PPF Calculator: Your Public Provident Fund account can make you a crorepati; expert Balwant Jain reveals how

PPF Calculator: Amid lowering returns in equity-linked investment options, investors have started to realise the importance of government-backed zero-risk-oriented options like Public Provident Fund (PPF), Post Office FD, etc.

PPF Calculator: Amid lowering returns in equity-linked investment options, investors have started to realise the importance of government-backed zero-risk-oriented options like Public Provident Fund (PPF), Post Office FD, etc. However, it would be interesting to know that a disciplined investment for a longer period in the PPF can create huge amounts of money and even turn an investor into a crorepati. As per the latest notification by the Ministry of Finance, the current PPF interest rate is 7.1 per cent. If we assume this interest rate for the next 25 years, then an investor will be able to get a maturity amount of more than Rs 1 crore. However, for that, the PPF account holder will have to extend PPF account on two occasions after 15 and 20 years of account opening by submitting Form-16H.

Speaking on the PPF account benefits, Balwant Jain, a Mumbai-based tax and investment expert said, "Investment up to Rs 1.5 lakh is exempted under Section 80C of the Income Tax Act. So, one can avail income tax exemption on up to Rs 1.5 lakh per annum." However, Jain said that the PPF account maturity period is 15 years and one needs to submit Form 16-H to extend one's PPF account. "PPF account can be extended in a block of 5 years and for that one will have to submit Form 16-H in 15th year of PPF account opening. Similarly, if an investor decided to remain invested in PPF for the next five years, he or she will have to submit Form 16-H in the 20th year of account opening," Jain said.

See Zee Business Live TV Streaming Below:

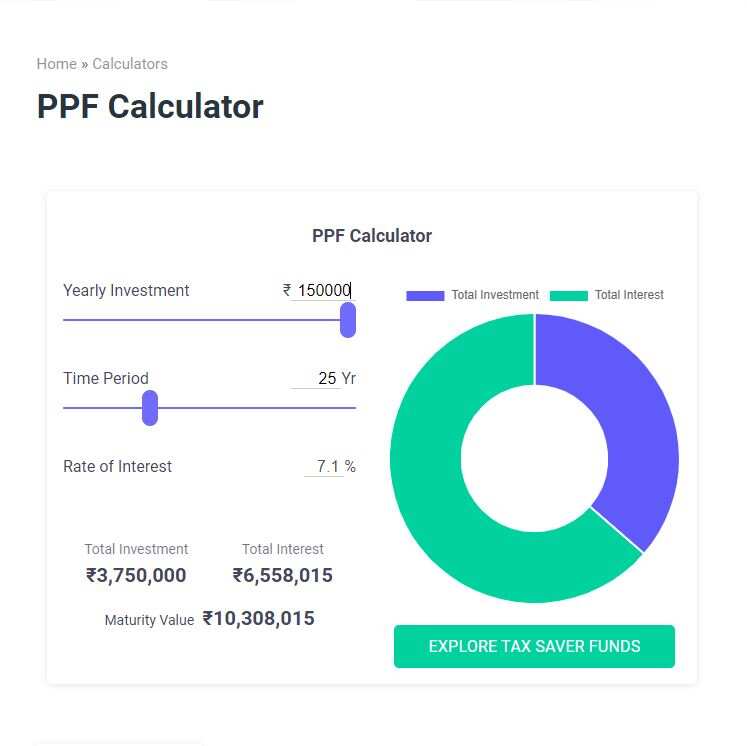

So, if a PPF account holder submits Form 16-H on two occasions, then he or she will remain invested in the PPF for 25 years (15+5+5). Assuming the current 7.1 per cent PPF interest rate for an investor for the entire period (though it can be changed on a quarterly basis), if a PPF account holder invests Rs 1.5 lakh per year in one's PPF account for 25 years, the PPF calculator suggests that one will get Rs 1,03,08,015 or Rs 1.03 crore.

As per the PPF calculator, during this 25 years of PPF account, one will be investing Rs 37.5 lakh while one will earn PPF interest of Rs 65,58,015.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Income Tax Calculations: What will be your tax liability if your salary is Rs 8 lakh, Rs 14 lakh, Rs 20 lakh, and Rs 26 lakh?

8th Pay Commission: Can basic pension cross Rs 3 lakh mark in new pay commission? See calculations to know its possibility?

Retirement Planning: How one-time investment of Rs 10,00,000 can create Rs 3,00,00,000 retirement corpus

Power of Compounding: How long it will take to build Rs 8 crore corpus with Rs 7,000, Rs 11,000 and Rs 16,000 monthly investments

Monthly Pension Calculations: Is your basic pension Rs 25,000, Rs 35,000, or Rs 50,000? Know what can be your total pension as per latest DR rates

Dearness Allowance (DA) Calculations: Is your basic monthly salary Rs 25,500, Rs 35,400, or Rs 53,100? Know how much DA will you get at different rates

12:55 PM IST

PPF For Regular Income: How to get Rs 1,20,000/month tax-free income from Public Provident Fund?

PPF For Regular Income: How to get Rs 1,20,000/month tax-free income from Public Provident Fund? PPF For Regular Income: How can you get Rs 12,87,575 annually tax-free income from Public Provident Fund?

PPF For Regular Income: How can you get Rs 12,87,575 annually tax-free income from Public Provident Fund? PPF For Regular Income: Can you get Rs 1,06,828/month tax-free income from Public Provident Fund?

PPF For Regular Income: Can you get Rs 1,06,828/month tax-free income from Public Provident Fund? PPF For Regular Income: Can you get Rs 85,000 a month, tax-free income from Public Provident Fund?

PPF For Regular Income: Can you get Rs 85,000 a month, tax-free income from Public Provident Fund? SIP vs PPF: By investing Rs 1 lakh annually, how much wealth can you expect to build in 15 years?

SIP vs PPF: By investing Rs 1 lakh annually, how much wealth can you expect to build in 15 years?