Piramal Enterprises demerger news: Check record date, share ratio - what investors should know

According to Piramal Enterprises, the company will issue 4 equity shares of Rs 10 each of Piramal Pharma for every 1 equity share of Rs 2 each to shareholders of Piramal Enterprises Limited.

Piramal Enterprises demerger latest news: Piramal Enterprises shares on will trade ex-date on Tuesday, August 30, ahead of the demerger. Piramal Enterprises' demerger record date is September 1. Zee Business Managing Editor Anil Singhvi said that investing in the shares of the company could be a good investment on a long-term basis post-demerger.

Piramal Enterprises Ltd (PEL), in its board meeting, had approved the demerger of its pharma business Piramal Pharma Ltd (PPL) via a composite scheme of the arrangement, the company had said in a filing.

According to Piramal Enterprises, the company will issue 4 equity shares of Rs 10 each of Piramal Pharma for every 1 equity share of Rs 2 each to shareholders of Piramal Enterprises Limited.

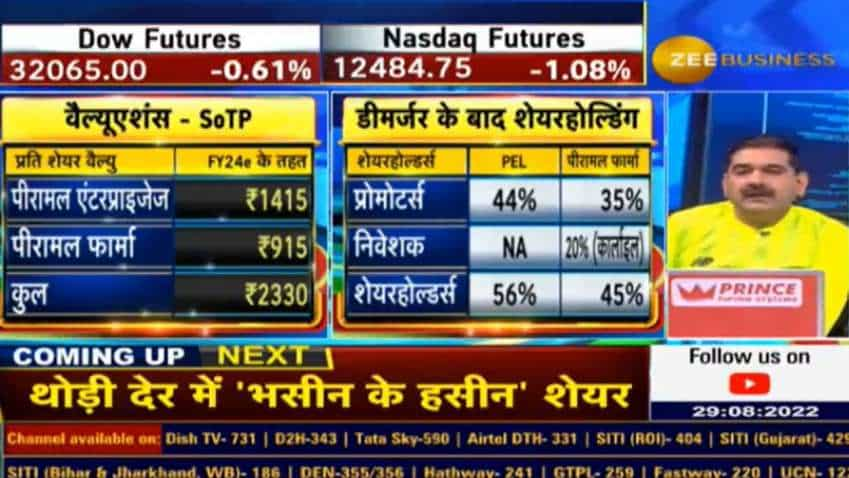

Post demerger, the promoters will have 44 per cent holdings in Piramal Ent and around 35 per cent in Piramal Pharma, while global investment firm Carlyle will hold 20 per cent in Piramal Pharma. Similarly, around 56 and 45 per cent of holding will be with shareholders in Piramal Ent and Piramal Pharma, respectively.

कल PEL डीमर्जर की एक्स-डेट

डीमर्जर से पहले #PEL में खरीदारी का मौका

क्या है PEL के डीमर्जर का रेश्यो

क्या है #PiramalEnterprises की डीमर्जर स्कीम ?

कैसे हैं अभी वैल्युएशंस और कैसे निवेशकों को होगा फायदा?

जानिए नूपुर से पूरी डिटेल्स...@Nupurkunia #StockMarketindia pic.twitter.com/wsT8Ixrx5V

— Zee Business (@ZeeBusiness) August 29, 2022

Piramal said the proposed demerger will facilitate the pursuit of scale with more focused management and flexibility as well as liquidity for shareholders (following the listing of the shares of PPL pursuant to the Scheme) and will also insulate and de-risk both the businesses from each other and allow potential investors and stakeholders the option of being associated with the business of their choice.

Piramal Enterprises will have financial services business, including retail and wholesale lending, while Piramal Pharma, which will be relisted on exchanges after the demerger, would have pharma, and CDMO business, according to Zee Business research analyst.

All the derivative contracts of the stock will expire on Monday and new ones will be issued from Tuesday, the research analyst said, adding that the pharma entity will be listed in the next 3-4 quarters of the ongoing fiscal year.

On the book value of 1.3/1.4 times, Piramal Enterprises' share price comes to Rs 1415 per share with respect to FY24e and Piramal Pharma's share price comes to Rs 915 per share on 17 times EV/EBITDA on an average after factoring 20 per cent holding discount, Zee Business analyst Nupur Jainkunia said.

The total share price value comes to Rs 2330 per share, which shows around an 18-19 per cent upside from current market price, according to research analyst. The stock of Piramal Ent on Monday closed nearly 2 per cent lower to Rs 1940 per share levels on the exchanges.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Latest SBI Senior Citizen FD Rates: How much senior citizens can get on investments of Rs 5,55,555, Rs 7,77,777, and Rs 9,99,999 in Amrit Vrishti, 1-, 3-, and 5-year FDs

Stocks To Buy: Axis Direct recommends buying SBI Life Insurance, Glenmark Pharma, 4 other stocks for 2 weeks; check targets

after bumper 2024 rs 2 lakh crore worth ipos expected in 2025 primary market nsdl avanse financial ecom express sebi approval

Power of Rs 3,000 SIP: In how many years, Rs 3,000 monthly investment can generate corpuses of Rs 2 crore and Rs 3 crore? Know here

Power of Compounding: How can you create Rs 5 crore, 6 crore, 7 crore corpuses if your monthly salary is Rs 20,000?

Power of 15x5x3 Rule: In how many years your monthly Rs 13,000 SIP will grow to Rs 65,59,488, Rs 1,29,88,923, and Rs 1,91,49,745 through this formula

10:11 AM IST