Samsung officially launches Samsung Pay in India

Samsung Electronics on Wednesday officially announced the launch of Samsung Pay in India. The company had earlier during the month unveiled the mobile payment platform and had already opened for registrations in India on its official website.

#SamsungPay works with a range of premium Galaxy devices. Just launch, tap and pay! pic.twitter.com/qReMNfjXFN

— Samsung Mobile India (@SamsungMobileIN) March 22, 2017

Apart from allowing users in India to simply tap and pay on the go using their registered cards, Samsung Pay has integrated Paytm as well as the government’s Unified Payments Interface (UPI) into the app.

Samsung has also created a unique digital payment ecosystem by partnering with a number of issuers and card networks which include Visa, MasterCard, American Express, Axis Bank, HDFC Bank, ICICI Bank, SBI Card and Standard Chartered Bank. Citibank India is a forthcoming issuer and its credit cards will be live on Samsung Pay shortly.

The simplest and the most secure way to pay, that works everywhere! Watch to know more about #SamsungPay. https://t.co/DSP1Hk0FAn pic.twitter.com/5CQ92sTVZg

— Samsung Mobile India (@SamsungMobileIN) March 22, 2017

Samsung Pay is a highly secure platform as it works with three levels of security—fingerprint authentication, card tokenization and Samsung’s defense-grade mobile security platform Samsung KNOX, said the company in a release.

Samsung Pay works with Samsung’s patented Magnetic Secure Transmission (MST) technology as well as with Near Field Communication (NFC). MST replicates a card swipe by wirelessly transmitting magnetic waves from the supported Samsung device to a standard card reader. Through MST, Samsung pay will work seamlessly on a majority of Point of Sale terminals in India.

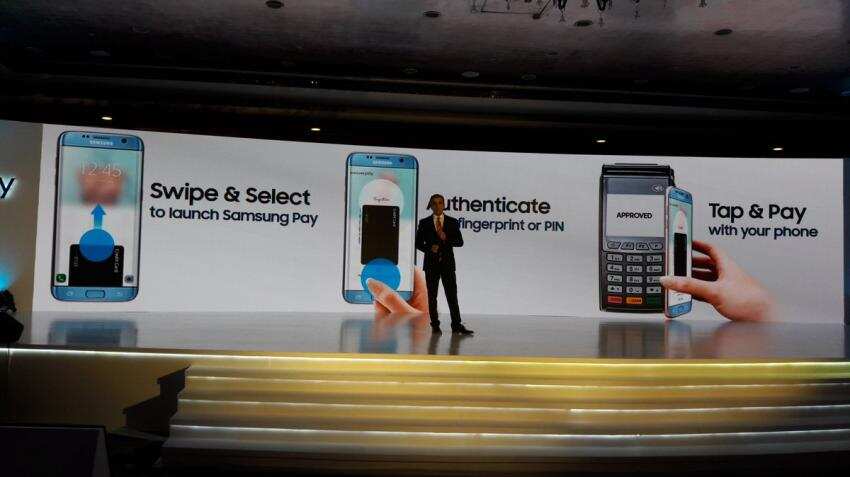

To launch Samsung Pay, a user needs to swipe up on an eligible Samsung Galaxy smartphone, select the card, authenticate using a fingerprint or PIN and bring the phone near the Point of Sale terminal.

HC Hong, President and CEO, Samsung Southwest Asia, said, “Samsung Pay is an example of how we continue to push the boundaries of innovations to make life simpler and better for consumers. I am confident Samsung Pay will redefine digital payments and contribute to Digital India.”

“When we launched Samsung Pay, our goal was to enable consumers across the globe to make payments that are simple, secure and accepted almost everywhere. Over the past year and a half, this vision has evolved into building a complete digital wallet solution, allowing customers worldwide to not only make payments but also use membership and transit cards, receive deals and rewards and more,” said Thomas Ko, Global GM of Samsung Pay.

The Samsung Pay UPI solution is powered by Axis Bank and facilitates peer-to-peer (P2P) transfer of funds between bank accounts on a mobile platform instantly.

Our esteemed #SamsungPay partners Rajiv Anand from @AxisBank, Rajesh Swaminathan from @HDFC_Bank, Anupam Bagchi from @StanChart. pic.twitter.com/MrXJOG9bGe

— Samsung Mobile India (@SamsungMobileIN) March 22, 2017

Samsung Pay also allows Indian consumers to integrate their Paytm accounts into Samsung Pay, enabling them to pay by scanning QR codes securely, generating one-time codes for merchant payments and also do peer to peer money transfers.

Samsung Pay will also be available on the Samsung Gear S3 Smartwatch shortly, allowing users to pay through their wearable device.

Samsung Pay is currently available on Galaxy S7 edge, Galaxy S7, Galaxy Note 5, Galaxy S6 edge+, Galaxy A5 (2016), Galaxy A7 (2016), Galaxy A5 (2017) and Galaxy A7 (2017).

With its launch in India, Samsung Pay is fully available in 12 global markets, including South Korea, the US, China, Spain, Singapore, Australia, Puerto Rico, Brazil, Russia, Thailand and Malaysia.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

03:35 PM IST

Digital Currency: Can Samsung Pay dent the Indian market?

Digital Currency: Can Samsung Pay dent the Indian market?  Samsung launches Samsung Pay platform in India; here's how it works

Samsung launches Samsung Pay platform in India; here's how it works South Korea's Court upholds impeachment of President in scandal involving Samsung

South Korea's Court upholds impeachment of President in scandal involving Samsung Totally geared up to take on Nokia 3310's challenge: Samsung India

Totally geared up to take on Nokia 3310's challenge: Samsung India Samsung India launches 3rd generation Galaxy A7 priced at Rs 33,490, A5 at Rs 28,990

Samsung India launches 3rd generation Galaxy A7 priced at Rs 33,490, A5 at Rs 28,990