Union Budget 2024: Big change in income tax slabs coming tomorrow? Here's what we know so far

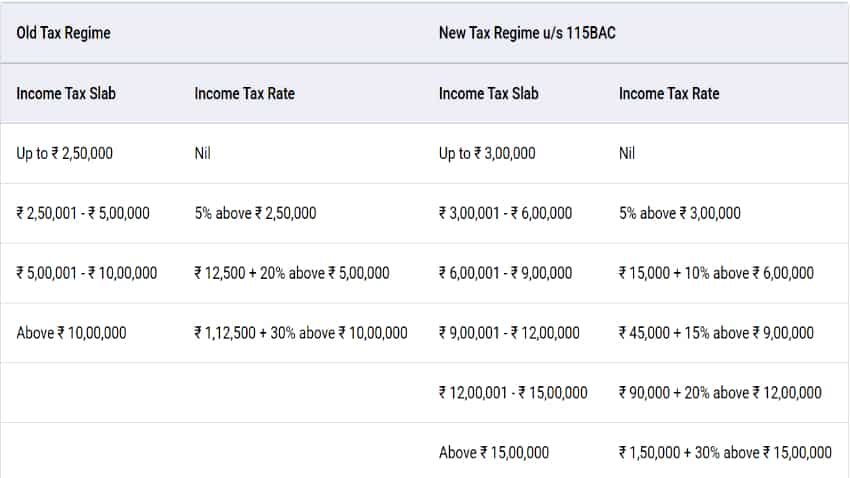

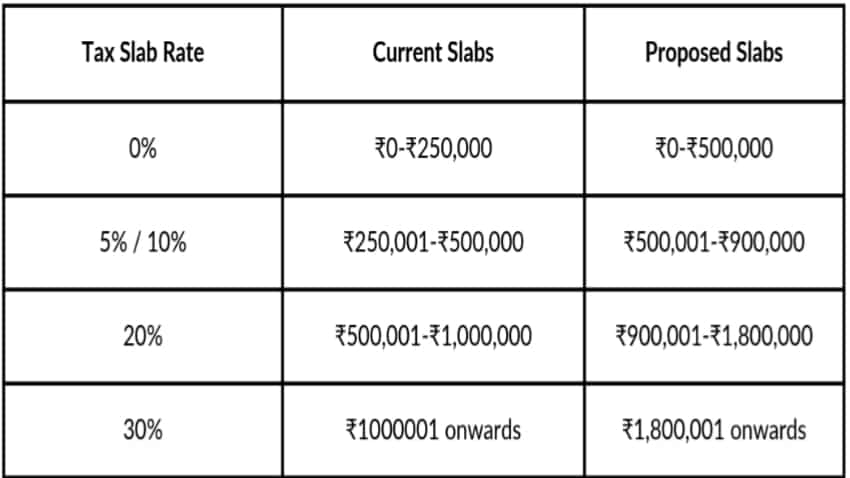

Old vs New Income Tax Slabs: The old regime has the same tax slabs as announced in the 2012–13 budget. Inflation has increased significantly in the last 12 years, but there have been no changes in slabs. A BankBazaar.com study shows Rs 10 lakh earned in 2012–13 is now Rs 5.50 lakh, so the 20 per cent tax slab should be Rs 9–18 lakh. Amid such a scenario, will finance minister Nirmala Sitharaman increase tax slabs in the Union Budget 2024 tomorrow (July 23, 2024)? Here's what Zee Business sources say

)

After adjusting with inflation, Rs 10 lakh earned in 2012-13 is now Rs 5.50 lakh, as per Bankbazaar.com study. Photo: Pixabay/Representational

Finance ministry quashes social media rumours there will be changes in new tax regime in Financial Year 24-25

Finance ministry quashes social media rumours there will be changes in new tax regime in Financial Year 24-25