Bulls trump bears on a volatile Thursday; metals shine led by rally in JSW Steel, Hindalco

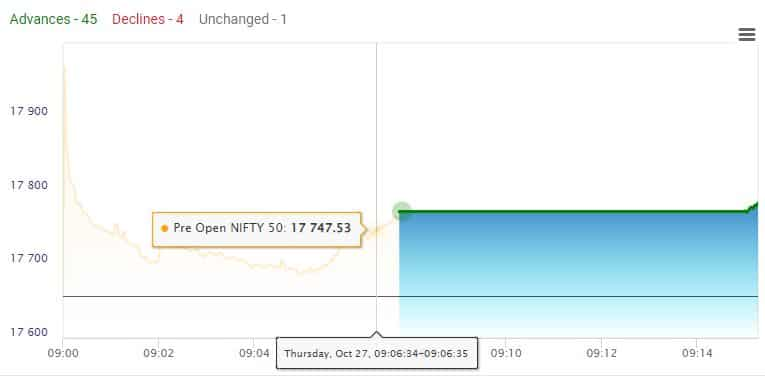

Stock Markets Updates: An eventful day today as the Thursday trading session saw constant tussle between the bulls and the bears. The Indian equity markets regained strength towards the fag end of the trading session. After a near 350 point drop from day's highs, BSE Sensex ended above 59850. Meanwhile, Nifty50 which lost nearly 100 points (High of 17,783.90) toward the middle of the session managed a closing above 17750. The markets reopened today after remaining closed for trading on Wednesday on account of Diwali Balipratipada. Bank Nifty was up by 200 points and was trading at 41336.55 around this time.

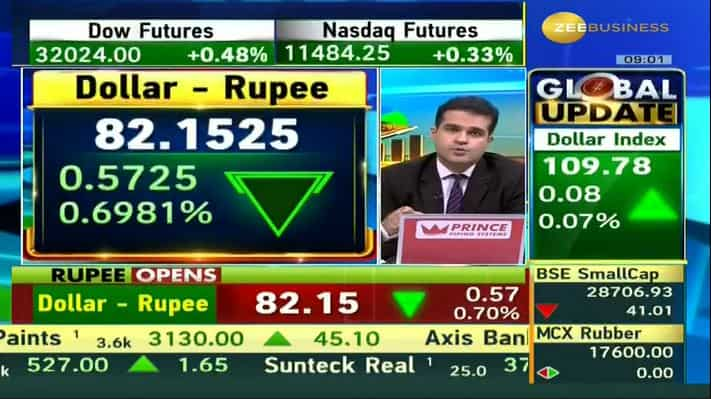

Earlier, today, Rupee opened with gains of 58 paise against the US Dollar at 82.15, though it gave some of its gains towards the closing time of equity markets.

Today was also the day of weekly expiry.

Zee Busines Managing Editor Anil Singhvi suggested a buy on dips strategy for intraday trading. His bet was metal sector for gains. Catch the FULL ACTION in markets here.

Stock Markets Updates: An eventful day today as the Thursday trading session saw constant tussle between the bulls and the bears. The Indian equity markets regained strength towards the fag end of the trading session. After a near 350 point drop from day's highs, BSE Sensex ended above 59850. Meanwhile, Nifty50 which lost nearly 100 points (High of 17,783.90) toward the middle of the session managed a closing above 17750. The markets reopened today after remaining closed for trading on Wednesday on account of Diwali Balipratipada. Bank Nifty was up by 200 points and was trading at 41336.55 around this time.

Earlier, today, Rupee opened with gains of 58 paise against the US Dollar at 82.15, though it gave some of its gains towards the closing time of equity markets.

Today was also the day of weekly expiry.

Zee Busines Managing Editor Anil Singhvi suggested a buy on dips strategy for intraday trading. His bet was metal sector for gains. Catch the FULL ACTION in markets here.

Latest Updates

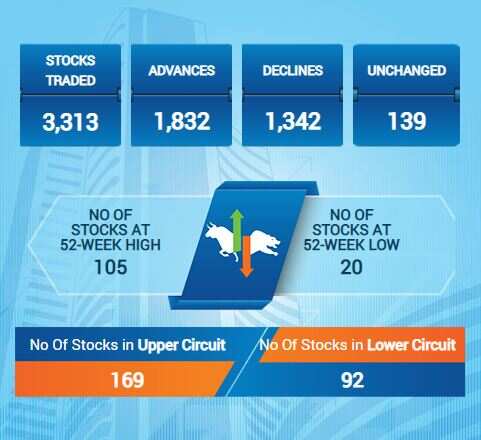

Equity markets witnessesd an eventful trading session with two-way trades. After a strong opening bears took over, leading to significant fall in BSE Sensex and Nifty50. However, the last half-an-hour saw bulls gaining ground. The Sensex ended at 59,756.84, up by 212.88 points or 0.36 per cent. Meanwhile, the Nifty50 settled at 17,736.95, up by 80.60 points or 0.46 per cent. Nifty Bank closed at 41229.30 and was up by 176 points or 0.43 per cent at the closing time.

