PPF vs NPS: Which is better? Look at these calculations

PPF Calculator vs NPS: The National Pension System or NPS is a voluntary pension contribution system, which is administered and regulated by the Pension Fund Regulatory and Development Authority (PFRDA).

PPF Clculator vs NPS Calculator: The National Pension System or NPS is a voluntary pension contribution system, which is administered and regulated by the Pension Fund Regulatory and Development Authority (PFRDA). The NPS investment tool has been created through a parliamentary act. However, while investing in NPS accounts it has been found that people are confused between the Public Provident Fund (PPF) and NPS as both are meant for retirement fund accumulation.

Importantly, according to tax and investment experts, both are good investment tools to build retirement corpus but if someone has a high risk appetite and wants to earn much more, then NPS is better than PPF.

PPF vs NPS Confusion

SEBI registered tax and investment expert, Manikaran Singhal said, "Both PPF and NPS are voluntary contribution options. When it comes to choosing either PPF or NPS, people get confused as to which would give them more income tax exemption. Significantly, people invest in NPS when their PPF limit of Rs 1.5 lakh under Section 80C is over."

NPS Scheme

Manikaran said that NPS has eight fund managers where one can choose the equity option up to 60 per cent of the investment. And at the time of retirement, one can withdraw 60 per cent of the maturity amount, which is tax-free. Rest 40 per cent would remain in the NPS account for pension funding of the investor and it would be taxable.

Manikaran also added that NPS investment has two options: active mode and auto mode. In the active mode, one can evaluate one's return annually and can switch from equity to debt and debt to equity options. While in auto mode, there would be 8 fund managers handling one's investment and making a switch from debt to equity and vise-versa options on their wit and grit. He said that in NPS, one can have an income tax exemption on investment up to Rs 50,000 under Section 80CCD.

PPF vs Equity Returns Compared

Comparing PPF with NPS Kartik Jhaveri, Manager — Wealth Management at Transcend Consultants said, "Due to the equity exposure in NPS account, if an investor chooses the 50:50 option of the equity and the debt options, in the long-run debt option would give around 8 per cent returns while the equity exposure would give at least 12 per cent returns in the long-term."

Money Calculator

According to the calculation, that means, if a person invests Rs 100 in NPS and Rs 100 in PPF, he or she would get 7.1 per cent PPF interest rate while in NPS his or her returns would be 10 (6 + 4 = 10) per cent returns, which is 2.9 per cent higher than the PPF.

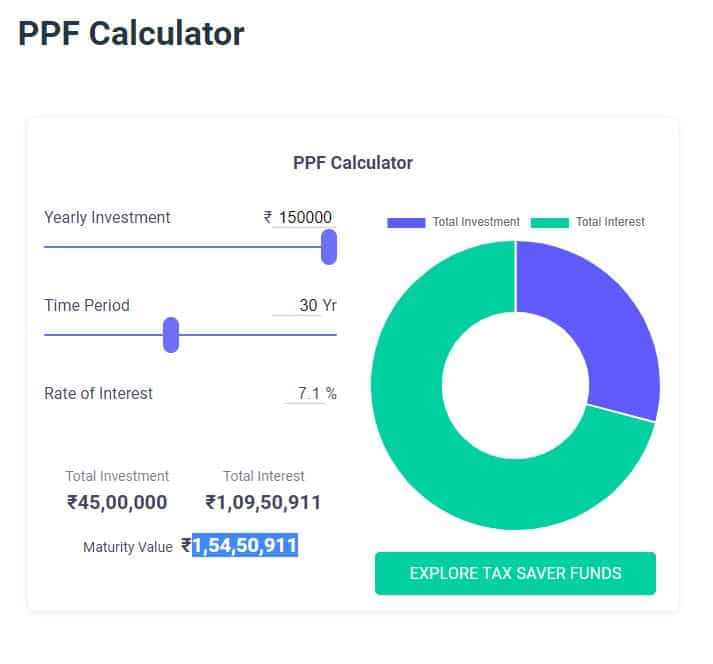

PPF Calculator

Let's assume a person invests Rs 1.5 lakh per annum or Rs 12,500 per month in one's PPF and its interest rate remains at current 7.1 per cent. then the PPF calculator suggests that one's maturity amount after 30 years will be Rs 1,54,50,911.

