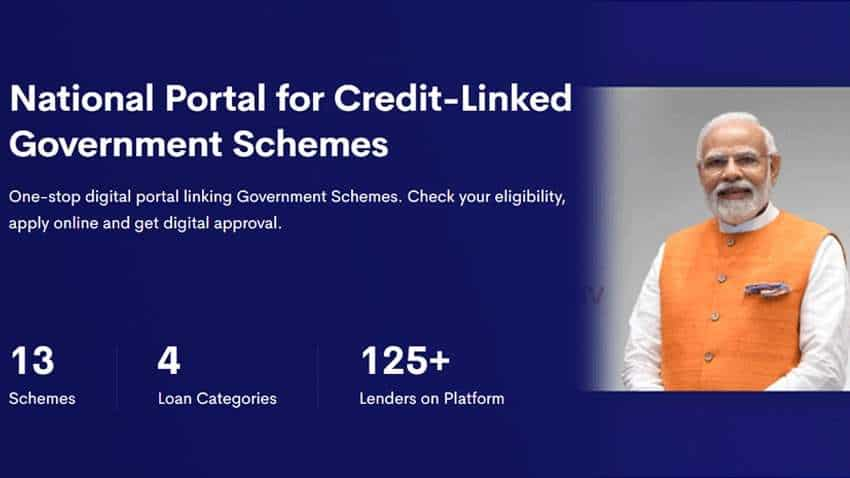

Jan Samarth Portal: All about one-stop platform for government's credit-linked schemes

What is Jan Samarth: The portal is one-stop digital platform that ensures a simple, quick and hassle-free lending process for the borrowers.

What is Jan Samarth Portal: Jan Samarth is a first-of-its-kind digital platform for the government’s credit-linked schemes which is aimed to make several government initiatives more accessible to all beneficiaries.

Beneficiaries can check their eligibility digitally in a few simple steps, apply online under the appropriate scheme and receive digital approval.

Jan Samarth benefits

1. The portal is a one-stop digital platform that ensures a simple, quick and hassle-free lending process for the borrowers

2. It directly connects the beneficiaries with the Banks, reducing the turn-around time

3. It aims to encourage inclusive growth and development across sectors by facilitating the right type of Government scheme benefit through end-to-end digitisation

4. The platform also provides the applicant with real-time status - updates pertaining to sanctions and disbursements

5. The platform has multiple integrations with Aadhar, CBDT, Udyam, Credit Guaranteed Funds, etc

6. Currently the platform is available in six languages- Hindi, Marathi, Gujarati, Bengali, Tamil, and Telugu in addition to English

Jan Samarth: How to apply

Visit the official Jan Samarth Portal jansamarth.in. On the homepage, click on the “Register” tab present in the main menu or directly click jansamarth.in/register

After creating your account, you can “Log In” at Jan Samarth Portal using the link – www.jansamarth.in/login

For your preferred loan category, you first need to check eligibility by providing answers to a few simple questions and once you become eligible under any of the schemes, you may select to proceed to apply online to receive digital approval.

Jan Samarth: Government schemes

The 13 schemes are present under the categories:

1. Education Loan

2. Agri Infrastructure Loan

3. Business Activity Loan

4. Livelihood Loan

To view each scheme in detail please visit https://www.jansamarth.in/government-of-india-schemes

Jan Samarth: Partner banks

Various Ministries, nodal agencies and lenders have come together on a single platform to ensure that government schemes can be availed quickly, smoothly and securely. On the platform, there are more than 9 Ministries, at least nodal agencies and over 125 lenders. You can select the loan category and check your eligibility for multiple schemes at once at Jan Samarth Portal.

Jan Samarth: Apply online and documents

Each scheme has different documentation requirements. To apply online on the Portal, the basic document required would be an Aadhaar number and a valid bank account along with a few basic details to be filled in on the portal.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

10:43 AM IST

Narendra Modi govt increasing exports to ensure fair price to farmers, says Home Minister Amit Shah

Narendra Modi govt increasing exports to ensure fair price to farmers, says Home Minister Amit Shah  Modi government plans to double defence exports

Modi government plans to double defence exports Supreme Court bans government's Fact-Check Unit; know why

Supreme Court bans government's Fact-Check Unit; know why 7th Pay Commission: After PM Modi's DA hike in Centre, Uttar Pradesh and Tripura governments increase DA; know new rates

7th Pay Commission: After PM Modi's DA hike in Centre, Uttar Pradesh and Tripura governments increase DA; know new rates Modi govt gulled people with lies, lectures: Congress

Modi govt gulled people with lies, lectures: Congress