Global shipments of personal computers fall 2.4% in first quarter of 2017: Gartner

Gartner on Wednesday said the worldwide PC shipments for the first time in a decade fell 2.4% to 62.2 million units in Q1 of 2017 on account of decline in consumer demand.

Highlights:1. The worldwide PC shipments was 62.2 million units in Q1 of 2017 as against 63.7 million units in Q1 of 2016

2. It was the first time since 2007 that the worldwide PC market experienced shipments below 63 million units in a quarter

3. The top three PC manufacturing firms-Lenovo, HP Inc and Dell have recorded moderate growth in Q1 of 2017

The global shipments of personal computers (PCs) for the first time in a decade declined over 2% in the first quarter (Q1) of the present year on account of fall in consumer demand, said Gartner Inc on Wednesday.

"Worldwide PC shipments totaled 62.2 million units in the first quarter (Q1) of 2017, a 2.4% decline from the first quarter (Q1) of 2016," cited the information technology and research advisory firm in a press release.

The global PC shipments were 63.7 million units in the first quarter (Q1) of 2016.

The first quarter (Q1) of 2017 was the first time since 2007 that the PC market experienced shipments below 63 million units in a quarter, it said.

Commenting on fall in the worldwide PC shipments, Gartner said, "The PC industry experienced modest growth in the business PC market, but this was offset by declining consumer demand. Consumers continued to refrain from replacing older PCs, and some consumers have abandoned the PC market altogether."

According to Gartner, companies will have maintain a strong position in the PC business market in order to keep the sustainable growth in the market.

ALSO READ: PC shipments continue to fall but Dell bucks the trend

"While the consumer market will continue to shrink, maintaining a strong position in the business market will be critical to keep sustainable growth in the PC market. Winners in the business segment will ultimately be the survivors in this shrinking market," Gartner principal analyst Mikako Kitagawa, said in a statement.

"Vendors who do not have a strong presence in the business market will encounter major problems, and they will be forced to exit the PC market in the next five years. However, there will also be specialised niche players with purpose-built PCs, such as gaming PCs and ruggedized laptops," Kitagawa added.

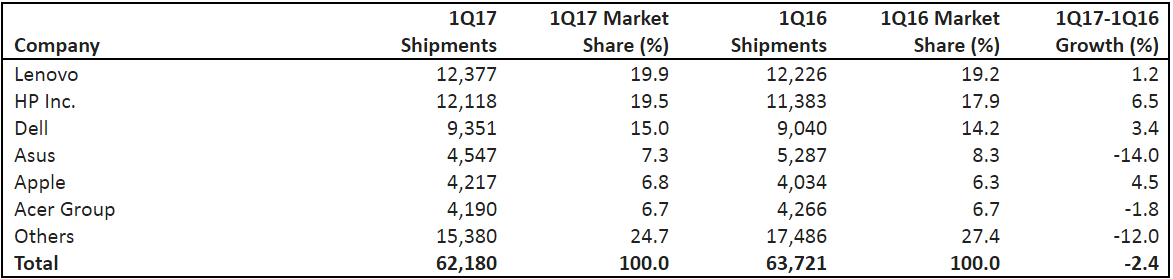

The top three PC manufacturing companies namely Lenovo, HP Inc and Dell have recorded moderate growth in the first quarter (Q1) of this year.

The global PC shipments of Lenovo in the first quarter (Q1) of 2017 was up 1.2% to 12,377 thousands of units as compared to 12,226 thousands of units in the first quarter (Q1) of 2016.

The worldwide PC shipments of HP Inc in the period under review was up 6.5% to 12,118 thousands of units as against 11, 383 thousands of units in the corresponding period of last year.

The global PC shipments of Dell in Q1 of 2017 rose by 3.4% to 9,351 thousands of units as against 9,040 thousands of units in Q1 of 2017.

Gartner's Preliminary Worldwide PC Vendor Unit Shipment Estimates for Q1 of 2017 (Thousands of Units):

"The top three vendors — Lenovo, HP and Dell — will battle for the large-enterprise segment. The market has extremely limited opportunities for vendors below the top three, with the exception of Apple, which has a solid customer base in specific verticals," Kitagawa said.

The competition among the top three vendors intensified in the first quarter (Q1) of 2017. Lenovo and HP were in a virtual tie for the top spot, she said.

However, PC manufacturing companies like Asus, Acer Group and others have witnessed a fall in their worldwide PC shipments during the first quarter (Q1) of 2017.

