Govt expects to generate Rs 1 lakh crore from disinvestment; Air India on the cards

The government has hiked the disinvestment target by over 10% to Rs 80,000 crore in FY19. Read all about it here.

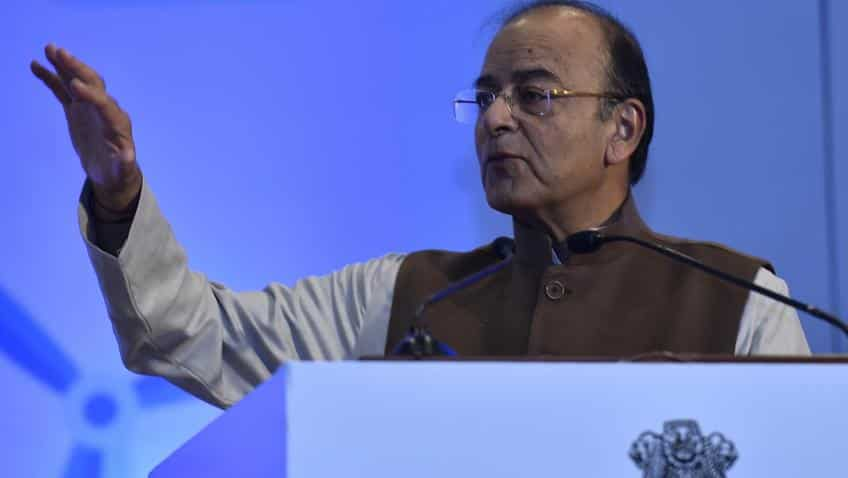

A total of 24 state-owned companies including Air India await to be disinvested by the government, Finance Minister Arun Jaitley said today while announcing Union Budget FY19.

The government expects to raise Rs 1 lakh crore from share of sales in this fiscal year - FY18.

The government has also hiked the disinvestment target by over 10% to Rs 80,000 crore in FY19.

“Highlighting the government’s effort to generate funds, the Finance Minister said that the Exchange Traded Fund Bharat-22 which was introduced to raise Rs. 14,500 Crore, was over-subscribed in all segments. Similarly, the 2017-18 Budget Estimates for disinvestment were pegged at the highest ever level of Rs.72,500 Crore and the estimated receipts from the same are expected to the tune of Rs.1,00,000 crore in 2017-18, far exceeding the target. The Finance Minister has also set the disinvestment target of Rs.80,000 crore for 2018-19,” Ministry of Finance said.

The Union Budget FY19 will come into effect from April 1, 2018.

Pushing ahead for disinvestment plans, Air India’s privatisation also hangs in the balance.

FM Jaitely, while presenting the General Budget 2018-19 in Parliament today, said that the government has initiated the process of strategic disinvestment in 24 CPSEs including strategic privatisation of Air India.

As on January 02, 2018, government has achieved Rs 32,321.92 crore from CPSE disinvestment compared to their target of Rs 46,500 crore. While Rs 4,153.65 crore has been achieved from strategic disinvestment so far in FY18 compared to their target of Rs 15,000, Department of Investment and Public Asset Management revealed.

Indian government has thus raised about Rs 53,833.05 crore – which was estimated to cover over 74% of disinvestment target for FY18.

According to Jaitley, the government has approved the listing of 14 CPSEs (Central Public Sector Enterprises), including two insurance companies, on the stock exchanges.

The disinvestment plan also includes the introduction of debt exchange-traded funds, which comes after the success of the CPSE ETFs and Bharat 22 ETFs.

The merger of three general insurance companies -- National Insurance, United India Assurance and Oriental India Insurance will be merged into a single entity and listed on the exchanges as part for the divestment programme.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

03:48 PM IST

Government revises definition of strategic disinvestment under Income Tax Act of 1961

Government revises definition of strategic disinvestment under Income Tax Act of 1961 Disinvestment process of RINL is under progress: Steel Ministry

Disinvestment process of RINL is under progress: Steel Ministry No separate mention of disinvestment proceeds in Budget 2023-24

No separate mention of disinvestment proceeds in Budget 2023-24 Government gets multiple EoIs for privatising NMDC Steel: DIPAM Secretary Tuhin Kanta Pandey

Government gets multiple EoIs for privatising NMDC Steel: DIPAM Secretary Tuhin Kanta Pandey Union Budget 2023: What is disinvestment and why it is done ?

Union Budget 2023: What is disinvestment and why it is done ?