Did Bitcoin's performance create investors interest in other cryptocurrencies?

Achievement of Bitcoin brings a new era for cryptocurrency, as investors found faith in other virtual currencies.

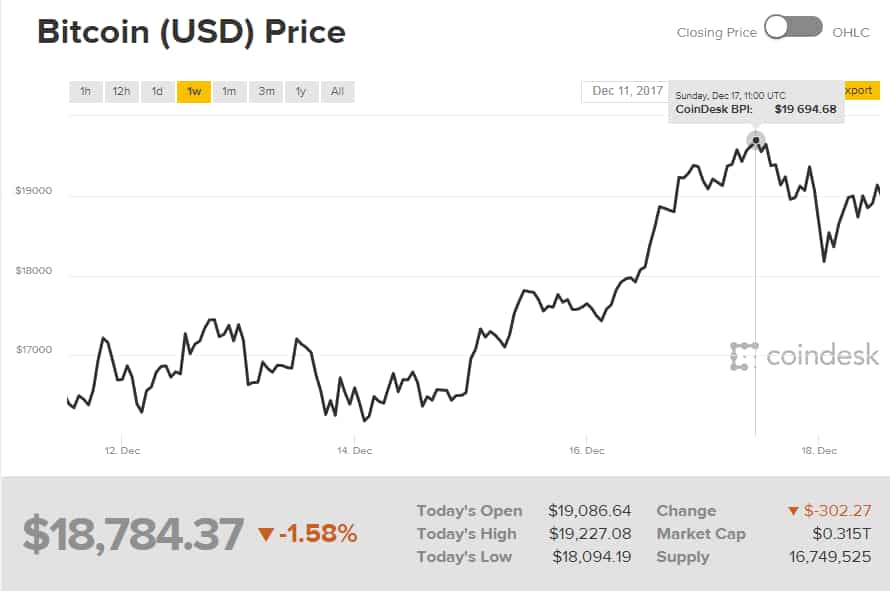

2017 will be remembered as a year of cryptocurrency, considering the performance of Bitcoin across the globe. The digital currency on Monday was trading at $19,125.32 higher by 0.20%, after touching a new $19,746.63 on December 17, as per CoinDesk data.

With this blockbuster performance, Bitcoin has gained to a whopping 141198.21% or 1412.98 times from the year 2013 to till date.

Interestingly, achievement of Bitcoin also brings a new era for cryptocurrency, as investors found faith in other virtual currencies.

Till 2011, Bitcoin was the only cryptocurrency that held 100% market capitalisation in the virtual currency.

The ICICI Bank data stated that there are over 1300 cryptocurrencies right now with a total market cap of over $300 billion, and bitcoin dominates at 55%.

According to Incrementum data, there are nine alternatives to Bitcoin namely – Etherium, Dash, Litecoin, Etherium Classic, Monero, Ripple, Aurouracoin, Dogecoin and MaidSafeCoin.

Incrementum further informs, “Today, Bitcoin’s share of the cryptocurrency market has fallen to less than half. In addition to Bitcoin, cryptocurrencies such as Litecoin, Dash, Ethereum, and Bitcoin Cash are attracting traditional investors to this new digital asset class.”

These siblings of Bitcoin are available at way lesser amount if compared with Bitcoin. Let's have a look at the performance ofsome of the alternatives.

Litecoin

This currency came into existence in 2011, and is often referred to as “silver”. The Litecoin network can process transactions four times faster than Bitcoin. Also, the total supply in Litecoin is higher to 84 million in comparison with Bitcoin whose supply is capped at 21 million.

Incrementum said, “This four-fold increase in cryptocurrency units means that the inflation rate of Litecoin is higher than Bitcoin.”

If we look at Litecoin's performance, this coin was trading at $4.3 till April 28, 2013, and touched its first over $50 mark in November 2013. However, it has been trading between $10 and $100 from its launch date till November 2017.

Litecoin, however, rose to $100.80 on December 2, and further jumped to $339.39 on December 12, 2017, and has since maintained this mark. From the year 2013 to till date, Litecoin has gained by 7792.79% or 78.92 times globally.

Dash

Dash came into existence during January 2014 with the name of Darkcoin. It was later rebranded as Dash in March 2015.

“Dash developed new methods for reducing the traceability of transactions by mixing many transactions together before sending them to the final destination. The process of mixing blurs the identity of the original sender,” said Incrementum.

To increase privacy further, Dash does not have a publicly available ledger. Recently, the developers have made successful efforts to increase merchant acceptance of Dash.

