Petroleum Ministry eases Make in India norms to usher foreign competition

The thresholds were greatly reduced on Tuesday through a Ministry order whereby the domestic content contribution was lowered to 30 per cent — gradually escalating to 50 per cent

)

Prime Minister Narendra Modi’s push for Make in India suffered a setback on Tuesday with Petroleum Ministry lowering the domestic content criteria as well as purchase preference advantage for homegrown firms in lumpsum turnkey (LSTK) or engineering, procurement and construction (EPC) projects floated by oil and gas public sector undertakings (PSUs).

To give preference to local suppliers and to promote domestic manufacturing and production of goods and services, India in 2017 classified a Class-I local supplier, with local content ‘equal to or more than 50 per cent’, as the winner in all PSU global contracts provided the Class-I supplier sourced 50 per cent of its content locally and matched the lowest bid, even if it had quoted 20 per cent higher than the lowest bid.

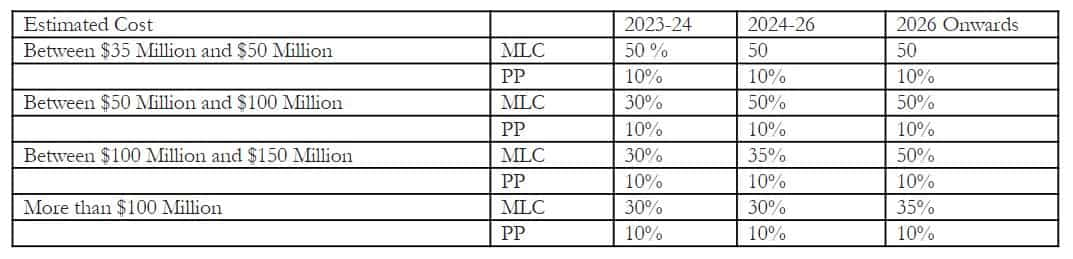

These thresholds were greatly reduced on Tuesday through a Ministry order whereby the domestic content contribution was lowered to 30 per cent — gradually escalating to 50 per cent — and the purchase preference price differential reduced to 10 per cent across the board and for all years to come.

That, in essence, means that any foreign firm stands a chance to win LSTK and EPC contracts even if it domestically sources 30 per cent of the project value (instead earlier 50 per cent) and majorly, that domestic Class-I firms would have to be well within 10 per cent price range (instead of the earlier 20 per cent) quoted by a foreign firm to bag the purchase preference advantage.

“…to increase competition and to incentivize progressive increase in Minimum Local Content (MLC) in high value oil and gas LSTK/EPC contracts/projects, it has been decided under para 14 of the Public Procurement (Preference to Make in India) Order 2017 to revise the MLC for getting the purchase preference and Margin of PP for such contracts/projects on progressive basis with predictable trajectory,” says the Ministry’s July 11 order.

On January 14 this year, Oil and Natural Gas Corporation (ONGC) had sought these relaxations for Offshore LSTK Projects as competition from foreign bidders in high value tenders had gone down in the last three years with domestic bidders – namely L&T — submitting offers at higher than ONGC estimated cost.

“Upon review of the situation, it was observed that the provision of granting 20 per cent PP to Class-I supplier order has emerged as one of the major constraints leading to non-participation of major foreign players in high value tenders for offshore EPC projects…In fact, there is only one domestic bidder L&T Hydrocarbon Engineering who (sic) has fabrication yards for construction in Hazira and at Kattupalli in Tamil Nadu. No other domestic or foreign bidder has fabrication yards in India. Thus, it is very difficult for any foreign bidder, or for that matter, any domestic bidder to have local content of more than 50 per cent in their bid.”

“It may please be appreciated that a margin of 20 per cent PP is very high and even after quoting the lowest price, bidder with local content less than 50 per cent becomes ineligible for award because the bidder having 50 per cent local content matches his rate with that quoted by L1 and gets the contract. Due to this reason, foreign bidders have stopped participating in our tenders for Offshore LSTK Projects resulting in very limited competition and quoting of very high rates in our tenders,” it added.

“Recent example being tender for Daman Upside Development Project, wherein quoted L1 price (of L&T) is 56.8 per cent higher than the estimated cost,” it said. The DUDP tender was subsequently cancelled because of monopolistic high prices.

“In view of the above, considering the lack of participation in our Offshore LSTK Projects, it is requested to exempt Offshore LSTK Projects of ONGC from the purview of Public Procurement (Preference to Make in India) Order 2017,” the ONGC letter to Petroleum Secretary had requested.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Latest SBI Senior Citizen FD Rates: How much senior citizens can get on investments of Rs 5,55,555, Rs 7,77,777, and Rs 9,99,999 in Amrit Vrishti, 1-, 3-, and 5-year FDs

Top 7 ETFs With Highest Returns in 1 Year: No. 1 ETF has turned Rs 8,78,787 investment into Rs 13,95,091; know how others have fared

after bumper 2024 rs 2 lakh crore worth ipos expected in 2025 primary market nsdl avanse financial ecom express sebi approval

Rs 1,000 Monthly SIP for 40 Years vs Rs 10,000 Monthly SIP for 20 Years: Which can give you higher corpus in long term? Calculations inside

Power of Rs 3,000 SIP: In how many years, Rs 3,000 monthly investment can generate corpuses of Rs 2 crore and Rs 3 crore? Know here

08:02 PM IST

Government increases windfall tax on domestic crude to Rs 12,100 per tonne, cuts levy on diesel & ATF

Government increases windfall tax on domestic crude to Rs 12,100 per tonne, cuts levy on diesel & ATF Exclusive: Oil ministry seeks financing avenues for strategic petroleum reserves phase 2 projects under PPP mode, sources say

Exclusive: Oil ministry seeks financing avenues for strategic petroleum reserves phase 2 projects under PPP mode, sources say  Oil, Gas Sector Alert! Reform and revival - Inside details of Modi government's possible steps | Specialist wing under Petroleum Ministry

Oil, Gas Sector Alert! Reform and revival - Inside details of Modi government's possible steps | Specialist wing under Petroleum Ministry Government is working to reduce dependency on import from oil, gas: Dharmendra Pradhan

Government is working to reduce dependency on import from oil, gas: Dharmendra Pradhan Oil supply to Indian refineries is adequate: Government

Oil supply to Indian refineries is adequate: Government