Reliance Jio continues to rule, adds 8.74 mn net subscribers in Feb, 2018

Reliance Jio once again ruled in terms of net addition of wireless subscribers by adding as many as 8.74 million in February, 2018.

The telecom regulatory authority of India (TRAI) released subscribers data performance for the month of February 2018. Both telecom and wireless subscribers data was presented as per company-wise, region-wise and state-wise. Under the data telephone subscribers increased from 1,175.01 million at the end of Jan-18 to 1,179.83 million at the end of Feb-18 generating growth rate of just 0.45%, while the total wireless subscribers (GSM, CDMA and LTE) rose by just 0.43% to 1,156.87 million in Feb compared to from 1,151.94 million at the end of Jan.

The Wireless subscription in urban areas declined from 652.85 million at the end of Jan-18 to 650.03 million at the end of Feb-18, however wireless subscriptions in rural areas increased from 499.09 million to 506.84 million during the month.

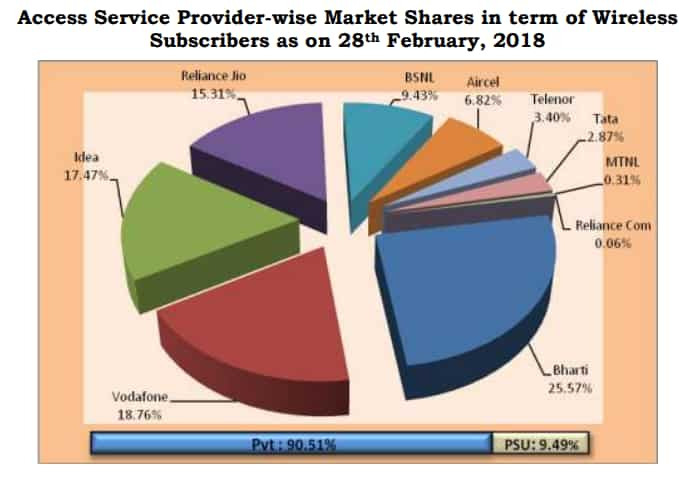

In case of access service provider-wise market share in terms of wireless subscribers the private telcos continued to dominate the state-owned ones by earmarking 90.51% share. The public sector companies held 9.49% market share.

Interestingly when it comes to see the market share, Bharti Airtel still holds the lead spot with market share of 25.57%, followed by Vodafone with 18.76%, Idea Cellular with 17.47% and Reliance Jio with 15.31%.

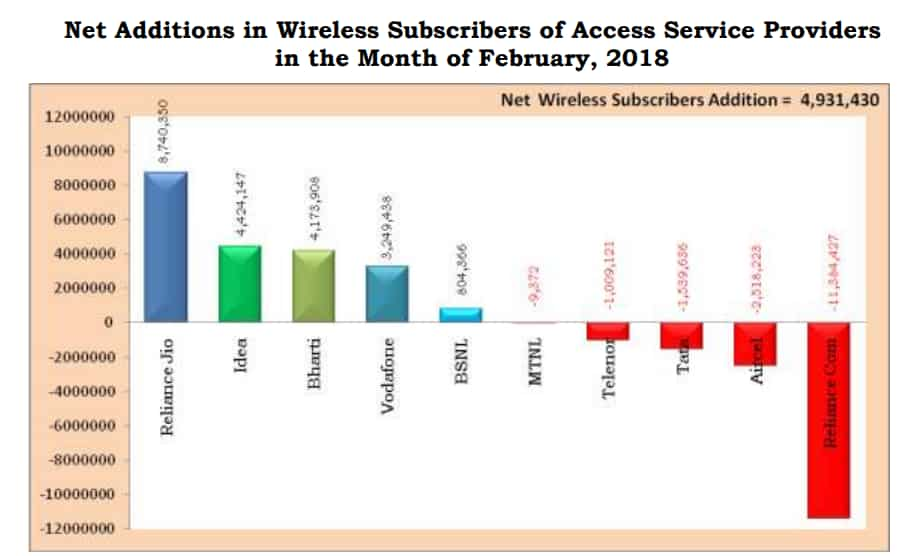

However, it needs to be noted that, Reliance Jio once again ruled in terms of net addition of wireless subscribers by adding 8.74 million people under its ambit during February 2018. Meanwhile, the rivals managed to add only half of what the Mukesh Ambani-led company has recorded during the month.

At the second spot was Idea with net addition of 4.42 million subscribers, followed by Bharti with 4.17 million subscribers and Vodafone with 3.24 million subscribers.

Apart from these top four telecom-giant, it was only state-owned BSNL who managed to see positive performance by adding over 80 lakh net subscriber.

Remaining other telcos saw decline in February 2018.

Where big brother Mukesh Ambani’s RJio was making headlines with strong performance, the younger brother Anil Ambani’s Reliance Communication recorded 11.38 subscribers leaving their network.

Other telcos like Aircel, Tata, Telenor and MTNL also saw subscribers leaving their network to 2.51 million, 1.53 million, 1 million and 9,372 respectively.