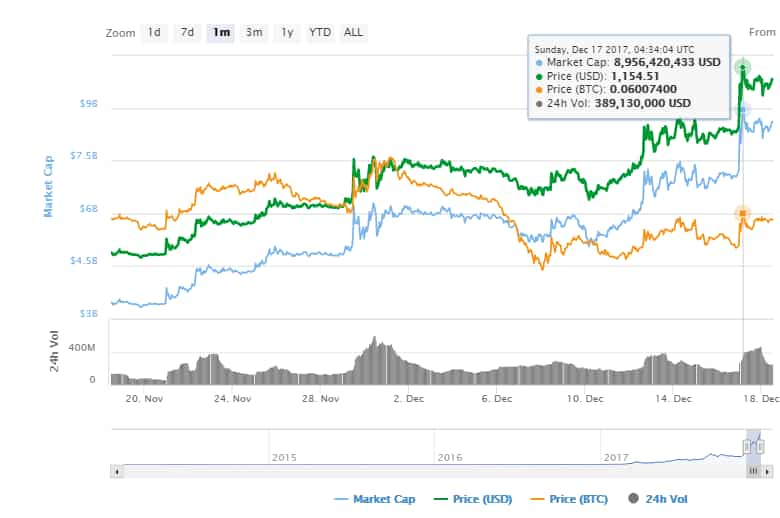

Performance of Dash since its inception has been commendable just like Litecoin and Bitcoin. Dash, which was below $1 between January 2014 and April 2014, went higher and was trading near $10 from May 2014 till January 2017.

This year, it saw quite an uptick. It was at $11.59 on January 2, 2017 – which increased to $109.33 on March 19, and ahead to $500 in the month of November 2017. Dash increased to $936.14 on December 12, and further to $1154.51 on December 17, 2017.

Dash has thus grown by 9861.25% or 99.61 times globally.

Ethereum

Unlike Bitcoin Cash, Litecoin and Dash, Ethereum is an infrastructure cryptocurrency that enables “smart” contracts – digital contracts that automatically execute pre-programmed agreements.

Launched in 2015, Ethereum provides a platform where decentralized applications can be built and operated by anyone. Also, Ethereum smart contracts operate without downtime or censorship.

As per Incrementum, Etheruem's market capitalisation is approximately $44 billion with approximately 94 million ethers and a price of $460 per token.

Ethereum has touched a high of $736.21 in this month, which made it grew by nearly 5537.13% or 56.37 times so far since its launch.

Monero

Monero was first known to the world in April 2014 and as per Investopedia, but this coin soon spiked great interest among cryptography community and enthusiasts.

Monero has been launched with a strong focus on decentralisation and scalability, and enables complete privacy by using a special technique called as “ring signatures”.

From April 2014 to till date, Monero has surged by 6975.20% or 70.75 times globally.

Alexis Roussel, CEO Bity, in the Incrementum report said, “Until recently we had individuals from financial institutions buying Bitcoin because they were working on crypto projects at their company and wanted to see how it worked. This year, it is the institutions themselves that are investing in cryptocurrencies.”

However, investment in cryptocurrency is on wait-and-watch mode by many economists. As their performance has been very volatile, it has become very difficult to keep a tab on them for future outlook.

Andrew Kenningham, Chief Global Economist at Capital Economics, said, "We will have more to say about the economics of cryptocurrencies in the coming months for now the key point is that it is a curiosity, but not a major economic risk.”

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How soon will monthly SIP of Rs 6,000, Rs 8,000, and Rs 10,000 reach Rs 5 crore corpus target?

SBI Guaranteed Return Scheme: Know how much maturity amount you will get on Rs 2 lakh, 2.5 lakh, 3 lakh, 3.5 lakh and Rs 4 lakh investments under Amrit Vrishti FD scheme

SBI Senior Citizen FD Rate: Here's what State Bank of India giving on 1-year, 3-year, 5-year fixed deposits currently

SBI Senior Citizen Latest FD Rates: What senior citizens can get on Rs 7 lakh, Rs 14 lakh, and Rs 21 lakh investments in Amrit Vrishti, 1-, 3-, and 5-year fixed deposits

08:15 PM IST

Why Bitcoin prices are at an all-time high? Here's what Anil Singhvi has to say

Why Bitcoin prices are at an all-time high? Here's what Anil Singhvi has to say Anil Singhvi decodes why Bitcoin has soared 125% in 8 months and 25% in 1.5 months

Anil Singhvi decodes why Bitcoin has soared 125% in 8 months and 25% in 1.5 months Japan Airlines counts losses from plane destroyed in runway collision

Japan Airlines counts losses from plane destroyed in runway collision Bitcoin rocketing higher, topping $35,000 for the first time since May 2022

Bitcoin rocketing higher, topping $35,000 for the first time since May 2022 Finance Minister Nirmala Sitharaman says any action on crypto assets will have to be global

Finance Minister Nirmala Sitharaman says any action on crypto assets will have to be global