What does SBI merger tells us about the upcoming bank mergers?

The Union Cabinet has approved an alternate mechanism for the merger of other PSBs in the coming days. Even though the move is expected to help but yet not entirely the solution needed for PSBs.

Key Highlights:

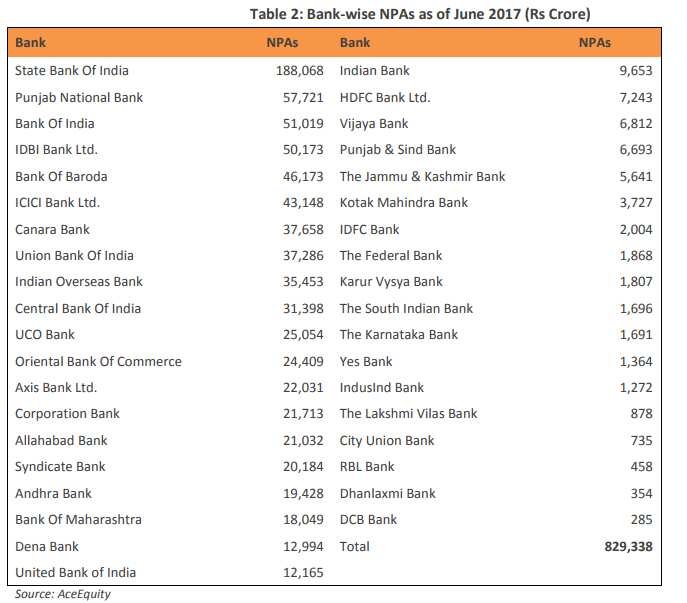

- Five state-owned banks account nearly half of total NPAs as on June 30, 2017

- SBI accounts highest 22.75% in total NPAs of all banks post merger

- SBI merger with six associate banks have been in effect from April 01, 2017

An “alternative mechanism” has been approved by the Union Cabinet chaired by Prime Minister Narendra Modi for mergers of Public Sector Banks (PSBs).

This mechanism would facilitate consolidation among the nationalised banks to create 'strong and competitive banks'.

Consolidation of PSBs comes at the backdrop of rising non-performing assets or bad loans. Bad loans in PSBs has resulted in higher provisions, deterioration in asset quality, higher slippages and thus lower earnings for banks -- not to forget their future lending is at stake.

As on June 2017, banks listed on stock exchanges saw sharp rise of 34.17% in NPAs to Rs 8,29,335 crore compared to Rs 6,18,109 crore in the corresponding period of the previous year.

Interestingly, five public sector banks (PSBs) namely SBI, Punjab National Bank, Bank of India, IDBI Bank and Bank of Baroda (BoB) bagged the top five spots in highest NPA. Together they accounted a share of 47.4% totalling up to Rs 3,93,154 crore.

Jignesh Shial, analyst at Quant Broking said, “We continue to remain cautious towards all corporate lenders (especially PSU banks) considering their subdued growth, mounting quantum of losses and weak adequacies. For PSU banks, rise in provisioning charges along with inability to raise capital, consistent loss of marketshare and rising probability for sector consolidation through mergers would keep pressurizing earnings and market valuations.”

Decision to consolidate banks is expected to facilitate the creation of strong and competitive banks in public sector space to meet the credit needs of a growing economy, absorb shocks and have the capacity to raise resources without depending unduly on the state exchequer.

Viral Acharya, Deputy Governor of RBI in his report titled, “A Bank Should Be Something One Can “Bank” Upon” said, “As many have pointed out, it is not clear we need so many public sector banks. The system will be better off if they are consolidated into fewer but healthier banks. After all, we do have cooperative banks and micro-finance institutions to provide community-level banking. So some banks can be merged, as a quid pro quo for timely government capital injection into the combined entity.”

“It would offer the opportunity to rejig management responsibility away from those who have under-performed or dragged their feet the most. Synergies in lending activity and branch locations could be identified to economize on intermediation costs, allowing sales of real estate where branches are redundant,” added Acharya.

However, the consolidation concept is not entirely new in India. In 1991, it was suggested that India should have fewer but strong PSBs.

Though it was only in May 2016 that effective action to consolidate state-owned banks struck headlines with six associate banks getting merged into State Bank of India.

