Your salary to rise if Govt acts on new income tax slabs in Budget 2017; we calculate

Currently, no tax is charged up to income of Rs 2.5 lakh per year.

Ministry of Finance is likely to act on a proposal to revise the personal income tax slabs in Budget 2017. If that happens, your in-hand salary may rise.

According to sources, the finance ministry has proposed that no tax will be liable up to the income worth Rs 4 lakh. Currently, no tax is charged up to income of Rs 2.5 lakh per year.

ALSO READ: This is how your new income tax slabs may look after Budget of 2017

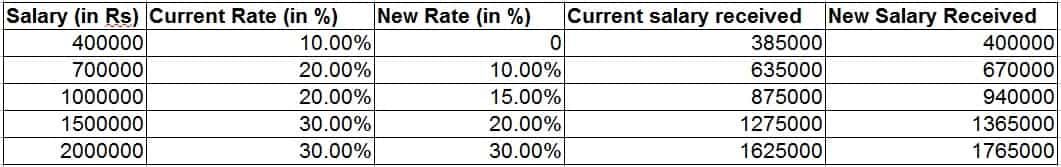

Salary Rs 4 lakh

If you earn Rs 4 lakh per year currently, then as per the existing income tax slabs, you will not pay any tax on income up to Rs 2,50,000 but the remaining Rs 1,50,000 will be taxed at 10%, or Rs 15,000.

However, under the new proposed income tax slabs, income up to Rs 4,00,000 may be exempt from income tax which means you tax liability will be nil.

Salary Rs 7 lakh

Government likely to impose 10% tax on income between Rs 4 lakh to Rs 10 lakh as per the new income tax slabs.

However, as per current income tax slabs, taxable income of Rs 7 lakh would fall in the middle bracket of income tax slab or 10%. Income tax liability currently for this income would come to Rs 65,000.

However, if the new proposals are expected, then the tax slab will change to 10% tax for income between Rs 4 lakh to Rs 10 lakh. This means that your tax liability will fall to Rs 30,000.

Salary Rs 10 lakh

As per the existing income tax slabs, taxable income of Rs 10 lakh fell in the bracket of 20%. This means that if earning Rs 10 lakh a year, tax liability would come to Rs 1,25,000.

However, under the new scheme, your tax liability may fall to Rs 60,000.

Salary Rs 15 lakh

Income of over Rs 10 lakh per year is currently taxed at the highest rate of 30%. This means that taxable income of Rs 15 lakh would attract Rs 2,25,000.

Under the new income tax slab, this would fall to just Rs 1,35,000.

Salary 20 lakh

Further, for the income between 15 lakh to Rs 20 lakh, 20% of tax will be charged. Currently, 30% tax rate is levied on income more than Rs 10 lakh.

Suppose, your annual salary is Rs 20 lakh, under the current tax slab, 30% tax rate is imposed so the tax liability will come to Rs 3,75,000.

However, with new income tax slabs firming tax of 30% of income up to Rs 20 lakh, your income tax liability will fall to Rs 2,35,000.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

05:23 PM IST

Zomato gets Rs 803.4 crore tax demand from GST authorities

Zomato gets Rs 803.4 crore tax demand from GST authorities  Income tax refunds jump 46.3% to Rs 3.04 lakh crore in April-November

Income tax refunds jump 46.3% to Rs 3.04 lakh crore in April-November No proposal on income tax relief for senior citizens under consideration: Centre

No proposal on income tax relief for senior citizens under consideration: Centre  Income tax return filer base up 2.2 times in 10 years, 5 times growth in Rs 50 lakh-plus income category: Sources

Income tax return filer base up 2.2 times in 10 years, 5 times growth in Rs 50 lakh-plus income category: Sources  This is India's only tax-free state, residents earn crores without paying Income Tax

This is India's only tax-free state, residents earn crores without paying Income Tax