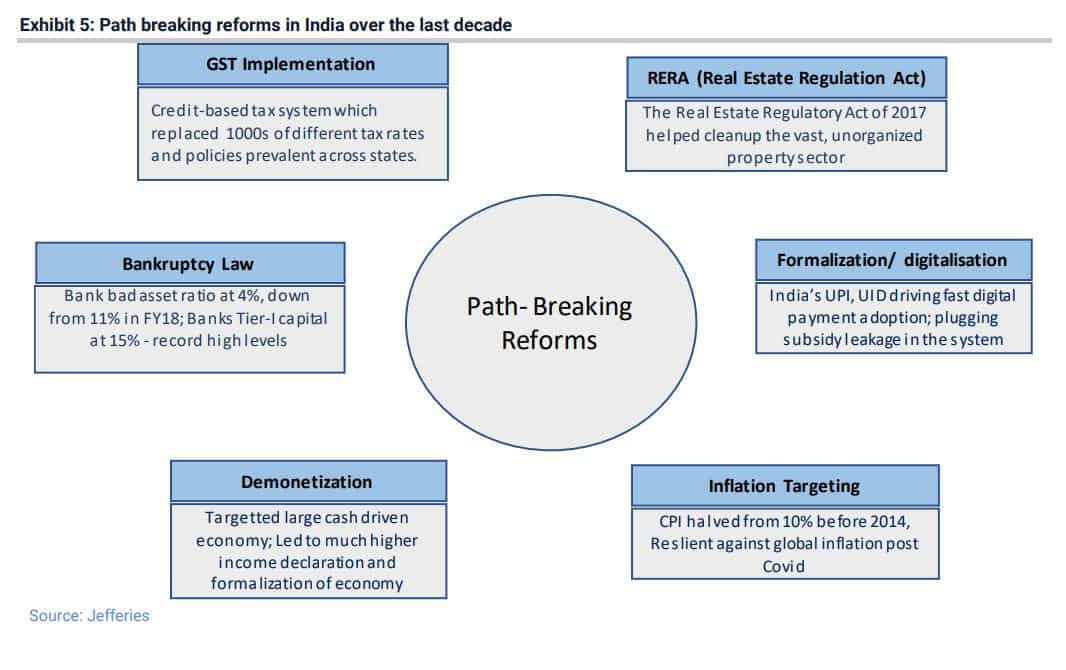

Backing up the claims on GDP growth, Jefferies said that Goods and Services Tax (GST) implementation, the Real Estate Regulation Act, and the government's focus on roads, airports, railways, and digital infrastructure have been drivers of the growth.

Further, Jefferies believes that it will be impossible for large global investors to ignore India as its market capitalisation is likely to grow to around US$10 trillion by 2030, which stands currently at US$4.5 trillion. This will happen assuming the market returns are in line with the last 15-20-year history and new listings.

Here are Jefferies' reasons for being upbeat about the Indian economy.

1. Rising entrepreneurship/ vibrant start-up ecosystem driving innovation

Jefferies believes that India's start-up ecosystem is driving innovation as India is home to 111 unicorns, making it the third largest unicorn hub globally after the US and China. The market value of these 111 unicorns stands at approximately US$350 billion.

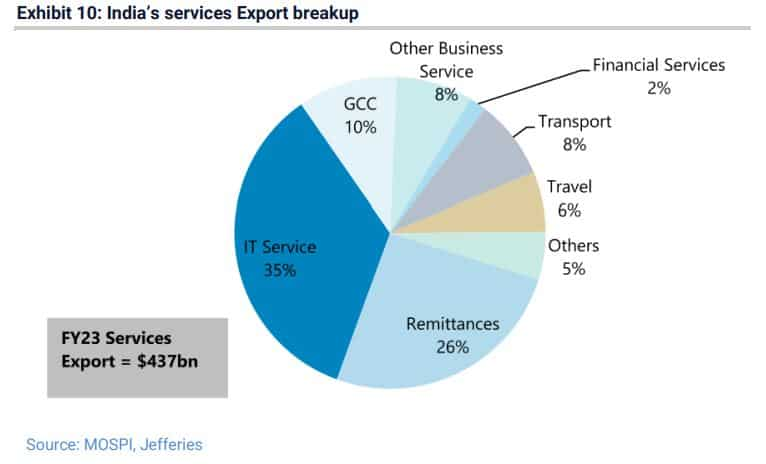

2. India becoming a service export hub

As per the report, services exports account for nearly US$450 billion per year, and superior digital infrastructure and young and well-educated human resources will be drivers of this segment in the coming time.

3. Strong corporate culture and a history of strong market returns

Touching on the corporate sector and performance of the Indian markets, the brokerage said that the return on the equity-focused corporate sector, along with the strong institutional framework of regulators (SEBI, RBI), and intermediaries (responsible asset managers), has developed a large domestic investor base.

Sustainable investment habits give visibility of US$50 billion per year flow into equities from domestic investors, which will likely keep the valuations on the expensive side but also reduce market volatility.

Catch the latest stock market updates here. For all other news related to business, politics, tech and auto, visit Zeebiz.com.

DISCLAIMER: The views and investment tips expressed by investment experts on zeebiz.com are their own and not those of the website or its management. zeebiz.com advises users to check with certified experts before making any investment decisions.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Hybrid Mutual Funds: Rs 50,000 one-time investment in 3 schemes has grown to at least Rs 1.54 lakh in 5 years; see list

Power of Compounding: In how many years, investors can achieve Rs 6.5 cr corpus with monthly salaries of Rs 20,000, Rs 25,000, and Rs 30,000?

Rs 5,000 SIP for 40 years vs Rs 50,000 SIP for 20 years: Which can create higher corpus? See calculations to know it

11:05 AM IST

Gold NBFCs will benefit from potential rate cuts and prices surge: Jefferies

Gold NBFCs will benefit from potential rate cuts and prices surge: Jefferies Rising claims pose challenge for health insurance sector in India: Jefferies

Rising claims pose challenge for health insurance sector in India: Jefferies India will remain top choice for private equity investments despite external shocks: Jefferies

India will remain top choice for private equity investments despite external shocks: Jefferies Weddings now $130 billion industry in India, a family spending over Rs 12 lakh on average

Weddings now $130 billion industry in India, a family spending over Rs 12 lakh on average This PSU stock hits 52-week high as company receives RFP from Defence Ministry - Details

This PSU stock hits 52-week high as company receives RFP from Defence Ministry - Details