At 94 pct debit cards lord it over Indian card business, report says

Debit cards own about 94% of total cards issuance share according to 'the India Digital Payment Report' published by Worldline India, taking a lion's share of the card business in India

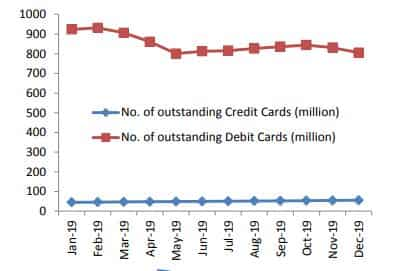

Debit cards own about 94 pct of total cards issuance share according to 'the India Digital Payment Report' published by Worldline India, taking a lion's share of the card business in the country. Notably, however, debit cards declined from 923.39 million in January 2019 to 805.32 million in December 2019, the report further says. Meanwhile, credit card issuance witnessed a growth of over 10 million cards from 45.17 million to 55.33 million in 2019, the report added.

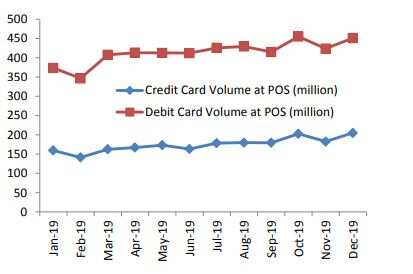

As such, total number of cards in circulation stood at 860.65 million as of December 2019 according to this report. The volume through debit cards at POS terminals achieved 4.9 trillion transactions, a 16% growth as compared with previous the year, while credit card transactions' volume at POS stood at 2 trillion, achieving a 20% YoY growth, the report said.

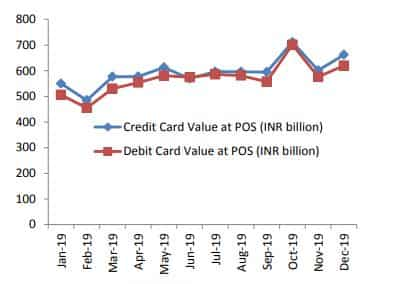

In value terms, the transaction value of debit cards stood at INR 6.8 trillion while transaction value of credit cards stood at INR 7.1 trillion, registering an on-year growth of 21% and 33% respectively.

It is interesting to note that in spite of just 6% share in total outstanding cards, credit cards accounted for 30% transactions in terms of volume and 51% in terms of value, the report says.

The number of POS or Point of Sale terminals deployment by merchant acquiring banks increased to 4.98 mn in December 2019 from 3.59 million in December 2018 according to 'India Digital Payment Report' published by Worldline India. This was an on-year rise by 39%, the report said.

RBL bank, HDFC Bank, State Bank of India, Axis bank and ICICI Bank emerged as top 5 merchant acquiring banks to deploy POS terminals in 2019, the report further said.

The report further says that Indian recorded a combined transaction volume of over 20 trillion and combined value of over INR 54 trillion from new retail payment products like debit cards, credit cards, Immediate Payment Services (IMPS) and Unified Payments Interface (UPI), in 2019.

Indian consumers are gradually moving to digital payment modes, the report says adding that there was an on-year increase in adoption of traditional as well as new retail payment products including debit cards, credit cards, IMPS and UPI.

See Zee Business Live TV Streaming Below:

This annual report takes a look and provides insights on Indian digital transactions in 2019 as well as insights on transactions that were processed in Worldline network. In addition, it also looks at how asset-lite products will transform digital payments in 2020.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

09:33 AM IST

Cashfree Payments launches RiskShield to empower merchants curb cyber payment frauds in real-time

Cashfree Payments launches RiskShield to empower merchants curb cyber payment frauds in real-time Exclusive: Centre plans Rs 5,016 crore incentive to promote RuPay, BHIM-UPI

Exclusive: Centre plans Rs 5,016 crore incentive to promote RuPay, BHIM-UPI Digital Transformation: 84% of Indian retailers use WhatsApp to receive orders - Study

Digital Transformation: 84% of Indian retailers use WhatsApp to receive orders - Study 42% consumers in India to use UPI for festive shopping this year: Report

42% consumers in India to use UPI for festive shopping this year: Report Affordable smartphones fuelling digital payments, content creation in India: Report

Affordable smartphones fuelling digital payments, content creation in India: Report