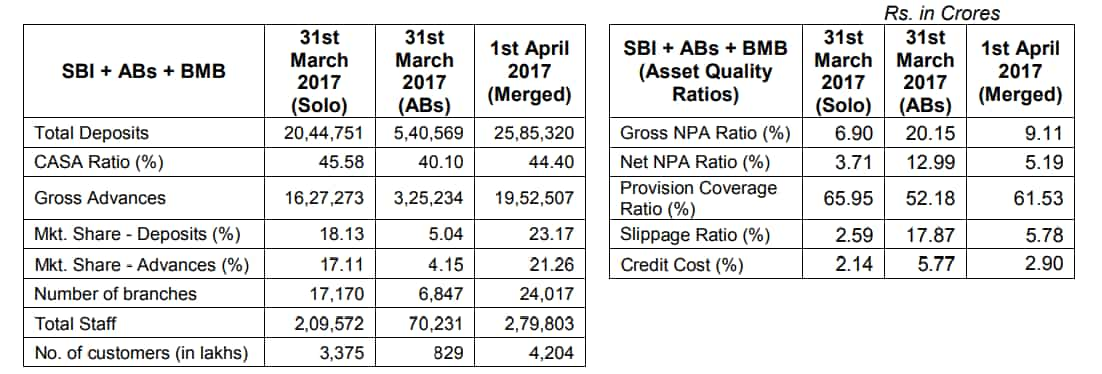

Merger of five associate banks and Bharatiya Mahila Bank Limited with SBI has been in effect from April 01, 2017. The bank has presented its first quarter ended June 30, 2017 (Q1FY18) result taking into account all the figures, ratios and other information based on the merged audited numbers.

Hatim Broachwala, analyst at Nirmal Bang said, "The merger of associate banks with SBI has been complete seamlessly, but in the process SBI inherited some stressed assets from its associate banks."

State Bank of India accounted for largest share of about 22.75% in total NPAs of all banks in the first quarter of the current fiscal year. The bank's NPA stood at Rs 1,88,068 crore as June 2017 post merger with five associates and Bharatiya Mahila Bank.

Gross NPAs of SBI post merger, in percentage terms stood at 9.97% in Q1FY18 compared to 9.11% in Q4FY17 and 7.40% in Q1FY17.

Darpin Shah and Pranav Gupta, analysts at HDFC Securities said, "SBI began FY18 on a disappointing note (in line with corporate heavy peers), with a sharp rise in slippages (6.55% ann.) which management clarified was led by conservative recognition of stress in home and agri loans as well as one large corporate exposure.”

Loan slippage remained elevated as the bank was unable to monitor non-corporate (SME/agriculture/retail) loan accounts properly during the merger process, resulting in higher slippage of Rs17,900 crore from this segment. Of the corporate segment slippage of Rs 8,400 crore, 95% of it was from the watch list.

As a result, watchlist eased to Rs 24,400 crore (1.4% of loan book) with 43% of the watch list pertaining to the power sector.

Nilesh Parikh, Kunal Shah, Prakhar Agarwal and Malav Simaria, analysts at Edelweiss Financial Services said, "Q1FY18 reflected integration challenges. Henceforth, key will be merger transition. Given the scale of transition, we expect recovery trend during merger to be gradual, which will weigh on SBI’s core performance."

From the performance of SBI post merger, even though merger of PSBs can be one solution to end weaker banks, but resolution for rising NPAs is still a key that would be needed.

Earlier a Moody's Investors Services report stated that merging will do a little to resolve the issue of a high level of stressed assets on the books of banks and will not result in any meaningful release of capital.

"From a credit perspective, industry consolidation would strengthen the banks` bargaining power, help save costs and improve supervision and corporate governance across the banking system," Moody`s said.

There are now 20 PSBs other than SBI.

What will their fate be as stronger banks post their mergers?

"If any other PSB board gives a consolidation proposal, to oversee that proposal an alternative mechanism will be in place to give in principle approval for the proposal of the banks for a scheme of amalgamation," Jaitley said.

"The decision regarding creating strong and competitive banks will be solely based on commercial considerations," he said.

According to one estimate by Acharya, Indian public banks need Rs 10 lakh crore capital to meet Basel III norms.

Given the fact that NPAs are continuing to rise and capital requirements getting critical, mergers may be the move forward only if done right.

"Our experience of consolidation has been positive. It increases the entity`s commercial strength, the ability to absorb market shocks," Jaitley said on Wednesday.

ALSO READ:

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Tata Motors, Muthoot Finance and 3 more: Axis Direct recommends buying these stocks for 2 weeks; check targets, stop losses

05:28 PM IST