Fed's rate-cut confidence likely shaken but not yet broken by inflation

The housing market in particular "is facing major imbalances" between supply and demand that won't get fixed with high interest rates discouraging home and apartment construction, they wrote in a letter signed by members of the Congressional Progressive Caucus and others, including Senator Elizabeth Warren of Massachusetts, a frequent critic of Powell.

)

Federal Reserve officials left their policy meeting in late January in search of "greater confidence" that inflation was on a sustainable downward path, a notably squishy standard they set for determining when the U.S. central bank might start cutting interest rates. Instead, they have been buffeted by services prices roaring upward, job growth that continues to surprise to the upside, and housing costs that have kept climbing faster than expected.

Far from confidence, the issue they face in the two-day meeting that concludes on Wednesday is whether progress on inflation has flat out stalled and, if so, whether the Fed's policy rate needs to stay in the current 5.00 per cent-5.25 per cent range longer than anyone - investors, consumers, politicians and U.S. central bank officials themselves - had expected. That range was set last July after a historic round of aggressive monetary tightening triggered by inflation surging to a 40-year peak. Fresh economic projections due to be released at 2 p.m. EDT (1800 GMT) alongside a new monetary policy statement will show if officials still expect to reduce the policy rate by three-quarters of a percentage point this year, an outlook they've held since December and which was premised on inflation's continued decline.

At a press conference shortly after the end of the meeting, Fed Chair Jerome Powell will elaborate on the new policy statement before being quizzed on whether his recent comment that the U.S. central bank was "not far" from making a decision on an initial rate cut remains the case in the face of faster-than-anticipated price increases. Another key point is whether the statement will still refer to inflation as "elevated," an adjective the Fed has used throughout the current tight credit phase and which could be removed to signal that rate cuts are imminent.

Powell will be under pressure from both sides of the debate, as some economists see signs that inflation is becoming lodged at levels too far above the Fed's annual 2 per cent target to ignore, while others expect an upcoming slowdown in economic growth and hiring to keep price pressures muted and warrant rate cuts soon.

POLITICAL WINDS

Ahead of this week's Fed meeting, major investment firms scaled back the rate cuts they are expecting this year. Goldman Sachs went from forecasting a full percentage point of cuts in 2024 to three-quarters of a point. Roger Aliaga-Diaz, the chief economist for the Americas at Vanguard, said between recent data and a "cautious" Fed, "it's entirely possible that the Fed may not be in position to cut rates this year" at all.

Pantheon Macroeconomics chief economist, Ian Shepherdson, who was among the earliest to correctly forecast the dramatic softening in inflation over the course of last year that underpins the now-widely embraced "soft-landing" thesis, meanwhile argued that savings-depleted households were now "exposed" more fully to the Fed's tight credit policies. Moreover, he said, recent small business surveys suggest hiring could potentially slow sharply in the coming months. Some Democrats in the U.S. Congress also have peppered Powell with rate-cut demands. With headline inflation running at 2.4 per cent in January by the Fed's preferred measure - the personal consumption expenditures price index - lawmakers argued in a March 18 open letter to the U.S. central bank chief that keeping monetary policy this tight was not necessary and put the current economic expansion at risk.

The housing market in particular "is facing major imbalances" between supply and demand that won't get fixed with high interest rates discouraging home and apartment construction, they wrote in a letter signed by members of the Congressional Progressive Caucus and others, including Senator Elizabeth Warren of Massachusetts, a frequent critic of Powell.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

04:14 PM IST

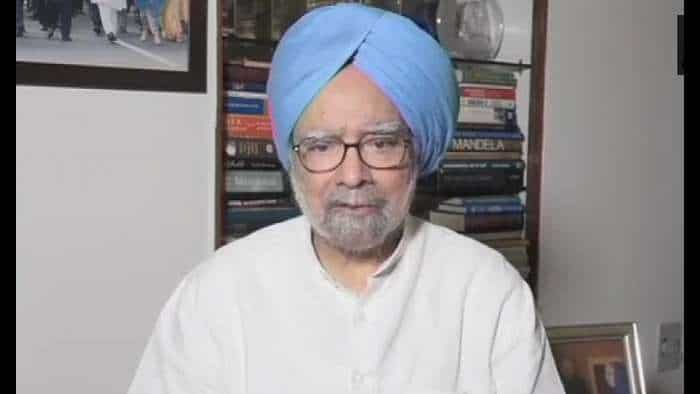

RBI: After another status quo year, all eyes on a growth-propping rate cut with new Guv at helm By Ashish Agashe

RBI: After another status quo year, all eyes on a growth-propping rate cut with new Guv at helm By Ashish Agashe UK inflation rises further above Bank of England's target in November

UK inflation rises further above Bank of England's target in November Consumer inflation eases to 5.48% in November, in line with expectations

Consumer inflation eases to 5.48% in November, in line with expectations India's retail inflation likely to ease: Report

India's retail inflation likely to ease: Report Thank you, PM Modi, FM Sitharaman, Team RBI: Shaktikanta Das on his last day in office

Thank you, PM Modi, FM Sitharaman, Team RBI: Shaktikanta Das on his last day in office