Vedanta Dividend News: Metal major gains day after record date announcement - check ex-date, history

Vedanta Dividend News, Record Date November 2022, Ex Date: Vedanta has fixed the record date for determining the eligibility of shareholders for receiving dividends. The company is yet to announce the dividend amount.

Vedanta Dividend News, Record Date November 2022, Ex Date: Vedanta gained on Friday after the mining company made an announcement regarding the record date for the payment of dividend. The company in an exchange filing said that its Board of Directors will meet on November 22 to consider approval of third interim dividend for the current fiscal.

Vedanta Dividend Record Date

Vedanta has fixed the record date for the purpose of determining the entitlement of the equity shareholders for the said dividend, if declared. The record date is November 30, Wednesday.

Vedanta Dividend Ex Date

Vedanta shares will trade ex-date a business day before the record date. Usually, an ex-date is a business day prior to the record date. Accordingly, Vedanta ex-dividend date would be November 29, Tuesday.

A person should buy a company's shares before the ex-date so that shares are credited into the Demat account before the record date. To receive the benefits of corporate actions like dividend, bonus, split and others, one must hold the share in his/her Demant account on the record date.

Vedanta Dividend History

The natural resources conglomerate has so far given investors interim dividend on two occasions in FY23 -- Rs 31.50 in May and Rs 19.50 in July. The company spent Rs 18,917 crore in dividend payouts. Apart from this, the company paid Dividend Distribution Tax (DDT) of Rs 3000 crore.

In FY22, the metal major distributed a total dividend of Rs 45 per share to its investors. The payout to equity shareholders of the company was Rs 6,845 crore, according the information available on the exchanges.

In FY21, the company paid Rs 9.5 dividend per share. In the preceding fiscal, it paid Rs 3.9 dividend per share. Before that, the Mumbai based multinational had paid Rs 40.05 dividend per share to its investors.

Vedanta: Buy, Sell or Hold?

Technical Analyst Nilesh Jain recommended a Hold rating on the counter with a long term view. Support is seen at Rs 300 while resistance at Rs 320, he said.

The metal sector is witnessing weakness amid current global uncertainties and any fresh moves, he said, adding that taking fresh position is not advisable with a short term view.

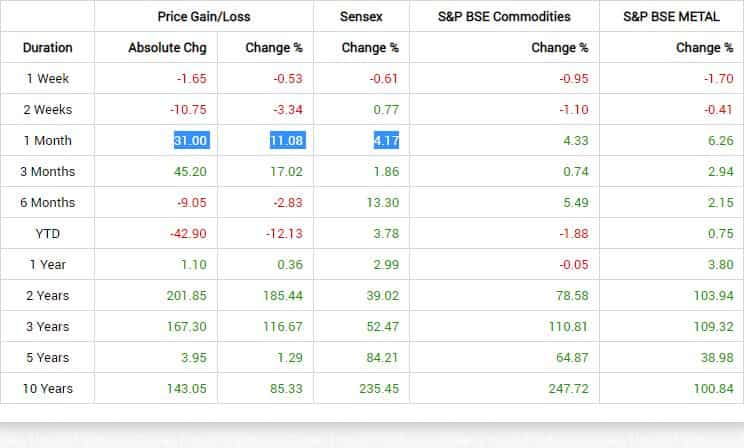

Vedanta has underperformed the BSE Sensex in the past six months, yielding negative returns of 2.83 per cent versus 13.30 per cent gains by 30-stock index. However, the stock has appreciated by Rs 31 in the past one month, gaining almost 11 per cent.

Meanwhile, brokerage firm Citi has given a ‘Sell’ call on this stock for a revised target of Rs 235 from an earlier target of Rs 215. The recommendation was given at a price of Rs 307.

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

03:49 PM IST

Vedanta shares fall 2% post its fourth dividend announcement; Citi bullish on the largecap stock

Vedanta shares fall 2% post its fourth dividend announcement; Citi bullish on the largecap stock Vedanta to raise Rs 2,500 crore in non-convertible debentures

Vedanta to raise Rs 2,500 crore in non-convertible debentures Vedanta dividend: Board to meet on this date to consider 1st payout of 2023-24

Vedanta dividend: Board to meet on this date to consider 1st payout of 2023-24  Govt's Hind Zinc stake sale only after clarity on proposed global asset transfer; may miss revised divestment target

Govt's Hind Zinc stake sale only after clarity on proposed global asset transfer; may miss revised divestment target Exclusive: Vedanta has enough cash flow to prepay debts, says chairman Anil Agarwal

Exclusive: Vedanta has enough cash flow to prepay debts, says chairman Anil Agarwal