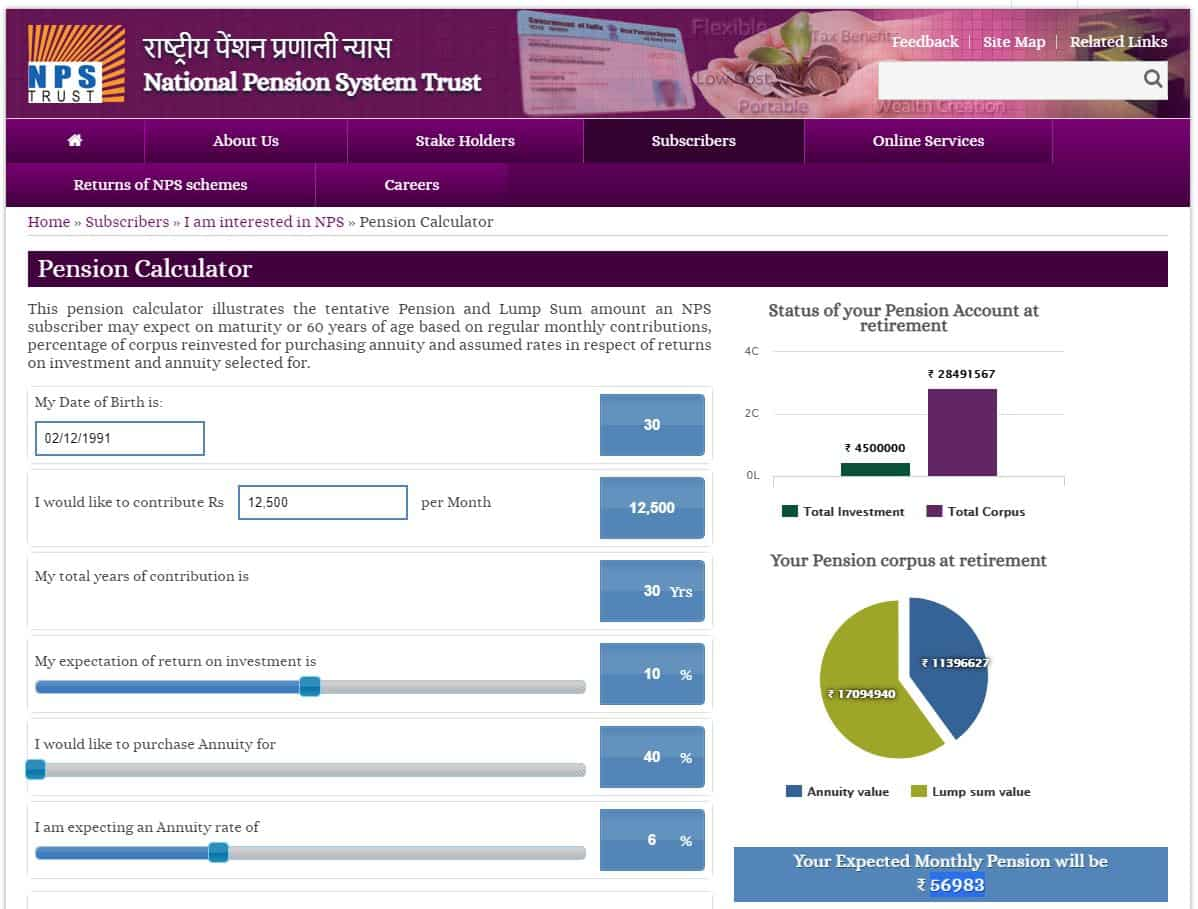

NPS Calculator

Similarly, if a person invests Rs 1.5 lakh or Rs 12,500 per month in NPS Scheme keeping annuity at 40 per cent. In that case, the NPS calculator suggests that one's money allowed for withdrawal will be Rs 1,70,94,940 while the rest Rs 1,13,96,627 will be used for buying annuity that will fetch monthly pension of around Rs 56,983.

Therefore, by opting for the NPS Scheme ahead of PPF account, one would not only get more money at the time of retirement, one will be able to get a monthly pension that he or she can use for regular financial requirements.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

LIC Saral Pension Plan: How to get Rs 64,000 annual pension on Rs 10 lakh one-time investment in this annuity scheme that everyone is talking about

Gratuity Calculation: What will be your gratuity on Rs 45,000 last-drawn basic salary for 6 years & 9 months of service?

Rs 1,500 Monthly SIP for 20 Years vs Rs 15,000 Monthly SIP for 5 Years: Know which one can give you higher returns in long term

Income Tax Calculations: What will be your tax liability if your salary is Rs 8.25 lakh, Rs 14.50 lakh, Rs 20.75 lakh, or Rs 26.10 lakh? See calculations

8th Pay Commission Pension Calculations: Can basic pension be more than Rs 2.75 lakh in new Pay Commission? See how it may be possible

SBI Revamped Gold Deposit Scheme: Do you keep your gold in bank locker? You can also earn interest on it through this SBI scheme

Monthly Pension Calculations: Is your basic pension Rs 26,000, Rs 38,000, or Rs 47,000? Know what can be your total pension as per latest DR rates

09:56 AM IST

Post Office PPF Calculation: How much will you get by investing Rs 2,000, Rs 6,000, and Rs 10,000 monthly for 15 years?

Post Office PPF Calculation: How much will you get by investing Rs 2,000, Rs 6,000, and Rs 10,000 monthly for 15 years? PPF For Regular Income: How to get Rs 60,000/month tax-free income from Public Provident Fund?

PPF For Regular Income: How to get Rs 60,000/month tax-free income from Public Provident Fund? PPF For Regular Income: How to get Rs 1,20,000/month tax-free income from Public Provident Fund?

PPF For Regular Income: How to get Rs 1,20,000/month tax-free income from Public Provident Fund? PPF For Regular Income: How can you get Rs 12,87,575 annually tax-free income from Public Provident Fund?

PPF For Regular Income: How can you get Rs 12,87,575 annually tax-free income from Public Provident Fund? PPF For Regular Income: Can you get Rs 1,06,828/month tax-free income from Public Provident Fund?

PPF For Regular Income: Can you get Rs 1,06,828/month tax-free income from Public Provident Fund?