Bill to address bankruptcy in financial sector this session: Das

In order to address the bankruptcy issue in the financial sector, government is likely to introduce a Bill for resolution of insolvent financial firms during the current session of Parliament.

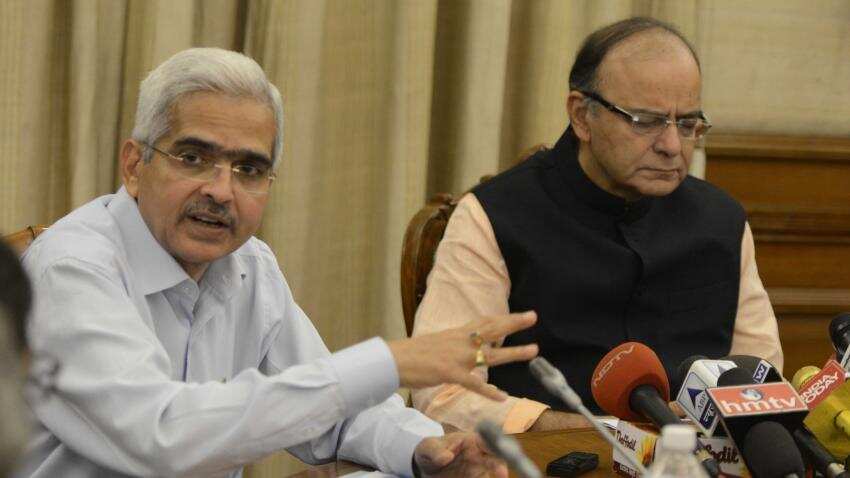

"The Bill relating to resolution of mechanism in relation to stressed assets of financial firms is going to be introduced in the second leg of the Budget session," Economic Affairs Secretary Shaktikanta Das said.

The second half of the Budget session will convene on March 9 and continue till April 13.

Speaking about protectionism, Das said, it is not sustainable in the long run and India will pursue its policy of openness that is free movement of goods, services and manpower.

"Protectionism in any form is not going to be sustainable in the long run considering where the world economy stands today considering the kind of interdependence which we have today between countries in term of requirement of skills and manpower," he said.

As far as India is concerned, he said, "We feel we should stick to our policy of openness, free movement of good, services and manpower and there should not be any restriction on this. Let us see how the situation plays out. I am sure the current trend which you see in many parts of the world may not be sustainable for very long."

With regard to the Payment Settlement Board, he said, the Finance Minister has also said the government will comprehensively review Payment Settlement Act.

"Whether therefore RBI should be a part of it or there should be an alternative mechanism to be built up, that is a matter the government will review, the government will consult the all stakeholders and take a considered call because we are aware a lot of payment takes place outside banking system," he said.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

05:44 PM IST

RBI: After another status quo year, all eyes on a growth-propping rate cut with new Guv at helm By Ashish Agashe

RBI: After another status quo year, all eyes on a growth-propping rate cut with new Guv at helm By Ashish Agashe RBI to stay alert & agile to meet challenges, it's an honour to head it: Governor Sanjay Malhotra

RBI to stay alert & agile to meet challenges, it's an honour to head it: Governor Sanjay Malhotra  Sanjay Malhotra takes charge as RBI Governor

Sanjay Malhotra takes charge as RBI Governor Thank you, PM Modi, FM Sitharaman, Team RBI: Shaktikanta Das on his last day in office

Thank you, PM Modi, FM Sitharaman, Team RBI: Shaktikanta Das on his last day in office IAS Sanjay Malhotra to be 26th RBI Governor; here's what economists say

IAS Sanjay Malhotra to be 26th RBI Governor; here's what economists say