TCS share buyback: Should Infosys follow suit?

However, analysts and industry experts have now trained their eyes towards the other IT behemoth -- Infosys Ltd. Should Bengaluru-based bluechip that is currently in a corporate governance storm follow TCS and announce its own share buyback to appease shareholders?

Tata Consultancy Services (TCS) on Monday said that the company will buyback 2.85% equity at Rs 2850 per share. The total spend for this activity will be around Rs 16,000 crore thereby making it the largest share buyback in the history of India Inc.

However, analysts and industry experts have now trained their eyes towards the other IT behemoth -- Infosys Ltd. Should Bengaluru-based bluechip that is currently in a corporate governance storm follow TCS and announce its own share buyback to appease shareholders?

A share buyback improves return on equity (RoE) of the company for its shareholders.

Given the controversy surrounding returns that Infosys has given to its shareholders that its co-founders were very vocal about last month, a share buyback doesn't seem an idea too far-fetched.

As on December 30, 2016, liquid assets including cash and cash equivalents and investments for Infosys Ltd stood at Rs 35,697 crore, as compared Rs 31,526 crore in the corresponding period of the previous year.

Kawaljeet Saluja and Jaykumar Doshi analysts at Kotak Institutional Equities said, “The revenue growth had some chinks in quality, viz. decline in revenues from large accounts for Infosys, high passthrough revenues for Tech Mahindra and TCS. Nonetheless the numbers were healthy overall. “

On year-on-year basis c/c revenue growth for each of the Infosys, TCS, Tech Mahindra and HCL Technologies stood at 7.3%, 8.6%, 12% and 13.8% respectively.

The duo said, “Till end of the current financial year, the IT industry is expected to see growth between 8-9% and could grow at same pace or accelerate in FY2018.”

Infosys too expects single-digit growth by end of FY17. It revenue guidance has been further revised to 8.4%-8.8% from 8.0%-9.0% in constant currency.

When CEO Vishal Sikka was taking over in 2014, Infosys' former CFO T V Mohandas Pai, along with former colleague V Balakrishnan, had sought a $1.8 billion (about Rs 11370.6 crore) buyback of shares.

Infosys' Balakrishnan too had demanded that the company should announce a share buyback.

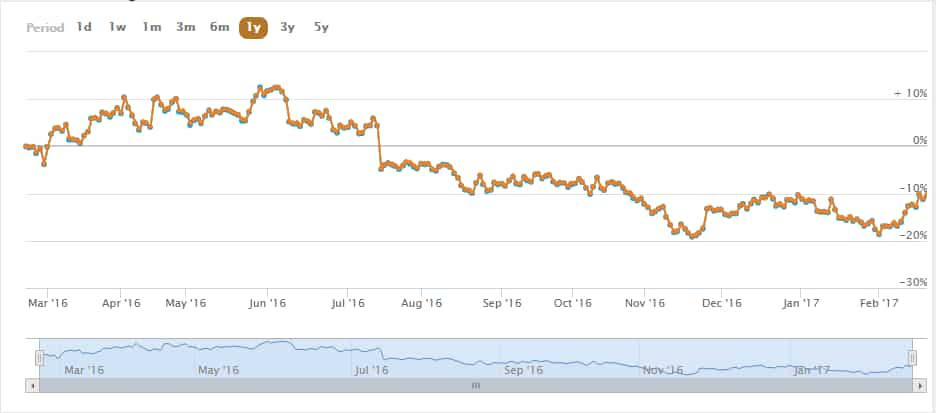

Share price of Infosys has been declining since the beginning of 2016.

It's not just TCS, another IT giant Cognizant too announced a $3.4 billion share buyback plan.

What will Infosys do?

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Rs 15,000 SIP: How long it will take to achieve Rs 7 crore corpus? See calculations to know

Largecap PSU Stock for 65% Gain in New Year: Anil Singhvi picks PSU bank for long term; know reasons and target prices

PPF vs SIP: Rs 12,000 monthly investment for 30 years; see which can create higher retirement corpus

SIP in Stocks For New Year 2025: Market guru Anil Singhvi recommends 1 largecap, 2 midcap scrips to buy in dips; note down targets

Largecap, Midcap Stocks To Buy: Analysts recommend buying L&T, Tata Motors, 3 other stocks for 2 weeks; check targets

10:21 AM IST

TCS invests over Rs 72 crore to bolster innovation in South America with a new 10-year partnership

TCS invests over Rs 72 crore to bolster innovation in South America with a new 10-year partnership TCS launches new Internet of Things engineering lab in the US

TCS launches new Internet of Things engineering lab in the US TCS Dividend 2024 Record Date: IT major may recommend final dividend soon | TCS Q4 Results FY 2024 Date

TCS Dividend 2024 Record Date: IT major may recommend final dividend soon | TCS Q4 Results FY 2024 Date Accenture fans IT industry spending gloom with annual forecast cut

Accenture fans IT industry spending gloom with annual forecast cut CLSA on IT sector: Downgrades TCS and HCL Tech; maintains ratings on these IT giants; shares fall

CLSA on IT sector: Downgrades TCS and HCL Tech; maintains ratings on these IT giants; shares fall