Income tax salary deduction: From tax on allowances to reimbursements, 5 top questions answered

Income Tax on Salary: Number of taxpayers have been on the rise in India, especially over the last couple of years. As many as 6.85 crore returns have been filed in FY2018. The Income-Tax department has added around 75 lakh new taxpayers in its list this fiscal till October. Most of these taxpayers are salaried persons and many of them are new to the taxation system and, to file their income tax returns, they often have questions related to tax on allowances and reimbursement among other issues. Here are the answer of five such queries:

Income Tax returns: Salary income

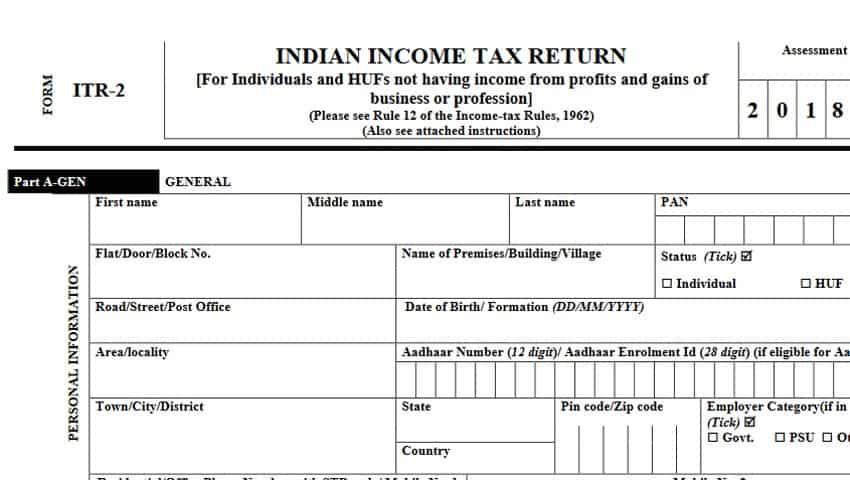

Q. Income Tax returns: What is considered as salary income?

Ans: Section 17 of the Income-tax Act defines the term ‘salary’. However, not going into the technical definition, generally whatever is received by an employee from an employer in cash, kind or as a facility [perquisite] is considered as salary. (PTI)

Income Tax returns: Allowances

Q. Income Tax returns: What are allowances?

Ans: Allowances are fixed periodic amounts, apart from salary, which are paid by an employer for the purpose of meeting some particular requirements of the employee. E.g., Tiffin allowance, transport allowance, uniform allowance, etc.

There are generally three types of allowances for the purpose of Income-tax Act - taxable allowances, fully exempted allowances and partially exempted allowances.

Perquisites are benefits received by a person as a result of his/her official position and are over and above the salary or wages. These fringe benefits or perquisites can be taxable or non-taxable depending upon their nature. Uniform allowance is exempt to the extent of expenditure incurred for official purposes U/S 10(14).

Income Tax returns: Expense reimbursement

Income Tax on PF and Gratuity

Q. Income Tax returns: Are retirement benefits like PF and Gratuity taxable?

Ans: In the hands of a Government employee Gratuity and PF receipts on retirement are exempt from tax. In the hands of non-Government employee, gratuity is exempt subject to the limits prescribed in this regard and PF receipts are exempt from tax, if the same are received from a recognised PF after rendering continuous service of not less than 5 years.

Income Tax returns: Conveyance allowance

Q. Income Tax returns: What is the taxability of Conveyance allowance?

Ans: As per section 10(14) read with Rule 2BB Conveyance allowance is exempt to the extent of amount received or amount spent, whichever is less. For e.g., If amount received is Rs. 100 and amount spent is Rs. 80, then only Rs. 20 is taxable. However, if amount actually spent is Rs. 100; then nothing is taxable.