Economic Survey 2017: Demonetisation has put country's growth at stake

Economic Survey 2017 was presented in Parliament by Finance Minister Arun Jaitley ahead of Union Budget.

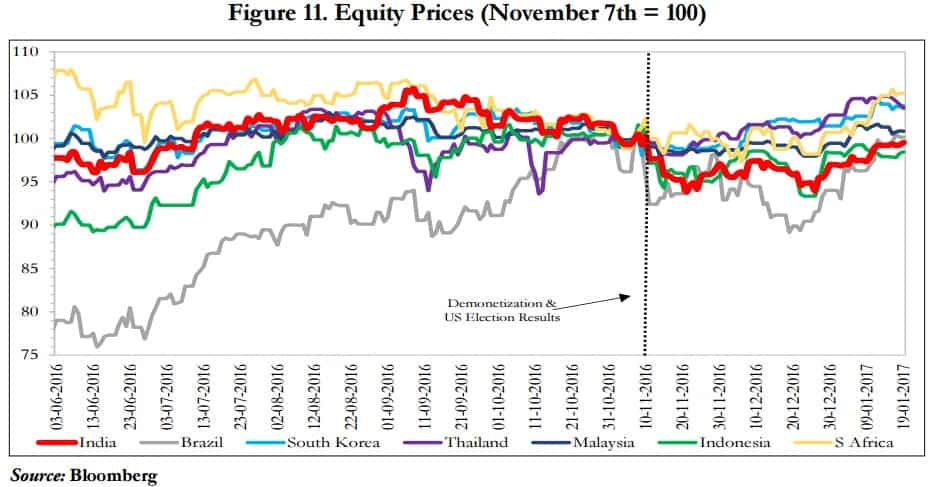

Ministry of Finance on Tuesday projected the country's Gross Domestic Growth for FY18 in the range of 6¾-7½% due to impact of demonetisation.

Today, Economic Survey 2017 was presented in Parliament by Finance Minister Arun Jaitley ahead of Union Budget, which is scheduled for tomorrow.

The survey started with "Against the backdrop of robust macro-economic stability, the year was marked by two major domestic policy developments, the passage of the Constitutional amendment, paving the way for implementing the transformational Goods and Services Tax (GST), and the action to demonetise the two highest denomination notes."

On November 8, Prime Minister Narendra Modi in a surprise move announced the ban on Rs 500 and Rs 1000 notes which had pulled out nearly 86% of the currency floating the country. The decision left the whole country in cash crunch situation and created chaos in the banks.

Moreover, the note-ban decision was highly criticised by some economists and opposition parties. However, the government kept ensuring that the whole exercise is positive for the economy of the country and will boost India's growth.

The government had given time till December 31 to deposit the "abolished notes" in banks and restrictions were placed on cash withdrawals. The aim of the action was to curb corruption, counterfeiting, the use of high denomination notes for terrorist activities, and especially the accumulation of “black money”, generated by income that has not been declared to the tax authorities.

Economic Survey 2017 said that the demonetisation will have both short-term costs and long-term benefits. The survey mentioned that "demonetisation of the large currency notes signaled a regime shift to punitively raise the costs of illicit activities."

The debate

As per the survey, the public debate on demonetisation has raised three questions: First, broader aspects of management, as reflected in the design and implementation of the initiative. Second, its economic impact in the short and long run. And, third, its implications for the broader vision underlying the future conduct of economic policy.

The survey said that the short-term costs have taken the form of inconvenience and hardship, especially those in the informal and cash-intensive sectors of the economy who have lost income and employment.

Calling these costs as "transitory", survey said these hardships may be minimised in recorded GDP because the national income accounts estimate informal activity on the basis of formal sector indicators, which have not suffered to the same extent. But the costs have nonetheless been real and significant. The benefits of lower interest rates and dampened price pressure may have cushioned the short-term macroeconomic impact.

