Digital Currency: Can Samsung Pay dent the Indian market?

While Samsung Pay offers a safer option for payment instead of using card, the limited availability of the service on all its smartphone devices is a big hurdle.

Beating Apple Inc to the race of digital currency and payments, Samsung has launched Samsung Pay in India earlier this week.

The world's largest phonemaker said that it has opened up registrations on its website and has tied up with banks such as HDFC Bank, ICICI Bank, SBI Bank, Standard Chartered Bank and Axis Bank. Going forward, Samsung Pay will also support Citibank and American Express.

How does it work?

Samsung Pay will work everywhere where one can swipe a debit or a credit card to make payments.

The system uses Near Field Communication (NFC) and Magnetic Secure Transmission (MST) that allows users to send magnetic signals from a smartphone to the payment terminal's or PoS machines.

Through MST, merchants can accept payments on regular card machines which fundamentally can make Samsung Pay the most widely accepted mobile payment service in India.

However, given the models that Samsung has currently launched this service with, cracking the Indian market is going to be difficult given Paytm already has raced to 200 million customers.

Some of the Samsung devices on which Samsung Pay is supported currently in India include Galaxy S7 edge, Galaxy S7, Note 5, S6 edge plus, A5 (2016) and A7 (2016). All new new models of Samsung to follow from hereon will also support Samsung Pay.

Herein lies the problem.

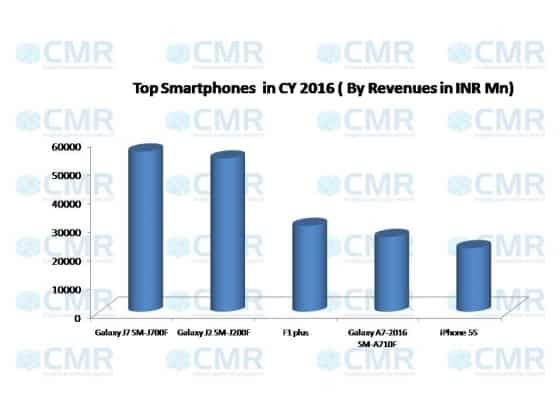

As in calendar year 2016, Samsung controlled slightly more than one-fourth of the Indian mobile phone market. This included feature-phones as well where the company holds nearly 24% market-share.

Most of the smartphones that currently support Samsung Pay are priced over Rs 20,000.

For instance, the Samsung Galaxy J series is the highest selling smartphone in the Samsung galaxy and is priced between Rs 7,500 to Rs 20,000. This means that such users cannot benefit from Samsung Pay platform currently.

Source: CMR Research

Not to mention, it is not available to feature phone users, which form a sizable chuck of Samsung users in India.

We did not receive a response from Samsung at the time of publishing this story.

Higher adoption is key for Samsung to be a meaningful player in the digital payments market in India.

However, technological constraints keep it from reaching more users as the smartphones need to be fitted with Near Field Communication (NFC) and Magnetic Secure Transmission (MST) that allows users to send magnetic signals from smartphone to the payment terminal's or PoS machines.

Samsung, while it has got a head-start on Apple Pay, needs to get a substantial number of phone owners to use the payment system.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 5,000 SIP for 40 years vs Rs 50,000 SIP for 20 years: Which can create higher corpus? See calculations to know it

Power of Compounding: In how many years, investors can achieve Rs 6.5 cr corpus with monthly salaries of Rs 20,000, Rs 25,000, and Rs 30,000?

PPF For Regular Income: How you can get Rs 78,000 a month tax-free income through Public Provident Fund investment?

07:02 PM IST

Samsung launches Samsung Pay platform in India; here's how it works

Samsung launches Samsung Pay platform in India; here's how it works Totally geared up to take on Nokia 3310's challenge: Samsung India

Totally geared up to take on Nokia 3310's challenge: Samsung India Samsung India launches 3rd generation Galaxy A7 priced at Rs 33,490, A5 at Rs 28,990

Samsung India launches 3rd generation Galaxy A7 priced at Rs 33,490, A5 at Rs 28,990 Samsung launches military grade Galaxy Xcover 4

Samsung launches military grade Galaxy Xcover 4 Samsung to launch Galaxy S8 by March 29

Samsung to launch Galaxy S8 by March 29