2021 is going to be very good for the textile industry: Hemant P Jain, Kewal Kiran Clothing Ltd.

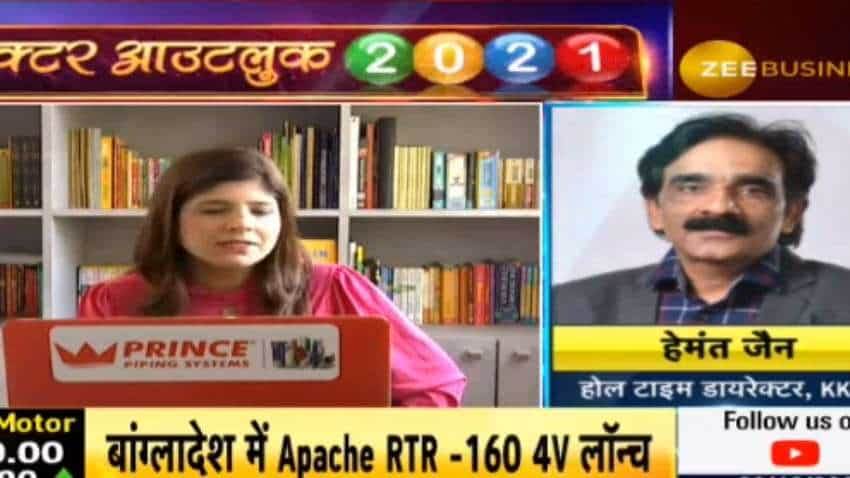

Hemant P. Jain, Whole Time Director, Kewal Kiran Clothing Limited (KKCL), talks about strategy to increase markets share and margins during a candid chat with Swati Khandelwal, Zee Business.

Hemant P. Jain, Whole Time Director, Kewal Kiran Clothing Limited (KKCL), talks about strategy to increase markets share and margins during a candid chat with Swati Khandelwal, Zee Business. Edited Excerpts:

Q: Killer and Integrity are two dominating brands in your business regarding the revenue share. What is your outlook on the segment-wise performance of your products and what is/are going to be important growth drivers for your company in 2021?

See Zee Business Live TV Streaming Below:

A: As you have said that Killer is counted among the flagship brand in our company and has the highest revenue comes from these brands. However, the first six months of the financial year has not been good but after that, the third quarter is very good and we have achieved at least 80% mark of what we achieved in the same period last year. I feel, if sentiment will continue to be good then 2021 will be good for the textile markets. But certain hurdles are coming on the way, like prices of yarn and cloths have gone up, and these are certain things that can stop growth a bit but I don’t feel that there will be some more problems in 2021 in the textile industry and everyone will grow. Customers will get out, buying will happen. Interestingly, no one has generated any new stocks in the last six to twelve months, so, I think that no one has stocks in hand; therefore, it seems that 2021 will be good for everyone, whether it is a retail store or a manufacturer.

Q: In this time, you would have looked forward and devised a strategy to grow in this business and increase the market share. What kind of changes can be brought in the company to ensure better growth, like entry to a new segment?

A: It is a good question. It is so that low segment business will grow a lot. If we divide our retail business into the upper, middle and low segments, then the low segment business will increase a lot. We were working in the upper-middle and upper segment to date, but now, we will have to enter into the lower segment as well. The brands that will track the customers of the low segment will grow because I feel that business has increased a lot in the segment and the value business has also increased a lot. In terms of value business, I feel, there is a possibility of getting a very growth. So, one addition is that we have to add value business. At the same time, several things have changed in the channel, if you are not available on the online platform then you will have to do something on the platform, where the customer is being driven or are coming and buying is increasing. If you have a look at Corona time then the online business was a business, which was not disturbed a lot. So, online business was not disturbed and customers were available there. So, you will have to upgrade your online channel and focus on tier-II and tier-III cities.

Q: What is your outlook on margins?

A: Margins will shrink because competition will increase but you will have to increase your scale and the speed of your turnover, which will help you in keeping the margins, stable.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Highest Senior Citizen FD rates: See what major banks like SBI, PNB, Canara Bank, HDFC Bank, BoB and ICICI Bank are providing on special fixed deposits

SBI Green Rupee Deposit 2222 Days vs Canara Bank Green Deposit 2222 Days FD: What Rs 7 lakh and Rs 15 lakh investments will give to general and senior citizens; know here

Power of Compounding: How many years it will take to reach Rs 10 crore corpus through Rs 10,000, Rs 15,000, and Rs 20,000 monthly SIP investments?

Top 7 Large Cap Mutual Funds With Highest SIP Returns in 3 Years: Rs 23,456 monthly SIP investment in No. 1 fund is now worth Rs 14,78,099

01:50 PM IST

IPO boom: Record Rs 1.6 lakh crore raised in 2024; new year to see greater heights

IPO boom: Record Rs 1.6 lakh crore raised in 2024; new year to see greater heights  Companies from 20 countries to participate in Didac India 2024

Companies from 20 countries to participate in Didac India 2024 HDFC Life sees 100 basis points hit on margins from higher surrender value

HDFC Life sees 100 basis points hit on margins from higher surrender value  Stride Ventures aims to enable up to USD 1 billion investment in cleantech

Stride Ventures aims to enable up to USD 1 billion investment in cleantech Macquarie considering $775 million possible offer for UK's Renewi

Macquarie considering $775 million possible offer for UK's Renewi