Paytm Payments Bank to begin operations from May 23

Paytm Payments Bank has received RBI approval to run its banking operations from May 23. The bank will be converting customers' e-wallets to bank accounts.

Key Highlights

- Paytm Payments Bank Ltd to commence operations from May 23.

- Paytm will convert customer wallets to bank accounts automatically if no communication from customer is received.

- Customers who have inactive wallets for six months will have their money transferred to the bank account only if the customer specifies consent.

Paytm’s owner and CEO, Vijay Shekhar Sharma on Wednesday tweeted that its Paytm Payments Bank was “coming soon!” as it has received a nod from Reserve Bank of India.

The One97 Communications Ltd owned company will begin banking operations as early as May 23 and will be transferring its wallet business to the bank.

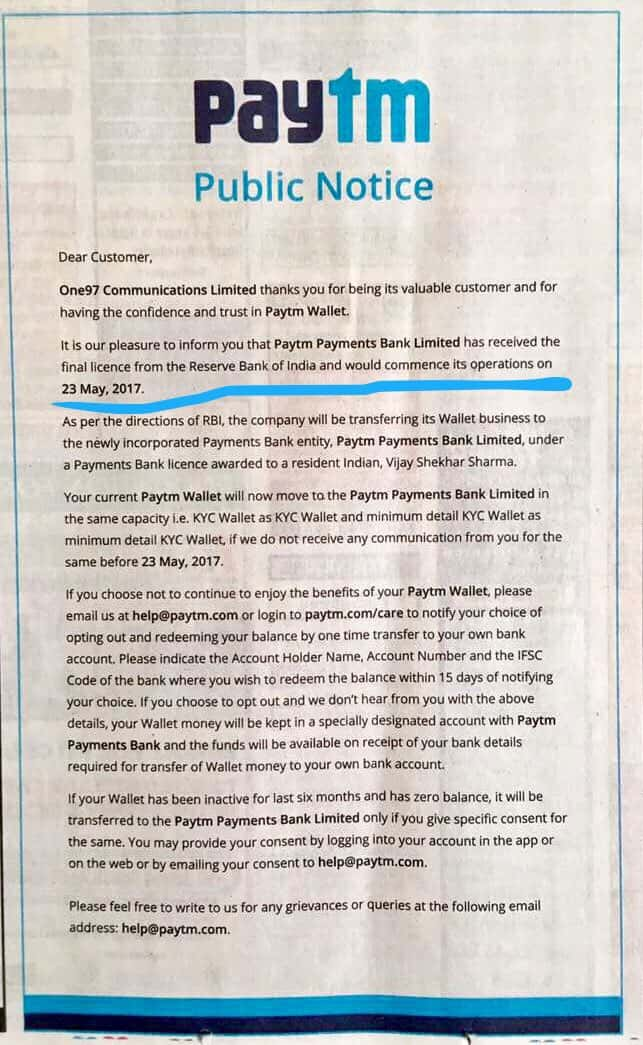

“It is our pleasure to inform you that Paytm Payments Bank Limited has received the final license from the Reserve Bank of India and would commence its operations on 23 May, 2017,” Paytm said in a public notice.

Customers’ Paytm Wallets will now convert to Paytm Payments Bank Ltd, as per the direction of RBI, maintaining the ‘same capacity,’ Paytm said.

Paytm said that if customers do not respond by May 23 their respective wallets will be transferred into bank accounts.

“If you choose not to continue to enjoy the benefits of you Paytm Wallet, please email us at help@paytm.com or login to paytm.com/care to notify your choice of opting out and redeeming your balance by one time transfer to your own bank account. Please indicate the Account Holder Name, Account Number and the IFSC Code of the bank where you wish to redeem the balance within 15 days of notifying your choice,” Paytm said.

Further Paytm said, “If you choose to opt out and we don’t hear from you with the above details, your Wallet money will be kept in a specially designated account with Paytm Payments Bank and the funds will be available on receipt of your bank details required for transfer of Wallet money to your own bank account.”

Those who have inactive wallets for the past six months Paytm said will have their money transferred to the bank account only if the customer specifies consent.

“If your Wallet has been inactive for last six months and has zero balance, it will be transferred to the Paytm Payments Bank Limited only if you give specific consent for the same. You may provide your consent by logging into your account in the app or on the web or by emailing your consent to help@paytm.com,” Paytm added.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 55 lakh Home Loan vs Rs 55 lakh SIP investment: Which can be faster route to arrange money for Rs 61 lakh home? Know here

Top 7 Flexi Cap Mutual Funds With up to 52% SIP Return in 1 Year: Rs 20,000 monthly SIP investment in No. 1 fund has generated Rs 3.02 lakh; know about others too

12:51 PM IST

Paytm arm to sell Stock Acquisition Rights in Japan's PayPay for Rs 2,364 crore

Paytm arm to sell Stock Acquisition Rights in Japan's PayPay for Rs 2,364 crore Paytm rolls out UPI Lite auto top-up for recurring daily payments under Rs 500 without PIN

Paytm rolls out UPI Lite auto top-up for recurring daily payments under Rs 500 without PIN Paytm rallies 149% in 6 months, can you still join the party? Analysts list key triggers

Paytm rallies 149% in 6 months, can you still join the party? Analysts list key triggers Zomato, Paytm, Delhivery, Varun Beverages gain up to 4% on F&O addition from November 29

Zomato, Paytm, Delhivery, Varun Beverages gain up to 4% on F&O addition from November 29 Paytm shares surge 12% after NPCI nod for onboarding new UPI users

Paytm shares surge 12% after NPCI nod for onboarding new UPI users