Budget expectations: Reintroduction of rebate for section 88E will result in a larger collection of STT/CTT, says ANMI

India is the only country levying STT and CTT taxes in the delivery-based as well as derivatives and commodities futures segment, thus, ANMI reckons that a rebate under Section 88E for STT and CTT paid should be reintroduced.

)

With the Union Budget 2024 just around the corner, the Association of National Exchanges Members of India (ANMI), a body comprising trading members across the country of stock exchanges, has listed down a wishlist that will be beneficial for the Indian share market participants.

The list includes the reintroduction of rebates under Section 88E for Securities Transaction Tax (STT) and Commodity Transaction Tax (CTT) paid.

As per ANMI, India levies Securities Transaction Tax (STT) in the cash market and derivatives segment. However, the same is only levied at the time of transfer of beneficial ownership (delivery-based) and no STT is levied if the trade does not result in delivery.

Additionally, India is the only country levying STT and CTT taxes in the delivery-based as well as derivatives and commodities futures segment, thus, ANMI reckons that a rebate under Section 88E for STT and CTT paid should be reintroduced.

ANMI President Vinod Kumar Goyal had already submitted association's recommendations to the CBDT Chairperson.

How will the reintroduction of rebate under Section 88E help?

Firstly, section 88E benefits can be continued as applied to entities having a business income. ANMI explains the benefits of 88E through the following illustrations.

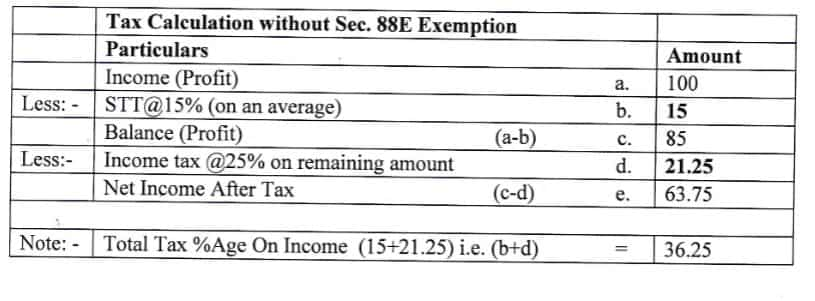

Illustration: A

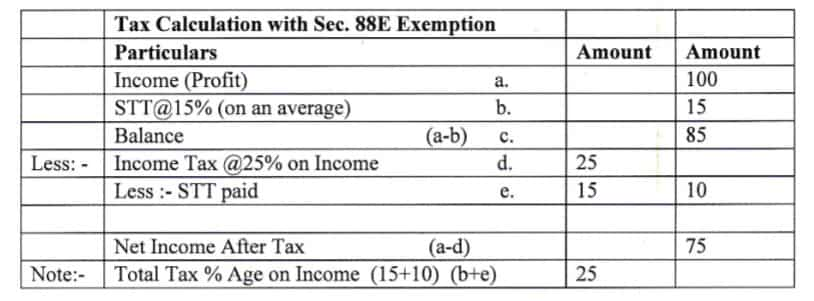

Illustration: B

The above illustration proves that sec. 88E benefit results in a reduction of income tax by 11.25 per cent (36.25-25). In such circumstances, ANMI submits that for entities dealing in securities and treating income as business income, STT should be treated as tax paid, not an expense, i.e., tax rebate u/s 88E to be restored.

Further, ANMI believes that the reintroduction of section 88E will result in increased volumes and therefore a much larger collection of STT/CTT. Thus, revenue loss will be negligible.

For all other news related to business, politics, tech and auto, visit Zeebiz.com.

DISCLAIMER: The views and investment tips expressed by investment experts on zeebiz.com are their own and not those of the website or its management. zeebiz.com advises users to check with certified experts before taking any investment decisions.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

'Bengaluru, absolute traffic hell...: City's congestion worsens as HSR Layout flyover shuts for metro work, netizens irked

Gratuity Calculation: What will be your gratuity on Rs 40,000 last-drawn basic salary and 5.2 years of service?

8th Pay Commission: Can basic pension cross Rs 3 lakh mark in new pay commission? See calculations to know its possibility?

SBI 444-day FD vs Central Bank of India 444-day FD: Which can provide higher maturity on Rs 5,00,000, Rs 7,00,000 & Rs 10,00,000 deposits?

UPS vs NPS vs OPS: Last drawn basic pay Rs 100,000; pensionable service of 30 years; what can be your monthly pension in each?

06:15 AM IST

Budget 2025: FM Nirmala Sitharaman quotes Telugu poet and playwright Gurajada Appa Rao – Who was he?

Budget 2025: FM Nirmala Sitharaman quotes Telugu poet and playwright Gurajada Appa Rao – Who was he? Ahead of Budget 2025, here's a recap of Narendra Modi 3.0 government's first Budget in 10 points

Ahead of Budget 2025, here's a recap of Narendra Modi 3.0 government's first Budget in 10 points Budget 2024: Double PM Mudra loan threshold of Rs 20 lakh a reality now

Budget 2024: Double PM Mudra loan threshold of Rs 20 lakh a reality now Narendra Modi 3.0 government to borrow 47% of FY25 target in October-March, stays on path laid out in Budget 2024

Narendra Modi 3.0 government to borrow 47% of FY25 target in October-March, stays on path laid out in Budget 2024 Budget 2024: Big relief, taxpayers! Centre may give option to calculate LTCG tax on property, pay lower tax under certain conditions

Budget 2024: Big relief, taxpayers! Centre may give option to calculate LTCG tax on property, pay lower tax under certain conditions