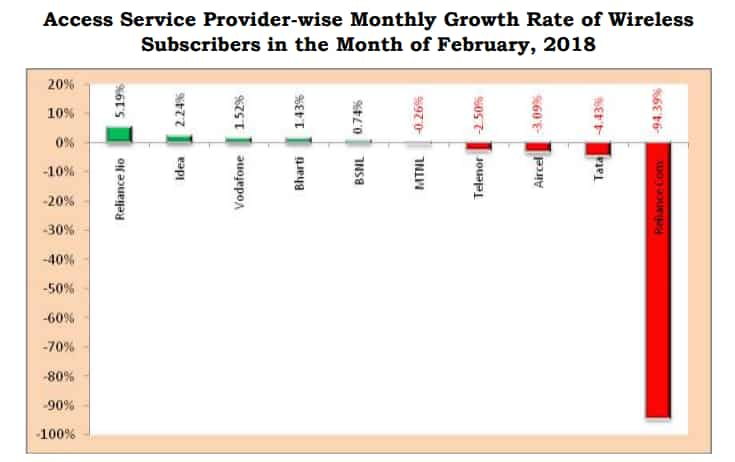

The data of TRAI further revealed that, access service provider-wise Monthly Growth Rate of Wireless Subscribers was higher in RJio compared to other telcos in the month.

In February 2018, RJio had growth rate of 5.19% in terms of wireless subscribers, where as Idea had 2.24%, Vodafone had 1.52% and Airtel had 1.43% growth rate.

It needs to be noted that, RCom was worst hit as the company declined by 94.39% in wireless subscriber, followed by Tata, Aircel, Telenor and MTNL which tumbled by 4.43%, 3.09%, 2.50% and 0.26% respectively.

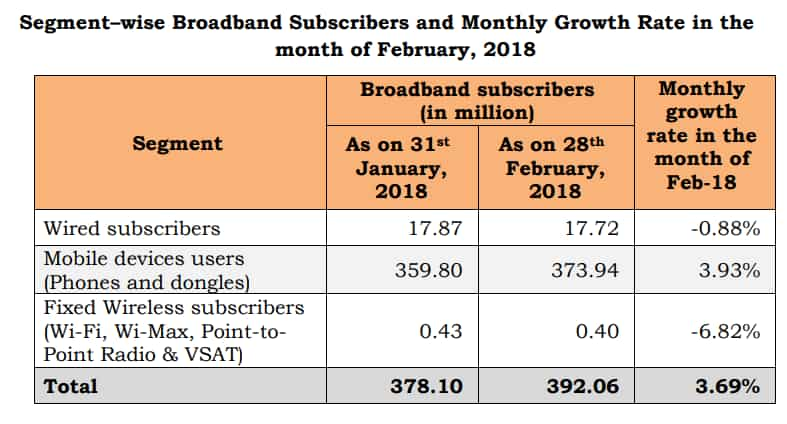

Going ahead, as per the reports received from the service providers, the number of broadband subscribers increased from 378.10 million at the end of Jan-18 to 392.06 million at the end of Feb-18 with a monthly growth rate of 3.69%.

Top five service providers constituted 94.99% market share of the total broadband subscribers at the end of Feb-18. These service providers were Reliance Jio Infocomm Ltd (177.13 million), Bharti Airtel (80.24 million), Vodafone (55.54 million), Idea Cellular (38.52 million) and BSNL (21.00 million).

Current status of telecom market, is such that, companies like Airtel, Idea and Vodafone are providing cheap data plans offering unlimited data and calls, thanks to the RJio who mastered the game of cheap offers when it began operations.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Hybrid Mutual Funds: Rs 50,000 one-time investment in 3 schemes has grown to at least Rs 1.54 lakh in 5 years; see list

18x15x12 SIP Formula: In how many years, Rs 15,000 monthly investment can grow to Rs 1,14,00,000 corpus; know calculations

Rs 5,000 SIP for 40 years vs Rs 50,000 SIP for 20 years: Which can create higher corpus? See calculations to know it

Power of Compounding: In how many years, investors can achieve Rs 6.5 cr corpus with monthly salaries of Rs 20,000, Rs 25,000, and Rs 30,000?

01:26 PM IST

Spectrum auction: DoT to issue demand note to telcos this week for payment

Spectrum auction: DoT to issue demand note to telcos this week for payment Telecom spectrum auctions done, all eyes now on imminent tariff hikes: Analysts

Telecom spectrum auctions done, all eyes now on imminent tariff hikes: Analysts  Spectrum auction Day 1: Telcos place bids worth about Rs 11,000 crore in five rounds

Spectrum auction Day 1: Telcos place bids worth about Rs 11,000 crore in five rounds Vodafone Idea approves offer price of Rs 11 per equity share for Rs 18,000 crore-FPO

Vodafone Idea approves offer price of Rs 11 per equity share for Rs 18,000 crore-FPO Reliance Jio gets $2.2 bn fund support from Swedish Export Credit agency to finance 5G roll-out

Reliance Jio gets $2.2 bn fund support from Swedish Export Credit agency to finance 5G roll-out