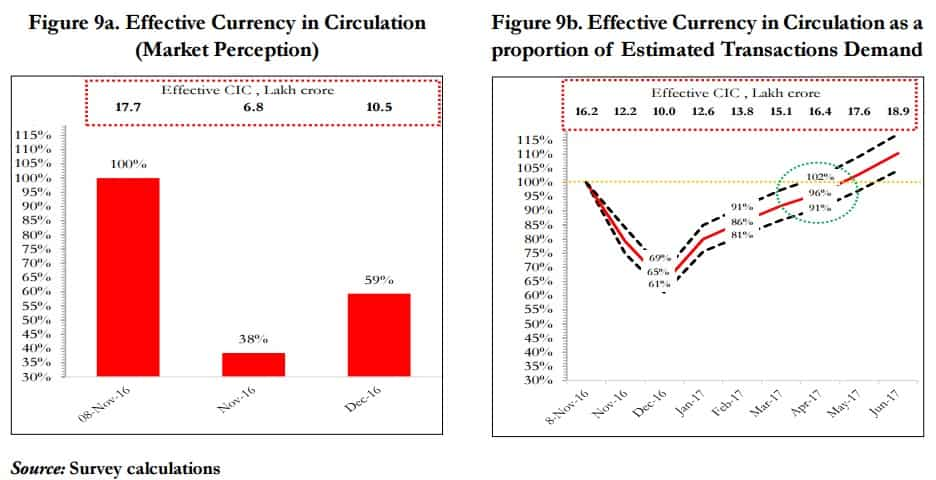

Remonetisation to rescue

The survey suggested that the "needed" actions to face the demonetisation hardships. It said, remonetizing the economy expeditiously by supplying as much cash as necessary, especially in lower denomination notes; and complementing demonetisation with more incentive-compatible actions such as bringing land and real estate into the GST, reducing taxes and stamp duties, and ensuring that the follow-up to demonetisation does not lead to over-zealous tax administration.

Chief Economic Adviser Arvind Subramanian while addressing the media after the pre-Budget economic Survey, said that remonetisation will be completed in a month or two and growth will pick up once the process is over.

"As remonetisation happens the economy will recover back. I think there should be a fast remonetisation. The earlier we withdraw the limit on the cash, the better," he said.

He further said the push to digital payment must be continued, "but I think one must be careful there". "The transaction has to be gradual. It must be inclusive because there are a lot of people who are not digitally connected. I have preference for doing it through incentives rather than controls," he said.

As per the survey, demonetisation has driven a sharp and dramatic wedge in the supply of these two: if cash and other forms are substitutable, the impact will be relatively muted; if, on the other hand, cash is not substitutable the impact will be greater.

Media reports

The GDP growth estimates of the CSO and the Survey, and especially the demonetisation impact, could potentially give rise to a number of misinterpretations which must be anticipated and clarified.

Subramanian said, "Many commentators will be tempted to compare this year’s real GDP growth estimate with last year’s outturn of 7.6%. But this would be inappropriate, because many other factors have influenced this year’s performance, quite apart from demonetisation."

Therefore, the most appropriate gauge of demonetisation would be to compare actual nominal GDP growth -- or the Survey’s estimate of it -- with the counterfactual nominal GDP growth without demonetisation. According to the CSO this counterfactual is 11.9 %, while the Survey’s estimate is around 11¼%.

Real Estate

The Economic Survey stated that the weighted average price of real estate in eight major cities which was already on a declining trend fell further after November 8, 2016 with the announcement of demonetisation.

It goes on to add that an equilibrium reduction in real estate prices is desirable as it will lead to affordable housing for the middle class and facilitate labour mobility across India currently impeded by high and unaffordable rents.

Talking about the impact of demonetisation on real estate, Subramanian said one of the aims of demonetisation is to bring down real estate prices.

"Real estate you do see a blip in prices, sales and launches and of course some of it may be adverse to the economy but in the long, some of that could be good because aim of the demonetisation is to bring down real estate prices," he said.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

07:11 PM IST

Rs 7,755 crore worth of withdrawn Rs 2,000 banknotes still in circulation

Rs 7,755 crore worth of withdrawn Rs 2,000 banknotes still in circulation 2,000-rupee note: A barrage of memes on social media as RBI presses 'exit' on 2,000 currency bill

2,000-rupee note: A barrage of memes on social media as RBI presses 'exit' on 2,000 currency bill Bye bye, Rs 2,000 banknote! 10 things to know about the bill that has been in circulation for 6 years

Bye bye, Rs 2,000 banknote! 10 things to know about the bill that has been in circulation for 6 years Finance Minister Nirmala Sitharaman says govt hasn't stopped banks from filling Rs 2000 notes in ATMs

Finance Minister Nirmala Sitharaman says govt hasn't stopped banks from filling Rs 2000 notes in ATMs Demonetisation in India: Timeline

Demonetisation in India: Timeline