Your Rs 4500pm can make you a crorepati; use this mutual funds SIP trick; check calculator

Crorepati Calculator: An investor aspires to become rich even with small investment amounts. Mutual Fund SIP (Systematic Investment Plan) has that ability to fulfill the small investors' dream to become a crorepati.

Crorepati Calculator: An investor aspires to become rich even with small investment amounts. Mutual Fund SIP (Systematic Investment Plan) has that ability to fulfill the small investors' dream to become a crorepati. According to tax and investment experts, investors should invest for the long term if they want to get higher returns. They are of the opinion that going long, say 15 to 20 years, in mutual fund SIP gives compounding benefits and that translates into earning big amounts - in fact, you earn interest on the interest earned.

Speaking on how to maximise mutual funds SIP gains, SEBI registered tax and investment expert Manikaran Singhal said, "One should invest in SIP for 15-20 years. By going long, the investor will be able to get compounding benefits on investments. So, if a SIP investment is done for 15 to 20 years, the growth amount in the later part of the investment will grow exponentially helping the investor to become rich at a faster rate."

On how much one can expect to earn on a 15 to 20 year mutual funds SIP, Kartik Jhaveri, Director — Wealth Management at Transcend Consultants said, "In such a long period, one can easily expect to get around 15 per cent returns if not more than that." Jhaveri said that it also depends upon the mutual fund SIP policy one has chosen but if a wise research has been done before choosing the mutual fund SIP plan, then at least 15 per cent returns can be expected.

See Zee Business Live TV streaming below:

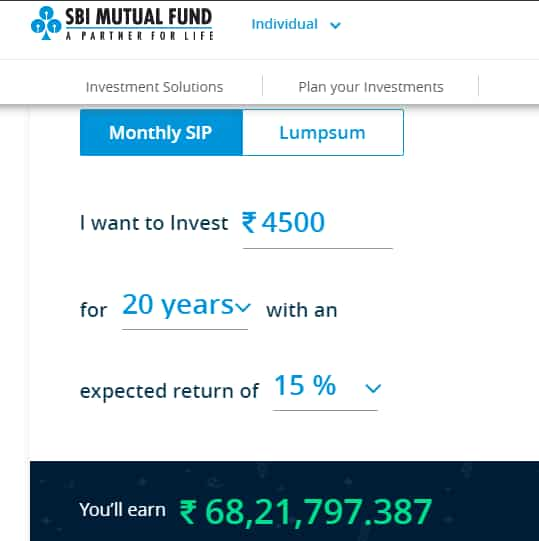

Assuming this 15 per cent returns on a SIP of Rs 4500 per month that has been done for 20 years, the mutual fund calculator says that one will get Rs 68,21,797.387 as maturity at the end of 20 years.

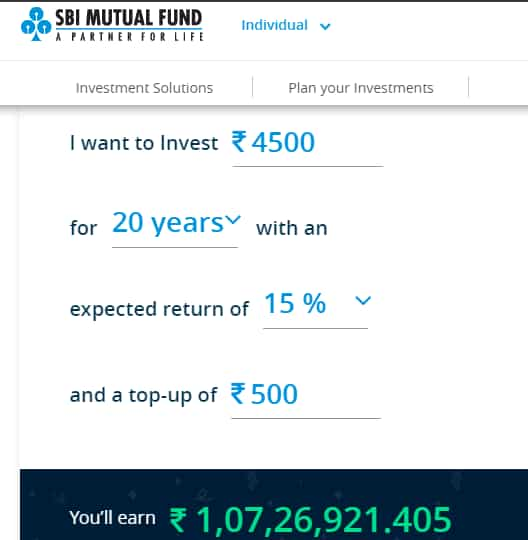

However, there is a trick that can help a person grow one's SIP to Rs 1,07,26,921.405. Yes, over a crore of rupees!

For this maturity amount what the SIP investor needs is to add Rs 500 as top up in one's monthly SIP after the end of every one year post the start of the SIP plan. If an investor uses this trick, then the same Rs 4,500 per month will help him or her to get Rs 1,07,26,921.405 as maturity amount.

So, by using Rs 500 annual top up, one can become a crorepati by simply starting a mutual funds SIP of Rs 4,500 per month.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

04:48 PM IST

Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example

Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example Debt mutual fund inflows reach Rs 1.57 lakh crore in October

Debt mutual fund inflows reach Rs 1.57 lakh crore in October What's keeping largecap funds attractive and should you join the party?

What's keeping largecap funds attractive and should you join the party? Indian bonds show neutral to marginally attractive valuation compared to equity amid rate-cut cycle: SBI Mutual Fund

Indian bonds show neutral to marginally attractive valuation compared to equity amid rate-cut cycle: SBI Mutual Fund The role of mutual funds in achieving financial independence

The role of mutual funds in achieving financial independence