Not a replacement but an add-on to social programmes; Universal Basic Income explained

The proposal for the provision of a Universal Basic Income (UBI) in the Economic Survey document began with quotes by Mahatma Gandhi.

“Wiping every tear from every eye” based on the principles of universality, unconditionally, and agency—the hallmarks of a Universal Basic Income (UBI)—is a conceptually appealing idea,” the Economic Survey said.

The concept of UBI outlines that society needs to guarantee to each individual a minimum income which they can count on, and which provides the necessary material foundation for a life with access to basic goods and a life of dignity.

Ensuring that the marginalised receive subsidies the government started the Direct Benefit Transfer in 2013 and aimed to transfer subsidies directly into their accounts.

“While Aadhar is designed to solve the identification problem, it cannot, on its own, solve the targeting problem. It is important to recognise that universal basic income will not diminish the need to build state capacity: the state will still have to enhance its capacities to provide a whole range of public goods,” the survey report said.

However, the government said that UBI will not be a ‘substitute for state capacity;' it will be a way of ensuring that state welfare transfers are more efficient so that the state can concentrate on other public goods.

UBI; a debateable concept

One of the debateable notions of the proposed plan in the report was whether UBI would reduce the incentive to work.

“…the levels at which universal basic income are likely to be pegged are going to be minimal guarantees at best; they are unlikely to crowd incentives to work,” the report justified.

Other arguments of whether income should be detached from employment and whether income should be an unconditional irrespective of individual contribution were all raised.

Some of the cons of the scheme were raised as it may induce gender disparity, technical problems in implementation, conspicuous spending and exposure to market risks.

What qualifies a person to come under UBI?

UBI will simply amount to a transfer of resources from above and need not be “accessed” by beneficiaries.

The survey report said that it would do away with the bureaucratic complexities of ‘separating the poor from the non-poor.’

“…beneficiaries are simply required to withdraw money from their accounts as and when they please, without having to jump through bureaucratic hoops,” the report said.

Further the document said that the scope for diversion would be reduced considerably, since discretionary powers of authorities are eliminated almost wholly.

However, the survey outlined steps to exclude ‘the obviously rich,’ through methods known by the government which are listed below:

1. Define the non-deserving based on ownership of key assets such as automobiles or air-conditioners or bank balances exceeding a certain size.

2. Adopt a ‘give it up’ scheme wherein those who are non-deserving chose to opt out of the programme just as in the case of LPG and are given credit for doing so.

3. Introduce a system where the list of UBI beneficiaries is publicly displayed; this would “name and shame” the rich who choose to avail themselves of a UBI.

4. Self-targeting: Develop a system where beneficiaries regularly verify themselves in order to avail themselves of their UBI – the assumption here is that the rich, whose opportunity cost of time is higher, would not find it worth their while to go through this process and the poor would self-target into the scheme.

People at the 0.45% of the poverty line will be considered for the scheme.

The report also spoke about the possibility of a separate UBI for women, children, widows, pregnant mothers, the old and the infirm.

Income under UBI

The survey pointed out that if UBI was to be kept at a standard rate it would not be able to buy the same amount of goods over a period of time.

“The process of determining a UBI amount is not a one-time exercise: as the UBI is a cash transfer, its ‘real’ value tends to be determined by inflation in the economy,” the report said.

It further added, “Calculations suggest that A UBI of Rs 12,000 per adult per year is expected to reduce the average distance from the nearest business correspondents (or banks) to 2.5 km from 4.5 km at about half the UBI amount.”

The report further added that while calculating the above figure ‘the effect was larger since a UBI is targeted at all individuals, not only adults.’

The report named places like Madhya Pradesh and Rajasthan where the average distance from a household to a bank was 5km.

However, if India has to achieve universal financial inclusion the report said that people could receive any figure between Rs 4,800 to Rs 12,000 per capita per year.

“A higher UBI would in turn require a lower commission,” the report added.

Due to the Pradhan Mantri Jan Dhan Yojana scheme financial inclusion increased significantly in India.

Financial Inclusion Insights showed that while ownership of bank accounts has increased to about 2/3rd of all adults in India, active use has increased to about 40%.

The report said that given the figures for UBI the scheme would target 90% financial inclusion in the country.

Where is the money to fund UBI going to come from?

Pointing out that even though UBI may be the shortest path to eliminating poverty; however, it should not become the ‘Trojan horse’ that usurps the fiscal space for a well-functioning state.

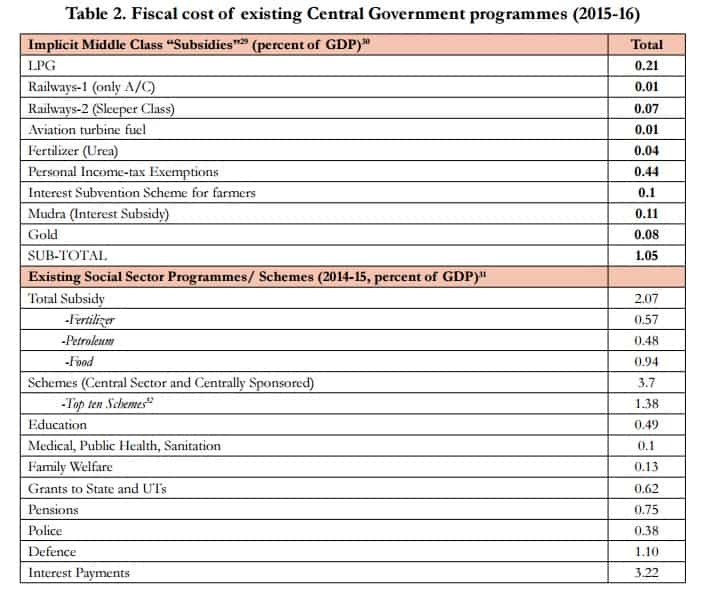

The Survey estimated that a UBI that reduces poverty to 0.5% would cost 5.2% of GDP, assuming that those in the top 25% income bracket are not part of the loop.

Speaking on how the government runs a plethora of schemes in subsidies the report said that any government will have to decide on what programmes or expenditures it will have to prioritize in order to finance a UBI.

Administration of UBI

The government said that the 26.5 crore Jan Dhan accounts will play a major role in the UBI scheme.

“Eventually, the JAM system could be used to provide funds to each individual directly into his or her account… since the per capita density of these accounts is relatively high in many of the poorer states,” the report said.

In a concluding remark the report said that the scheme would ‘like the GST’ involve complex negotiations between federal stakeholders.

“Initially, a minimum UBI can be funded wholly by the centre. The centre can then adopt a matching grant system wherein for every rupee spent in providing a UBI by the state, the centre matches it,” the report added.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

06:00 PM IST

Not Universal Basic Income, SBI report says just transfer cash to farmers

Not Universal Basic Income, SBI report says just transfer cash to farmers International Monetary Fund not endorsing Universal Basic Income in India: Official

International Monetary Fund not endorsing Universal Basic Income in India: Official UBI will be set in motion over next 1 year, hopes Jaitley

UBI will be set in motion over next 1 year, hopes Jaitley Economic Survey 2016-17: Universal Basic Income would reduce poverty by 0.5%, finance ministry says

Economic Survey 2016-17: Universal Basic Income would reduce poverty by 0.5%, finance ministry says Budget 2017: 8-10% cigarette tax, rural stimulus imminent, says FMCG experts

Budget 2017: 8-10% cigarette tax, rural stimulus imminent, says FMCG experts