Want car loan? ICICI Bank becomes 1st lender in India to launch Smart EMI facility - Check details, and how to avail money

Noteworthy, ICICI Bank is the 1st lender in the country to introduce this facility. The service will be available for both corporates and salaried individuals, and will soon be available for self-employed customers.

ICICI Bank and TranzLease, automobile leasing and mobility solutions company, have joined hands to launch ‘SMART EMI’ for car enthusiasts. Noteworthy, ICICI Bank is the 1st lender in the country to introduce this facility. The service will be available for both corporates and salaried individuals, and will soon be available for self-employed customers. Here is all you need to know:-

- As a pilot, customers in Mumbai and Delhi-NCR can avail of this facility and take home cars of almost all leading makers. It will soon be available in Pune, Bengaluru, Hyderabad and Chennai.

- Termed as ‘SMART EMI’, this next-gen auto loan takes care of the insurance and maintenance requirement of the vehicle during the financing period.

-The amount of ‘SMART EMI’ is much lower than regular car loan EMI as the estimated resale value of the car is deducted upfront.

- Above all, this gives the users an option to either own the car at the end of the tenure by making payment of an agreed resale value or simply return the car to the leasing company.

- In case of such return, customers are rewarded with special bonus.

"This simple yet cost effective offering is developed, keeping in mind the special need of corporates and individuals who are keen to upgrade their vehicles in a few years. This unique proposition offers lower EMI in comparison to a regular car loan EMI as well as eliminates the hassle of unbudgeted and unforeseen expenses and unknown resale value," an official statement said.

See Zee Business tweet below:

ICICI बैंक ने कार लोन के लिए पेश Smart EMI स्कीम, जानें खासियत#ICICIBank @ICICIBank pic.twitter.com/YhgzkPJqdP

— Zee Business (@ZeeBusiness) November 27, 2019

How to avail this car loan facility? STEPS TO FOLLOW

- Customers can avail of this facility by simply visiting https://www.icicibank.com/PersonalBanking/loans/car-loan/cl-smart-emi.pa..., select a car of their choice and look at various EMI options available including comparing with traditional auto loans.

- After selecting the car, they can call the ‘SMART EMI’ phone number +91-8130680080.

- Post-delivery of the car, ‘SMART EMI’ provides customers with a personalised car portal through which the customer can manage the entire car life-cycle from the date of purchase to the date of disposal.

- Visit https://www.icicibank.com/Personal-Banking/loans/car-loan/cl-smartemi.pa... and search for the car of your choice

- Explore various ‘SMART EMI’ options for the chosen car and generate digital brochure instantly; compare ‘SMART EMI’ scheme with loan options from a financial institution

- Select the tenure as 36 months or 60 months and book the car by calling ‘SMART EMI’ customer care at +91 8130680080

- Get access to the online portal after the car is taken through ‘SMART EMI’. The online portal will include cloud repository of all car documents, insurance, maintenance & accident management, referral and points programme

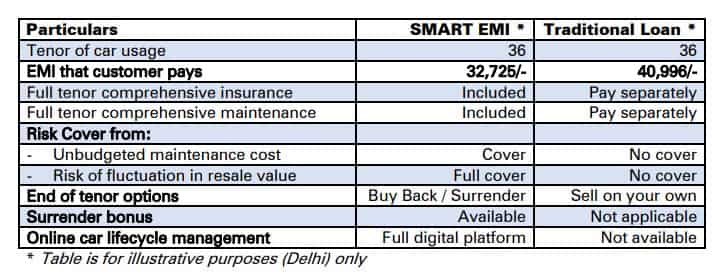

Illustration: How ‘SMART EMI’ works for a car (Ex-showroom INR 14.22 lakh)*

* Table is for illustrative purposes (Delhi) only

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Dearness Allowance (DA) Calculations: Is your basic monthly salary Rs 25,500, Rs 35,400, or Rs 53,100? Know how much DA will you get at different rates

Power of Compounding: How long it will take to build Rs 8 crore corpus with Rs 7,000, Rs 11,000 and Rs 16,000 monthly investments

Income Tax Calculations: What will be your tax liability if your salary is Rs 8 lakh, Rs 14 lakh, Rs 20 lakh, and Rs 26 lakh?

Monthly Pension Calculations: Is your basic pension Rs 25,000, Rs 35,000, or Rs 50,000? Know what can be your total pension as per latest DR rates

08:54 PM IST

ICICI Bank Q3 Review: Solid growth, stable asset quality impress analysts

ICICI Bank Q3 Review: Solid growth, stable asset quality impress analysts ICICI Bank Q3 Results Preview: PAT likely to grow 11%, interest income over 10%; asset quality may remain stable

ICICI Bank Q3 Results Preview: PAT likely to grow 11%, interest income over 10%; asset quality may remain stable ICICI Bank Q3 FY25 Results: PAT rises 15% to Rs 11,792 crore, meets Street estimates; asset quality stable

ICICI Bank Q3 FY25 Results: PAT rises 15% to Rs 11,792 crore, meets Street estimates; asset quality stable Bharti Airtel, TCS, ICICI Bank, 2 other blue-chip firms gain Rs 1.1 lakh crore in mcap in a week

Bharti Airtel, TCS, ICICI Bank, 2 other blue-chip firms gain Rs 1.1 lakh crore in mcap in a week ICICI Bank Under GST Scrutiny: Maharashtra GST conducted operations in several branches

ICICI Bank Under GST Scrutiny: Maharashtra GST conducted operations in several branches