Budget 2023: How is annual Union Budget prepared by government? EXPLAINED

Budget 2023: The Indian Union Budget is prepared by the Ministry of Finance in consultation with Niti Aayog and other concerned ministries.

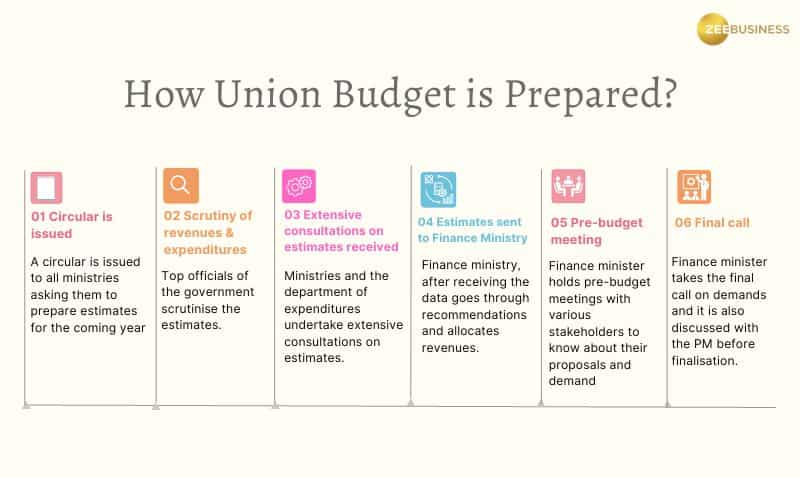

Budget 2023: Preparation of the Union Budget takes months of planning and execution. The budget-making process starts in August-September, that is, about six months prior to its date of presentation. After the presentation, the Budget has to be passed by both Houses of Parliament before the beginning of the financial year, that is, April 1.

The Indian Union Budget is prepared by the Ministry of Finance in consultation with Niti Aayog and other concerned ministries. Also, the Budget division of the Department of Economic Affairs (DEA) in the Finance Ministry is the nodal body responsible for producing the Budget.

1. Issue of circular

The Finance Ministry issues a circular to all the ministries, states, Union territories, and autonomous bodies asking them to prepare estimates for the coming year. This circular consists of skeleton forms along with requisite guidelines based on which ministries present their demands.

2. Estimates of expenditure

- After receiving the circular, various ministries initiate the process of estimating the expenditure for the year.

- The process begins with various ministries providing initial estimates of plan and non-plan expenditures.

- The ministries discuss the plan expenditures which include expenditures on electricity generation, infrastructure, education, and other productive areas of our economy with the Planning Commission.

- The financial advisors of the ministries prepare the non-plan expenditures, which is estimated expenditure provided in the budget for spending during the year on the routine functioning of the government.

- The expenditure secretary consolidates them and after intensive discussion with financial advisors, budget estimates are set for the ensuing fiscal year.

3. Estimates of revenues

- An assessment of expected revenues likely to flow into the government treasury is done.

- The amount to be received by way of tax revenues is estimated on the basis of existing rates of taxation and taking into consideration the likely growth and inflation rate over the ensuing fiscal year.

- On the capital receipts side, targeted amounts to be realised through divestment of public sector equity and amounts to be realised by way of repayments of loans are made.

- All the estimates are provided to the revenue secretary.

4. Scrutinity of Revenue and Expenditure

After requests are received, they are scrutinised by the top officials of the government, and extensive consultations are undertaken between the ministries and the department of expenditures. Upon approval, the data is then sent to the finance ministry.

Friendshoring: How India can benefit from US' attempt to diversify supply chain

5. Estimate of deficit:

- The finance ministry then compares the estimates of revenue and expenditure.

- This provides the first estimate of the expected lack of revenue to meet projected expenditure.

- The government then, in consultation with the Chief Economic Advisor, decides on the optimum level of borrowings to meet this deficit.

6. Narrowing the deficit

- After the targets for the fiscal deficits and the overall budget deficit is decided, any remaining shortage is filled through a revision in tax rates if feasible, keeping in mind the fiscal incentive structure the government wishes to put in place to stimulate the growth in different sectors.

- Following the initial plans, if any changes need to be made adjustments are made to the expenditure; usually the plan expenditure has to be modified.

- Due to the political sensitivities involved in reducing subsidies, non-plan expenditure of the government is inflexible about changing and it is the planned expenditures that are adjusted.

7. Allocating Revenue

The finance ministry, after going through all recommendations, allocates revenues to various departments for their future expenditures.

8. Pre- Budget Meeting

The finance minister then holds pre-Budget meetings with various stakeholders to know about their proposals and demands. These stakeholders include state representatives, bankers, agriculturists, economists, and trade unions.

9. Final Call on demands

Once the pre-Budget consultations are done, the finance minister takes the final call on demands and it is also discussed with the Prime Minister before finalisation.

10. Budget presentation

Finally, the Union Budget is presented in the Lok Sabha by the Finance Minister.

Click here to get more updates on Stock Market I Zee Business Live

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 5,000 SIP for 40 years vs Rs 50,000 SIP for 20 years: Which can create higher corpus? See calculations to know it

Hybrid Mutual Funds: Rs 50,000 one-time investment in 3 schemes has grown to at least Rs 1.54 lakh in 5 years; see list

PPF For Regular Income: How you can get Rs 78,000 a month tax-free income through Public Provident Fund investment?

18x15x12 SIP Formula: In how many years, Rs 15,000 monthly investment can grow to Rs 1,14,00,000 corpus; know calculations

05:20 PM IST

Budget 2024: Welfare of poor, women, youth, farmers government highest priority

Budget 2024: Welfare of poor, women, youth, farmers government highest priority Income tax: What are the 6 common tax-saving mistakes that can be avoided

Income tax: What are the 6 common tax-saving mistakes that can be avoided Punjab Finance Minister tables state budget for 2023-24

Punjab Finance Minister tables state budget for 2023-24 RuPay, UPI technologies are India's identity, says PM Modi

RuPay, UPI technologies are India's identity, says PM Modi  Chhattisgarh Budget 2023: Bhupesh Baghel to present last Budget ahead of Assembly election

Chhattisgarh Budget 2023: Bhupesh Baghel to present last Budget ahead of Assembly election