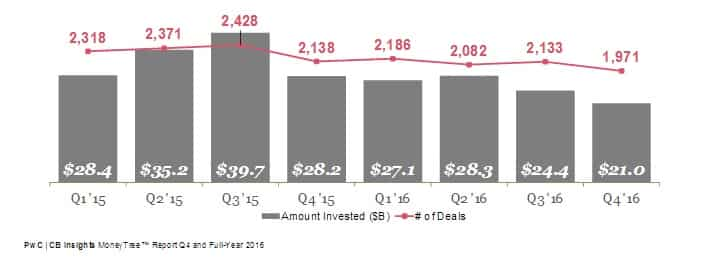

Funding to VC-backed start-ups declines by 23% globally in Q4 2016

The deal count for start-ups too dropped below 2,000 for the first time since Q4 2013.

Funding to start-ups by venture capitalists (VCs) globally has declined by 23% in terms of investment and 10% in terms of deals.

Deal count dropped below 2,000 for the first time since Q4 2013. In the whole of 2016, VC-backed companies received $100.8 billion across 8,372 deals, according to PwC-CB Insights MoneyTree Report.

Funding also fell for the second-straight quarter, seeing just $21 billion invested in Q4 2016. This represents an 89% drop since the 8-quarter peak in Q3 2015, which saw nearly $40 billion in funding, the report said.

Q4 2016 only saw a single deal above $1 billion, and 32 rounds above $100 million. There were 38 $100-million rounds the same quarter a year earlier.

In Asia too VC funding decreased in both deals and dollars in Q4 2016. It dropped to $5.5 billion in funding for the quarter, down 25% from $7.3 billion the quarter before. There were 337 deals into VC-backed Asian companies, the third quarter in a row below 400.

Every major start-up sector in Asia saw a slowdown in Q4 2016, with internet companies dropping the most by 43% in funding. Conversely, non-internet or mobile software jumped by 178%, fueled by a $120 million Series B funding to computer vision developer SenseTime.

“While Q3 2016 saw corporates participate in 43% of all deals in Asia, we saw a pullback and reversion to the norm with corporate participation reaching 34%. Early-stage deal size jumped from $2 million in every other quarter in 2016, to $3 million in Q4’16,” said the report.

North America received the highest funding of $12.2 billion from 1065 deals in Q4 2016, followed by Asia with $5.5 billion from 337 deals and Europe with $3 billion from 498 deals.

While North America received the highest VC-funding it had seen a drop below $13 billion for the first time since Q1 2014. While the US dropped in funding, Canada saw a jump of 49% between Q3 2016 and Q4 2016.

However, VC-funding for start-ups in Europe was the only one to beat the slowdown. In Q4’16, both deals and dollars went up in Europe. Funding jumped by 22%, hitting $3 billion of investment in the quarter. Deals increased for a third-consecutive quarter, hitting 498 deals.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

05:17 PM IST

Enterprise Security start-ups most sought-after by VCs in 2016

Enterprise Security start-ups most sought-after by VCs in 2016 Microsoft, Qualcomm invests in Team8 a cybersecurity start-ups

Microsoft, Qualcomm invests in Team8 a cybersecurity start-ups  Electric car start-up Faraday Future unveils first production car

Electric car start-up Faraday Future unveils first production car More start-ups failed this year as 2016 saw funding drying up

More start-ups failed this year as 2016 saw funding drying up Paytm accounts for nearly 40% funding in fintech start-ups in last 3 years

Paytm accounts for nearly 40% funding in fintech start-ups in last 3 years