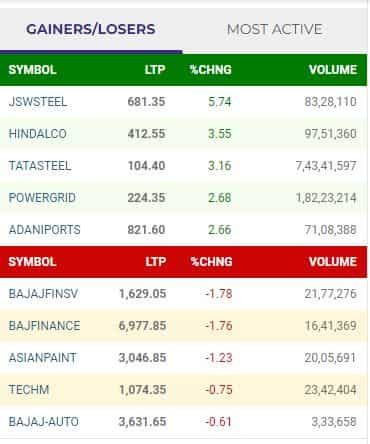

Led by Tata Steel, the 30-stock Sensex ended with 21 stocks in green while remaining in red. In Nifty50, 38 stocks advanced against 12 declines. Nifty IT was the sole loser among its 15 sectoral peers. The biggest gainer was Nifty Realty (+2.9 per cent) followed by Nifty Metal (up 2.7 per cent) and Nifty Oil & Gas (+1.36 per cent).

Top Gainers and Losers - Nifty50, Sensex

Domestic Stock Markets narrowed their gains further as they stepped into the final leg of trading. Sensex was trading at 59,555.49 and was up by just over 10 points at 2:33 pm. Meanwhile, Nifty50 was trading at 17,679.25, up by over 22.90 points or 0.13 per cent.

In the 30-stock Sensex, 18 were gainers and 12 were losers around this time. In the 50-stock Nifty50, 32 advanced, 17 declined while 1 remained unchanged.

The benchmark indices widened their gains within half an hour of the market opening. Sensex was trading at 59,915.66 and was up by 371 points or 0.62 per cent while NIFTY 50 was trading at 17,771.95, higher by 0.65 points. The overall positivity was also reflected in the broadet markets as well. THe Nifty Mid Cap 100 and Nifty Small Cap was trading at 31,127.45 (up 0.47 per cent) and 9,780.55 (up 0.52 per cent).

Barring the Nifty IT (down 0.10 per cent) index all other sectoral indices were among the gainers. The biggest gainers were Nifty Metals (2.26 per cent), Nifty Bank (0.83 per cent) and Nifty Consumer Durables (1.10 Per cent).

Stocks to Buy: Technical Analyst Anuj Gupta Stocks of IIFL Securities gives his recommendations on stocks which may double from this Samvat to next Samvat

Suzlon ...Target 20

Federalbank ... Target 260

Renuka sugar....Target 120

NTPC .... TARGET 300

Tata Steel....Target 200

Wipro....Target 600

Orient paper...Target 70

IDFC FIRST BANK....Target

DLF...Target 600

Tatamotors ...Target 750

Traders Diary: 20 stocks that are likley to show action on Thursday. The stocks have been compiled by Zee Business' Research Team Kushal Gupta and Varun Dubey.

Investors/ traders could focus on stocks including Century Textiles, Bharat Forge, ONGC, Hero MotoCorp, SBI Life and others.

Read Full Story: Traders Diary: 20 stocks that must be on your radar on Thursday; Here are top recommendations from Zee Business

27th October - Thursday

Top Q2FY23 Results: F&O: Indus Towers (post-market), Tata Chemicals (post-market), REC (Variable), SBI Cards & Payments (post-market)

Changes to the S&P BSE Indices

S&P BSE 500- Drop NMDC - Add Delhivery

S&P BSE 200- Drop NMDC - Add United Spirits

S&P BSE 100 LargeCap TMC (INR)- Drop NMDC - Add Adani Wilmar

S&P BSE SENSEX Next 50 TMC (INR) - Drop NMDC - Add Adani Wilmar

S&P BSE 150 MidCap Index (INR)- Drop Adani Wilmar- Add Delhivery

S&P BSE 250 LargeMidCap Index (INR) - Drop NMDC - Add Delhivery

S&P BSE 400 MidSmallCap Index (INR)- Drop Adani Wilmar- Add Delhivery

Kaveri Seed Company- Board may consider share buyback

Ex-Date:

Infosys- Interim Dividend Rs 16.5

ICICI Lombard General Insurance- Interim Dividend Rs 4.5

L&T Technology Services- Interim Dividend Rs 15

NMDC - Spin-off due to demerger (Adjustment of Futures and Options contracts, issue of 1 share of NMDC Steel for every 1 share to shareholders of NMDC )

Global:

Europe- ECB Interest Rate Decision

USA- Q3 GDP

Apple, Amazon Earnings in US

Results - F & O

- Dabur – Q2FY23 absolutely in line with estimates

Q2FY23 YOY

Rev at Rs.2987cr vs 2818cr, up 6% (EST 2997CR)

EBITDA at Rs.601cr vs 621cr, down 3.2% (Est 605cr)

Margins at 20.1% vs 22% (Est 20%)

PAT at Rs.491cr vs 505cr, down 2.8% (Est 491cr)

Domestic FMCG Growth

Healthcare down 7% yoy

Home & Personal Care up 6% yoy

Food & Beverage up 30% yoy

International Business grew by 12.3% in CC terms (2.5% in INR terms)

Rupee Vs Dollar: Anil Kumar Bhansali, Head of Treasury at Finrex Treasury Advisors LLP

Indian rupee likley to open at 82.05 after the dollar index fell to below 110 levels and US 10 year fell to 4.00%. The probable reason for this fall is slower rate hikes from US in November-22 despite inflation being higher.

The rise in oil prices from $ 90 per barrel to $ 94 per barrel would cap the rise in rupee as Oil is a major import for the country. Oil companies and importers will use this opportunity to buy dollars at a cheaper rate.

The range for the day is expected to be 81.80 to 82.40 as most Asian currencies have also risen from their recent lows. The KRW was at 1415 from 1435 and CNH was at 7.19 from 7.36.

Exporters may now sell on rise after the stop loss of 82.50 is breached while importers can buy dollars near to 82 levels to hedge their payables.

Source: BSE

Source: BSE