The global PC sales of Asus during the first quarter this year declined 14% to 4,547 thousands of units as compared to 5,287 thousands of units in the similar quarter of last year.

Acer Group's worldwide PC sales during the period under review fell by 1.8% to 4,190 thousands of units as against 4,266 thousands of units in the corresponding period of previous year.

Moreover, the global PC sales of other companies declined by 12% to 15,380 thousands of units in the first quarter (Q1) of 2017 as compared to 17,486 thousands of units in the first quarter (Q1) of 2016.

Gartner said that the data included desk-based PCs, notebook PCs and ultramobile premiums (such as Microsoft Surface), but not Chromebooks or iPads.

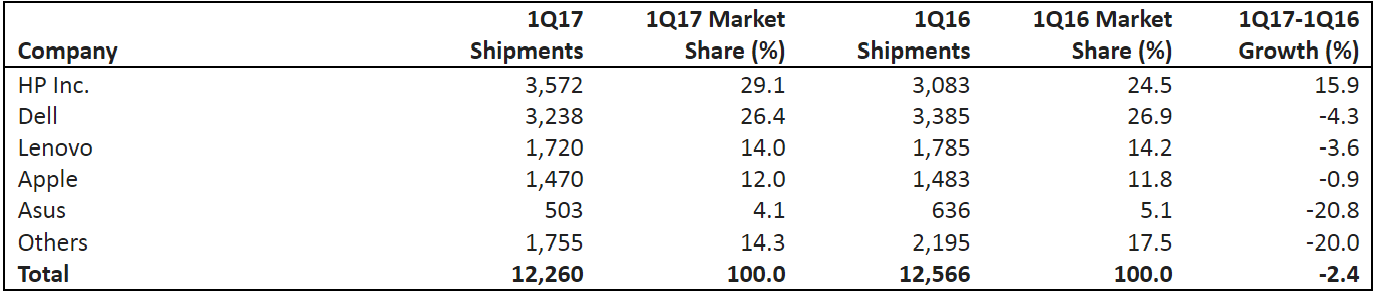

The research firm further said that HP showed the strongest growth among the top six vendors, as its global PC shipments increased 6.5% in the first quarter (Q1) of 2017. Further its shipments grew in all regions and it did especially well in the US wherein it had marketshare of 15.9% in PC shipments.

Gartner's Preliminary US PC Vendor Unit Shipment Estimates for Q1 of 2017 (Thousands of Units):

Dell has achieved four consecutive quarters of year-over-year growth. Its PC shipments increased in all regions except the US wherein it shipments declined by 4.3% to 3,238 thousands of units in the first quarter (Q1) of 2017 as against 3,385 units in the first quarter (Q1)of 2016, showed the Gartner findings.

In the US, PC shipments during the first quarter (Q1) of 2017 fell 2.4% to 12,260 thousands of units as against 12,566 thousands of units in the first quarter (Q1) of 2016.

"The US market has experienced a modest decline for two quarters. Much of the decline is attributed to the weak consumer market," Gartner said.

It further noted that the PC industry is also experiencing a price increase. Over two years ago, the price hike was attributed to the local currency deterioration against the US dollar. This time around, the price hike is due to a component shortage.

"DRAM prices have doubled since the middle of 2016, and SSD has been in short supply as well," Kitagawa said.

"The price hike will suppress PC demand even further in the consumer market, discouraging buyers away from PC purchases unless it is absolutely necessary. The price hike started affecting the market in Q1 of 2017. This issue will grow into a much bigger problem in Q2 of 2017, and we expect it to continue throughout 2017," she added.

Similarly, the PC shipments in EMEA region recorded a decline of 6.9% to 17.9 million units in the first quarter (Q1) of 2017.

"All major regions in EMEA experienced a decline in the first quarter. However, Russia saw single-digit PC growth, which was attributed to stabilisation of the local economy," the research firm said.

ALSO READ: Global IT spending likely to grow 1.4% to $3.5 trillion in 2017: Gartner

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

02:16 PM IST

PC shipments continue to fall but Dell bucks the trend

PC shipments continue to fall but Dell bucks the trend Global IT spending likely to grow 1.4% to $3.5 trillion in 2017: Gartner

Global IT spending likely to grow 1.4% to $3.5 trillion in 2017: Gartner 60% digital businesses to face service failures by 2020: Gartner

60% digital businesses to face service failures by 2020: Gartner